ForFarmers And 2 Other Undiscovered European Gems With Strong Potential

As the pan-European STOXX Europe 600 Index hits new highs, buoyed by an improving economic backdrop and closing 2025 with its strongest yearly performance since 2021, investors are increasingly turning their attention to promising small-cap stocks across the continent. In this environment, identifying companies with robust fundamentals and growth potential can be particularly rewarding, as they may offer unique opportunities in a market that continues to show resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Value Rating: ★★★★★★

Overview: ForFarmers N.V. is a company that offers feed solutions for both conventional and organic livestock farming across the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally with a market capitalization of approximately €411 million.

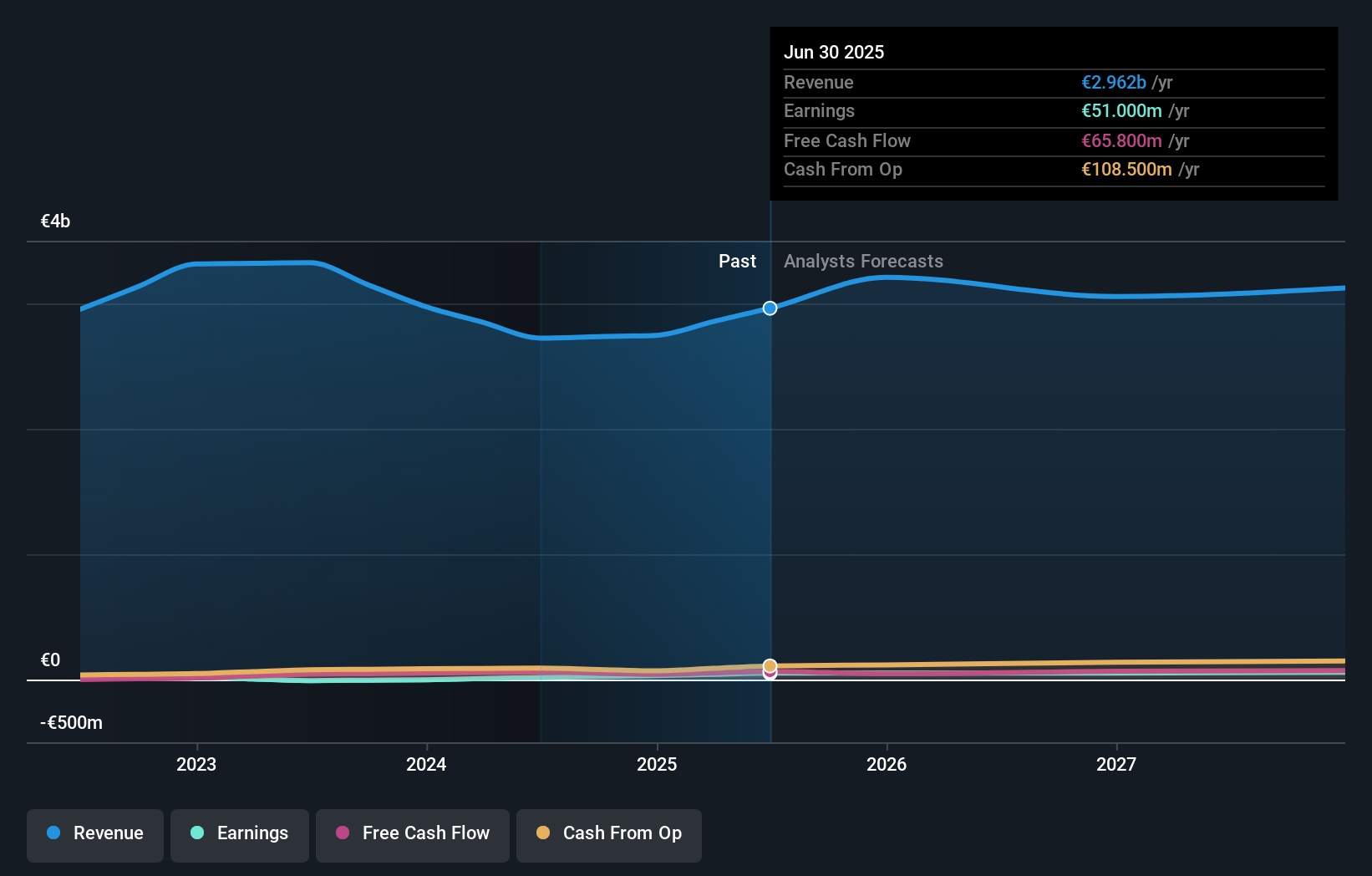

Operations: ForFarmers generates revenue primarily from its food processing segment, amounting to €2.96 billion. The company's financial performance is significantly influenced by this segment's operations.

ForFarmers, a player in the European agricultural sector, is trading at 79.5% below its estimated fair value, offering potential for value-seeking investors. Over the past year, earnings surged by 193%, outpacing the food industry's -3.6% performance. The company's net debt to equity ratio stands at a satisfactory 11.8%, reflecting prudent financial management. ForFarmers' strategy focuses on expanding in Eastern Europe and enhancing sustainability efforts to leverage rising protein demand. While positioned for growth with high-quality earnings and free cash flow positivity, challenges include dependency on acquisitions and regulatory pressures in markets like Poland and the Netherlands.

Jensen-Group (ENXTBR:JEN)

Simply Wall St Value Rating: ★★★★★★

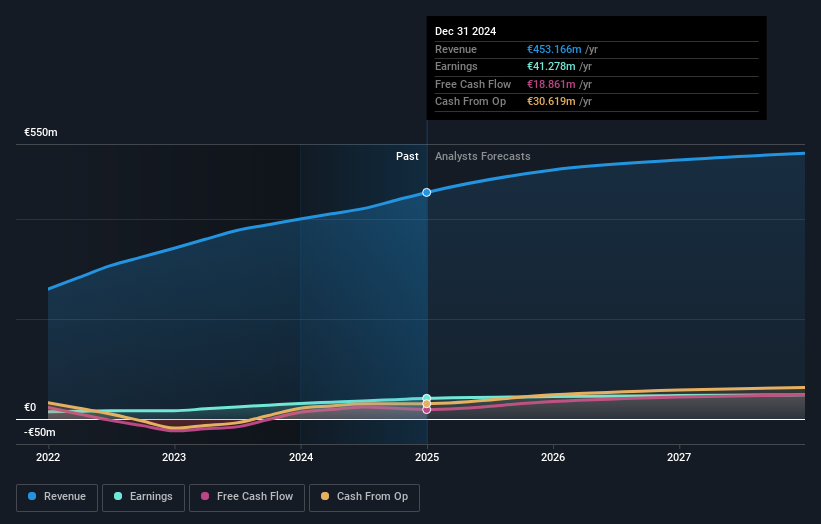

Overview: Jensen-Group NV, along with its subsidiaries, focuses on designing, producing, and supplying machines, systems, turnkey solutions, and automation processes for the heavy-duty laundry industry with a market capitalization of €552.67 million.

Operations: Jensen-Group generates revenue primarily from its heavy-duty laundry segment, with reported revenues of €488.99 million. The company's market capitalization stands at €552.67 million.

Jensen-Group, a small player in the machinery sector, seems undervalued, trading at 53.6% below its estimated fair value. Its earnings quality stands out with a notable growth of 44.5% over the past year, surpassing the industry average by a significant margin. The company's net debt to equity ratio is satisfactory at 5.9%, reflecting prudent financial management as it reduced from 36.6% to 15.2% over five years. With positive free cash flow and no immediate concerns about interest coverage or cash runway, Jensen-Group appears well-positioned within its industry context for potential future growth and value realization.

- Dive into the specifics of Jensen-Group here with our thorough health report.

Assess Jensen-Group's past performance with our detailed historical performance reports.

PCC Rokita (WSE:PCR)

Simply Wall St Value Rating: ★★★★★☆

Overview: PCC Rokita SA is a chemical company that designs, produces, and sells its products across various regions including Poland, Germany, the European Union, the United States, and Asia; it has a market capitalization of PLN1.32 billion.

Operations: The company's primary revenue streams include the Organochlorine segment at PLN 921.43 million and the Polyurethanes segment at PLN 759.69 million, with additional contributions from its Power Industry and Other Chemical Activities segments. The net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

PCC Rokita, a notable player in the chemicals sector, showcases strong financial health with its interest payments well covered by EBIT at 8.4 times. Over the past year, earnings surged by 20%, outpacing industry growth of 17.2%. The company's debt to equity ratio has impressively reduced from 98.9% to 32.2% over five years, reflecting prudent financial management and a satisfactory net debt to equity ratio of 26.5%. Recent results highlight a turnaround with Q3 net income reaching PLN 32.56 million compared to a loss last year, while sales for nine months were PLN 1,372.62 million against PLN 1,460.09 million previously.

- Unlock comprehensive insights into our analysis of PCC Rokita stock in this health report.

Understand PCC Rokita's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 298 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報