Zentalis Pharmaceuticals, Inc.'s (NASDAQ:ZNTL) Shares Bounce 28% But Its Business Still Trails The Industry

Zentalis Pharmaceuticals, Inc. (NASDAQ:ZNTL) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

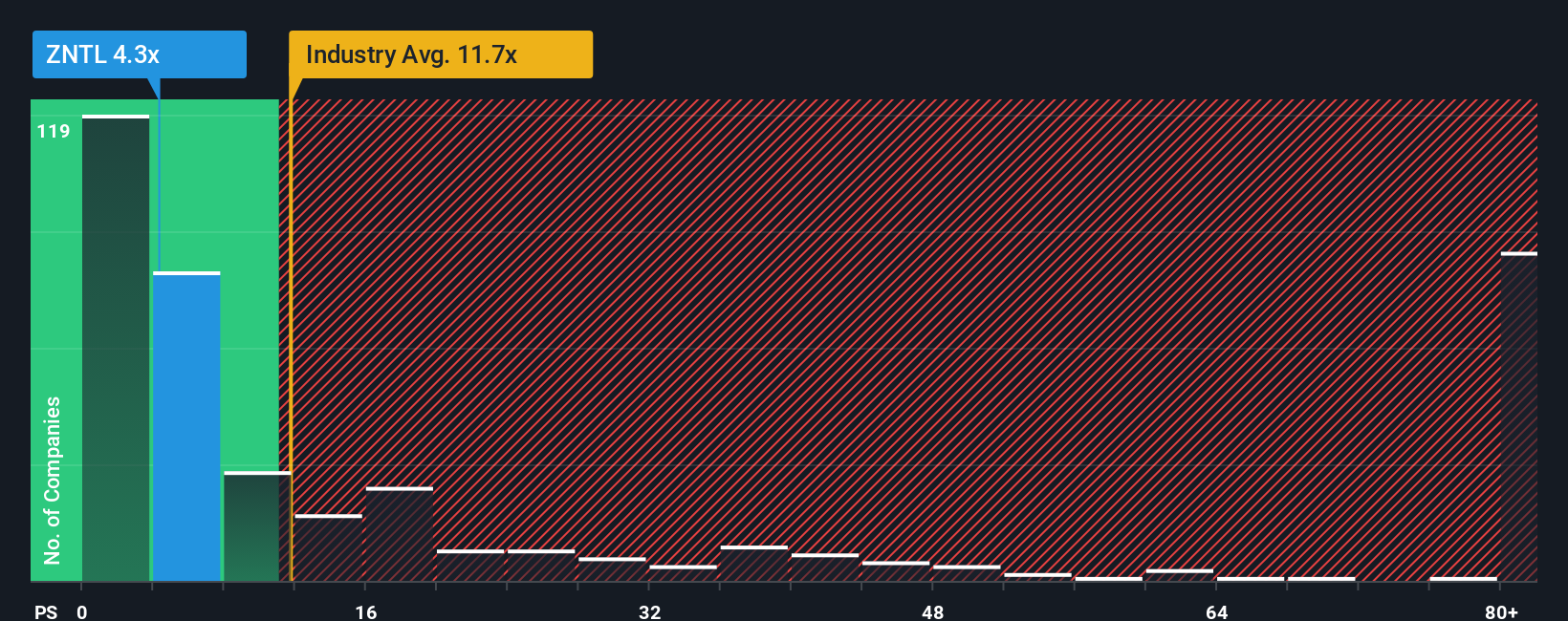

In spite of the firm bounce in price, Zentalis Pharmaceuticals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.7x and even P/S higher than 82x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Zentalis Pharmaceuticals

How Zentalis Pharmaceuticals Has Been Performing

Zentalis Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Zentalis Pharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Zentalis Pharmaceuticals' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 15% per year over the next three years. With the industry predicted to deliver 123% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Zentalis Pharmaceuticals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Zentalis Pharmaceuticals have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zentalis Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Zentalis Pharmaceuticals that you need to be mindful of.

If these risks are making you reconsider your opinion on Zentalis Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報