Assessing Nu Holdings (NU) Valuation After Record Highs And Brazilian Banking License Progress

Nu Holdings (NYSE:NU) is back in focus after its shares set fresh record highs. The move has been supported by upbeat quarterly results, strong investor interest and progress toward securing a Brazilian banking license that could reshape its regulatory footing.

See our latest analysis for Nu Holdings.

The latest move comes on top of a 15.52% 90 day share price return and a very large 3 year total shareholder return, while the 1 year total shareholder return of 60.04% points to momentum that is still building.

If Nu Holdings has caught your attention, it might be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With Nu now trading near record highs, a 60% 1 year return, and a small premium to the average analyst target of about US$19.21, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3.1% Undervalued

With Nu Holdings closing at US$17.86 against a most-followed narrative fair value of US$18.43, the story hinges on how future growth and margins play out.

The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness, supporting robust net margin expansion as digital penetration deepens.

Want to see what is baked into that premium growth story? The key ingredients mix rapid top line expansion with slimmer future margins and a higher earnings multiple. Curious which forecasts really carry the weight here? Read on to see how those moving parts combine to support that fair value call.

Result: Fair Value of US$18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story could be challenged if rising competition in Latin American fintech squeezes growth or if tougher regulation pushes up compliance and credit costs.

Find out about the key risks to this Nu Holdings narrative.

Another View: Pricing In A Lot Of Good News

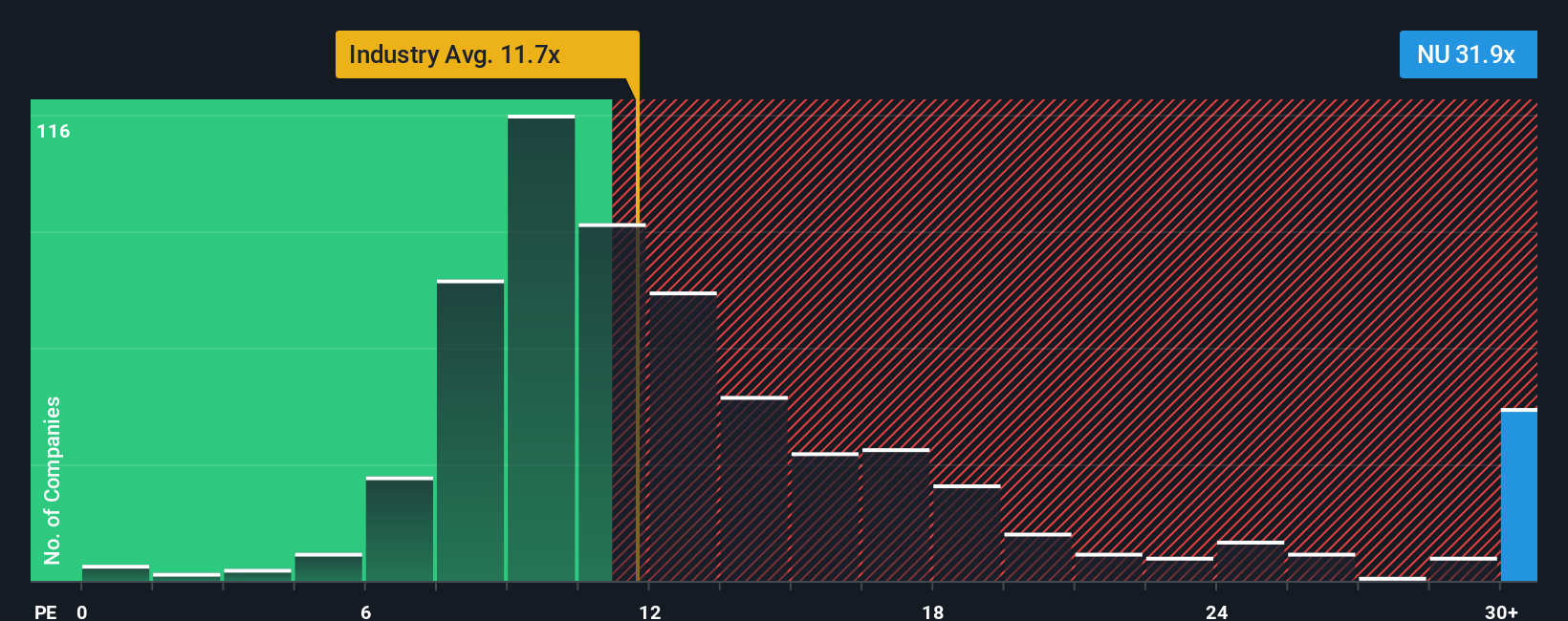

That 3.1% “undervalued” fair value story sits awkwardly next to how the market is actually pricing Nu Holdings today. The shares trade on a P/E of 34.2x, compared with 13.8x for peers and a fair ratio of 23.8x. This points to an expensive tag rather than a bargain. Is that extra premium comfort, or a risk you need to keep front of mind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see the story differently, or want to stress test these assumptions with your own inputs, you can spin up a fresh view in minutes: Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Nu Holdings is already on your radar, do not stop there. Broaden your opportunity set with targeted ideas built from the same data driven approach.

- Spot emerging names early by scanning these 3554 penny stocks with strong financials that combine smaller market caps with stronger financial underpinnings.

- Approach the AI trend more deliberately by filtering for companies at the core of this shift with these 25 AI penny stocks.

- Hunt for potential mispricings by focusing on these 876 undervalued stocks based on cash flows that screen as cheap relative to their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報