Assessing Vital Farms (VITL) Valuation After Recent Share Price Drop And Earnings Expectations

Vital Farms (VITL) recently saw its share price fall 6.64% on a day when the broader market gained, which has put extra attention on the company ahead of its upcoming earnings release.

See our latest analysis for Vital Farms.

That daily setback comes after a weaker patch, with a 7 day share price return of 9% and a 90 day share price return of 33%, while the 3 year total shareholder return of 94.37% points to stronger longer term momentum.

If Vital Farms’ recent swings have you thinking about what else is out there, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Vital Farms sharing a 1 year total return of negative 20.13% but trading at a reported 90% discount to one intrinsic value estimate, you have to ask: is this a genuine opening, or is the market already baking in future growth?

Most Popular Narrative: 39.3% Undervalued

At a last close of US$30.03 versus a narrative fair value of about US$49.45, the valuation framework sees a wide gap worth understanding.

Significant expansion of farm and production network, including acceleration of CapEx to build out capacity (two production lines at the Seymour, Indiana facility and additional cold storage), positions Vital Farms to fully capitalize on unmet/pent-up demand. This removes prior supply constraints and supports the potential for further revenue and earnings growth.

Want to see how capacity build out, margin assumptions and a rich future P/E are stitched together into one value story? The earnings ramp, revenue trajectory and discount rate all matter more than you might think. Curious which piece of that trio carries the most weight in the fair value math? Read on to see how it all connects.

Result: Fair Value of $49.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story could unravel if heavy capital spending turns free cash flow negative for longer than expected, or if discount driven competition chips away at pricing power.

Find out about the key risks to this Vital Farms narrative.

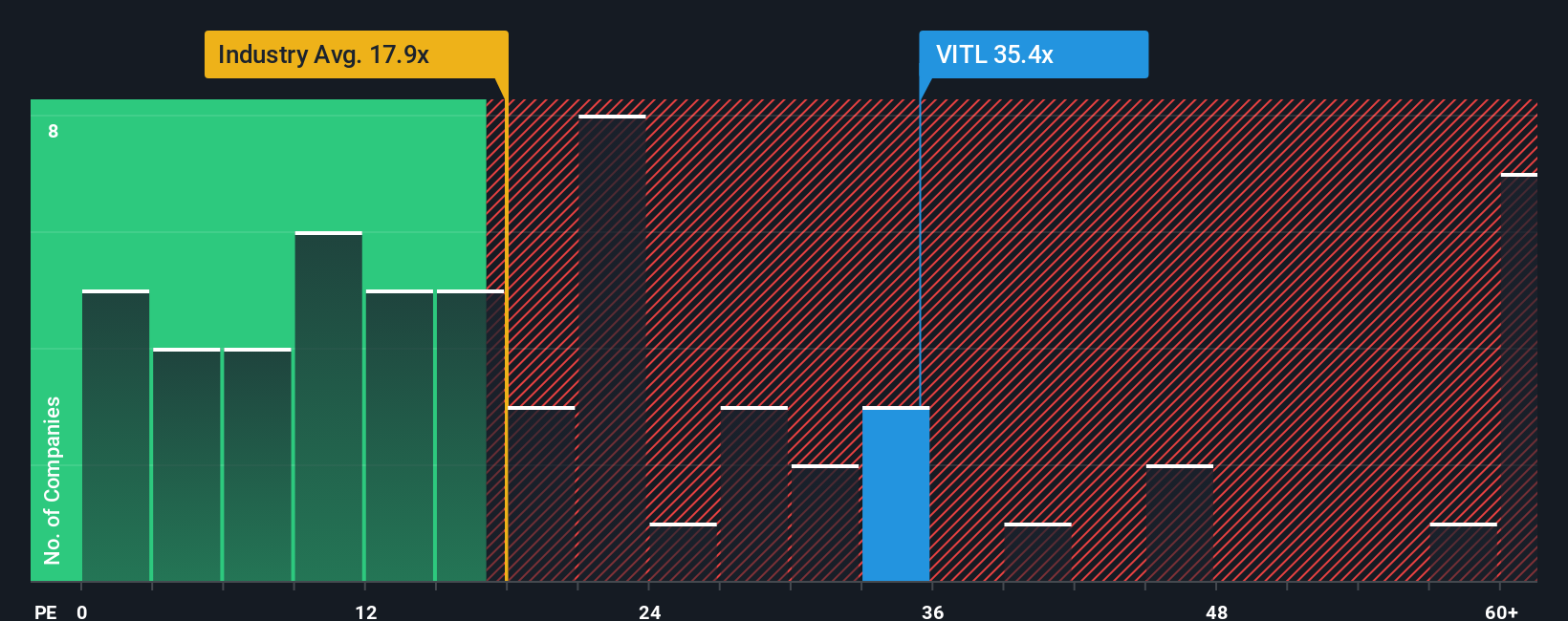

Another Angle: P/E Sends A Mixed Signal

The narrative fair value of about US$49.45 suggests upside, but the current P/E of 22.2x sits above both the US Food industry average of 19.7x and the fair ratio of 20x, even though it is well below the peer average of 73.4x. That gap leaves you weighing valuation headroom against the risk that sentiment shifts back toward the fair ratio. Which side of that trade off feels more comfortable to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vital Farms Narrative

If this version of the story does not quite match your view, you can stress test the numbers yourself and build a fresh take in minutes: Do it your way.

A great starting point for your Vital Farms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you like what you have learned about Vital Farms but do not want to stop there, now is the time to widen your search for other opportunities.

- Target potential mispricings by scanning these 875 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Ride powerful tech trends by zeroing in on these 25 AI penny stocks that are tied to artificial intelligence themes.

- Tap into recurring income potential by filtering for these 11 dividend stocks with yields > 3% that could strengthen the yield side of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報