Fresh Look At Phillips 66 (PSX) Valuation After Mixed Recent Share Price Performance

Fresh look at Phillips 66 after recent performance

With no single headline event driving attention today, Phillips 66 (PSX) is drawing interest after a mixed stretch of recent returns, including a 2.4% decline over the past month and a 4.1% gain over the past 3 months.

See our latest analysis for Phillips 66.

At a share price of US$136.65, Phillips 66 has seen short term share price momentum cool after a recent 7 day gain. The 1 year total shareholder return of 23.1% and 5 year total shareholder return of 125.3% point to stronger longer term rewards, which can reflect shifting expectations around both growth prospects and risk in the energy sector.

If you are comparing Phillips 66 with other energy names, it can also be useful to look across the sector using tools that surface aerospace and defense stocks as a different corner of the market where cash flows and risk profiles look very different.

With Phillips 66 trading at US$136.65, sitting below an analyst price target of US$150.05 and with some models implying a sizable intrinsic discount, the key question is whether you are looking at genuine value or a market that already reflects future growth.

Most Popular Narrative Narrative: 8.2% Undervalued

Against a last close of US$136.65, the most followed narrative points to a higher fair value of US$148.85, rooted in detailed cash flow assumptions.

Acquisitions like EPIC NGL are expected to be immediately accretive, providing fee-based earnings growth and supporting the company’s plan to grow Midstream EBITDA to $4.5 billion by 2027, positively impacting earnings.

Want to see what sits behind that uplift, and why earnings, margins and the future profit multiple all have to work together for this fair value to hold? The narrative leans heavily on changing revenue mix, improving profitability and a specific earnings path several years out. Curious which of those levers does the heavy lifting in the model, and how sensitive the outcome is to even small tweaks?

Result: Fair Value of $148.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are pressure points to watch, including weaker long term revenue expectations and earnings sensitivity to refining conditions and Midstream disruptions, which could derail this upside story.

Find out about the key risks to this Phillips 66 narrative.

Another View on Value

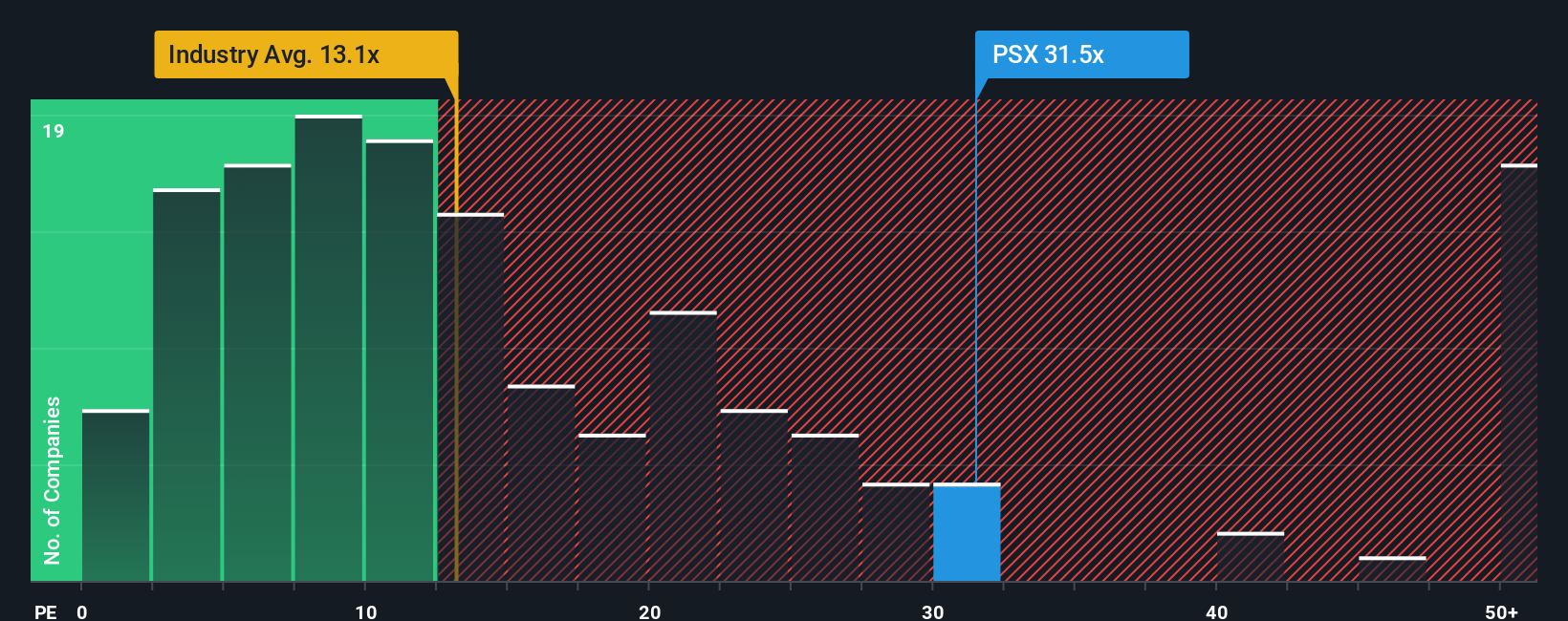

The narrative points to an 8.2% upside, but the P/E picture tells a different story. Phillips 66 trades on a 36.8x P/E, compared with 13.1x for the US Oil and Gas industry and 25.4x for peers. Our fair ratio is 23.6x, and that gap points to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you are not fully aligned with this view or prefer to test the numbers yourself, you can build a personalised Phillips 66 story in just a few minutes, Do it your way.

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Phillips 66 has caught your eye, do not stop there. Casting a wider net of ideas now can help sharpen how you think about any single stock.

- Spot potential bargains early by scanning these 875 undervalued stocks based on cash flows that line up with your view on cash flows and price.

- Explore major technology trends by checking out these 25 AI penny stocks that are tying artificial intelligence to specific business models.

- Target income first by focusing on these 11 dividend stocks with yields > 3% that put yield and regular cash payments at the center of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報