A Look At Abercrombie & Fitch (ANF) Valuation After Influencer Led Spring 2026 Denim Campaign Launch

Abercrombie & Fitch (ANF) has rolled out its Spring 2026 influencer led denim campaign, coinciding with strong social and editorial attention on its under $100 jeans, as well as recent commentary around its market performance and partnerships.

See our latest analysis for Abercrombie & Fitch.

The new influencer denim push lands at a time when momentum in Abercrombie & Fitch’s shares has been strong, with a 30 day share price return of 35.82% and a 90 day share price return of 69.21%, even as the 1 year total shareholder return of 15.30% decline contrasts with very large 3 and 5 year total shareholder returns of about 4.6x and 5.5x respectively at a latest share price of US$128.85.

If this kind of brand revival has your attention, it could be a good moment to widen your watchlist with fast growing stocks with high insider ownership.

With Abercrombie & Fitch now trading at US$128.85 after strong multi year returns, alongside recent gains and a price above the latest analyst target, investors may ask whether there is still value available or if the market is already pricing in future growth.

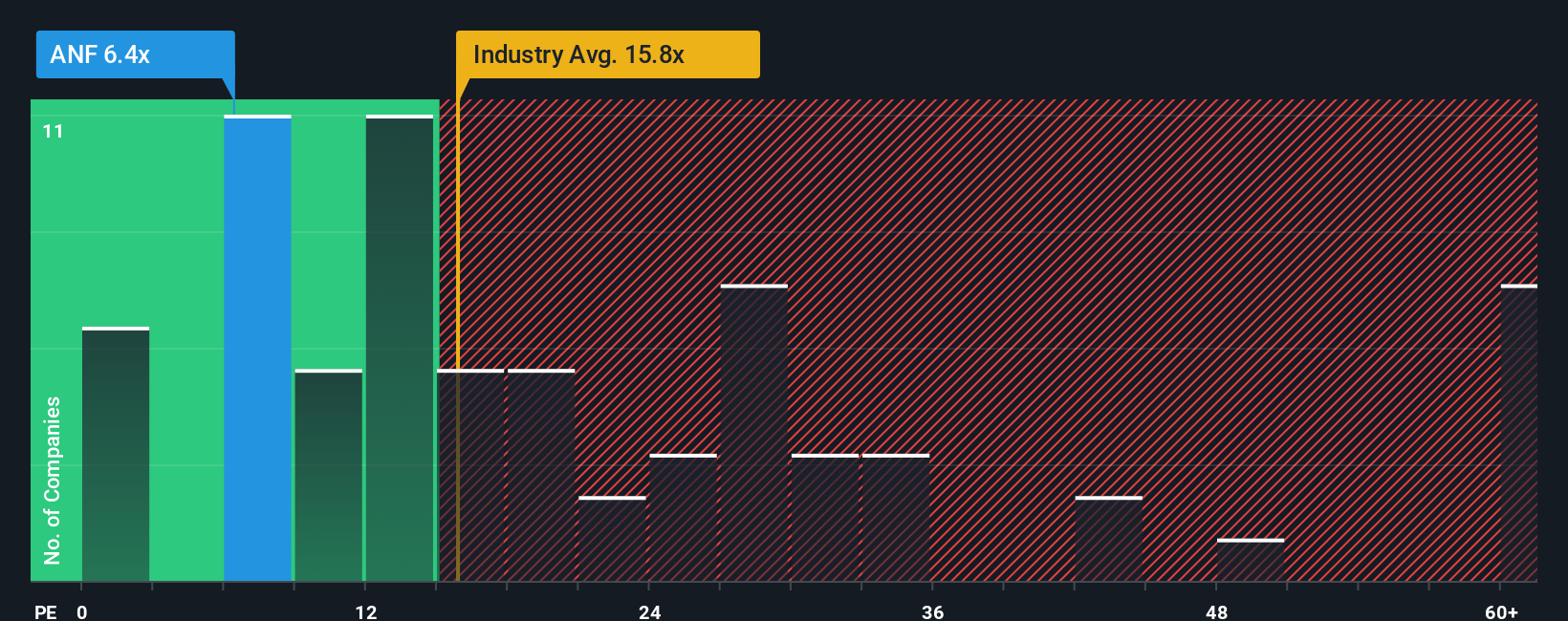

Most Popular Narrative Narrative: 15.8% Overvalued

With Abercrombie & Fitch closing at US$128.85 versus a narrative fair value of about US$111, the narrative suggests the recent share price strength runs ahead of its valuation work.

Consistently high free cash flow and a continued share repurchase program (approximately $250M already repurchased in the year, targeting $400M for FY25), combined with top-tier operating margins and prudent capital allocation, are set to boost earnings per share and unlock further value for shareholders.

Curious what kind of revenue path, margin reset, and future earnings multiple could still point to upside even as earnings are projected to soften and buybacks shrink the share count each year? The narrative lays out a full earnings and valuation framework using its own growth, margin, and discount rate assumptions. The tension is in how much earnings power and multiple the model is willing to assign beyond today.

Result: Fair Value of $111.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that framework could be challenged if tariff costs hit profitability harder than expected, or if softer Abercrombie brand sales and European weakness linger longer than analysts model.

Find out about the key risks to this Abercrombie & Fitch narrative.

Another View: Earnings Power Versus Price

The narrative fair value of about US$111 points to Abercrombie & Fitch looking 15.8% overvalued at the current US$128.85 share price. Yet its 11.3x P/E sits well below peers at 23.5x and below a fair ratio of 13x. This implies the market may be attaching a discount even after a strong run.

That gap cuts both ways. If earnings soften as forecasts suggest, the lower P/E could be a cushion. If they hold up better than expected, investors might ask whether the share price is already catching up to where the ratio could settle over time, or if some margin of safety remains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Abercrombie & Fitch Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a full Abercrombie & Fitch view in just a few minutes with Do it your way.

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Abercrombie & Fitch has you thinking differently about brands and valuation, it is a smart time to scan for other ideas that fit your style and risk appetite.

- Spot potential bargains early by checking out these 3555 penny stocks with strong financials. These pair lower share prices with balance sheets and earnings profiles you can scrutinise in detail.

- Ride long term tech shifts by reviewing these 25 AI penny stocks. Focus on companies tied to automation, data infrastructure, and real world AI applications.

- Prioritise price discipline by filtering for these 875 undervalued stocks based on cash flows. This can help you find opportunities that align with your preferred valuation metrics and avoid overpaying for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報