High Growth Tech Stocks To Explore In January 2026

As we enter January 2026, global markets are navigating a complex landscape marked by recent declines in U.S. stock indexes and mixed performances across regions, with the Nasdaq Composite and Russell 2000 experiencing notable drops while European indices have shown resilience. Amidst these dynamics, investors looking at high growth tech stocks should consider factors such as innovation potential and adaptability to economic shifts, which can be crucial in leveraging opportunities within this evolving market environment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Gold Circuit Electronics | 31.06% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| CD Projekt | 33.20% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. is a company that develops, manufactures, and sells fiber optics communication products in China with a market capitalization of CN¥25.83 billion.

Operations: T&S Communications generates revenue primarily from its Optical Communication Components segment, which accounts for CN¥1.67 billion.

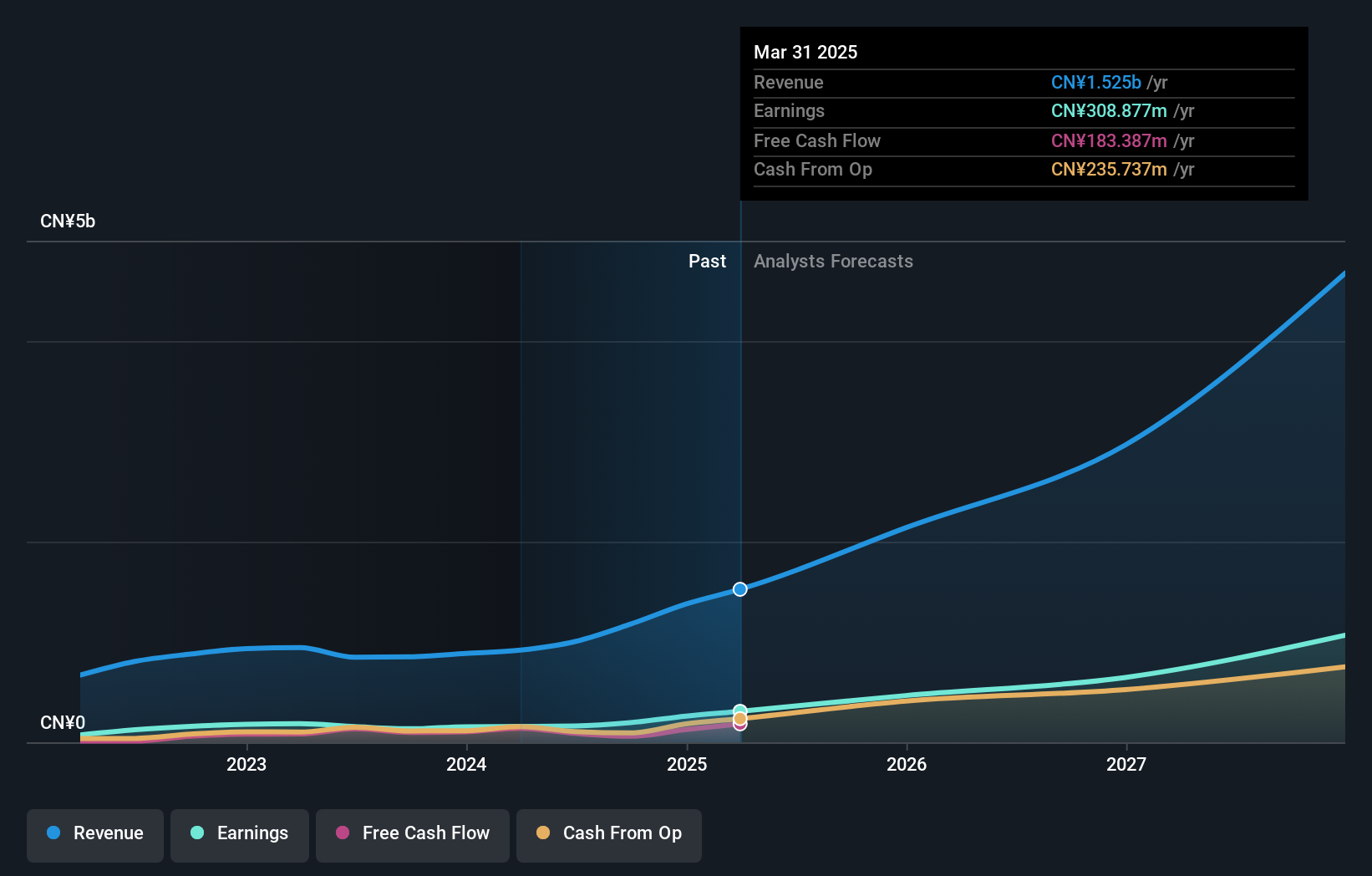

T&S Communications has demonstrated robust growth with a 91.7% increase in earnings over the past year, outpacing the communications industry's average of 14.4%. This surge is underpinned by significant R&D investments, aligning with its revenue growth forecast at 44.9% annually, which also exceeds the broader CN market projection of 14.4%. Recent strategic amendments to its bylaws and corporate structure underscore a proactive approach to governance that supports its aggressive expansion strategy. With earnings expected to grow by another 48.9% annually, T&S is positioning itself as a formidable entity in tech innovation and market share acquisition.

- Delve into the full analysis health report here for a deeper understanding of T&S CommunicationsLtd.

Gain insights into T&S CommunicationsLtd's past trends and performance with our Past report.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. manufactures and sells liquid crystal displays and display modules both in China and internationally, with a market capitalization of CN¥3.12 billion.

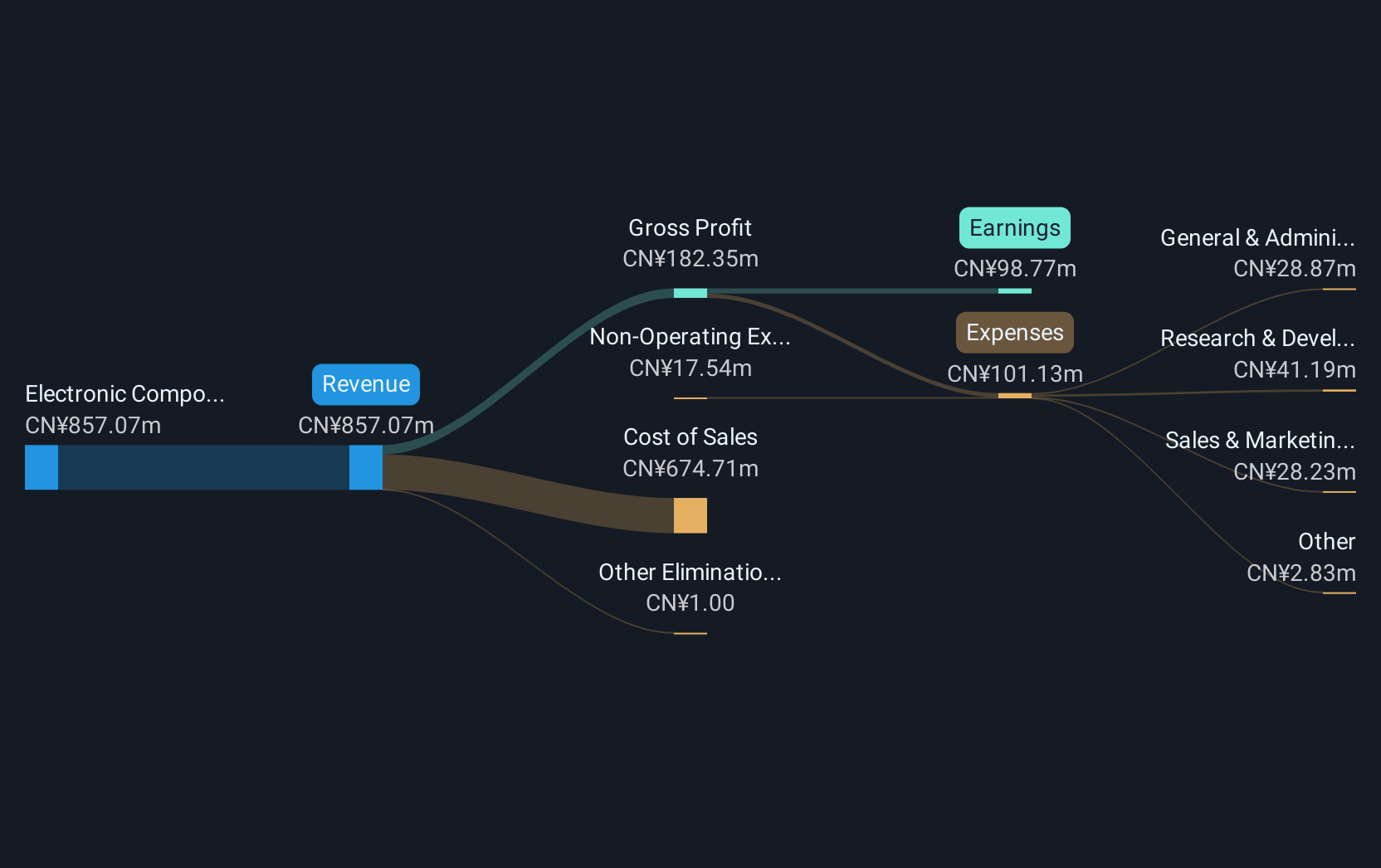

Operations: Smartwin generates revenue primarily from the sale of electronic components and parts, amounting to CN¥908.81 million. The company's operations focus on manufacturing liquid crystal displays and display modules for both domestic and international markets.

Amidst a dynamic tech landscape, Jiangsu Smartwin Electronics Technology Co., Ltd. stands out with its robust revenue growth, projected at 35.1% annually, significantly outpacing the broader CN market's 14.4%. This growth is complemented by an impressive forecast in earnings increase at nearly 50% per year. The company's commitment to innovation is evident from its recent strategic acquisitions and substantial R&D investments, positioning it well for sustained market relevance and competitive edge in the electronics sector.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market cap of CN¥5.97 billion.

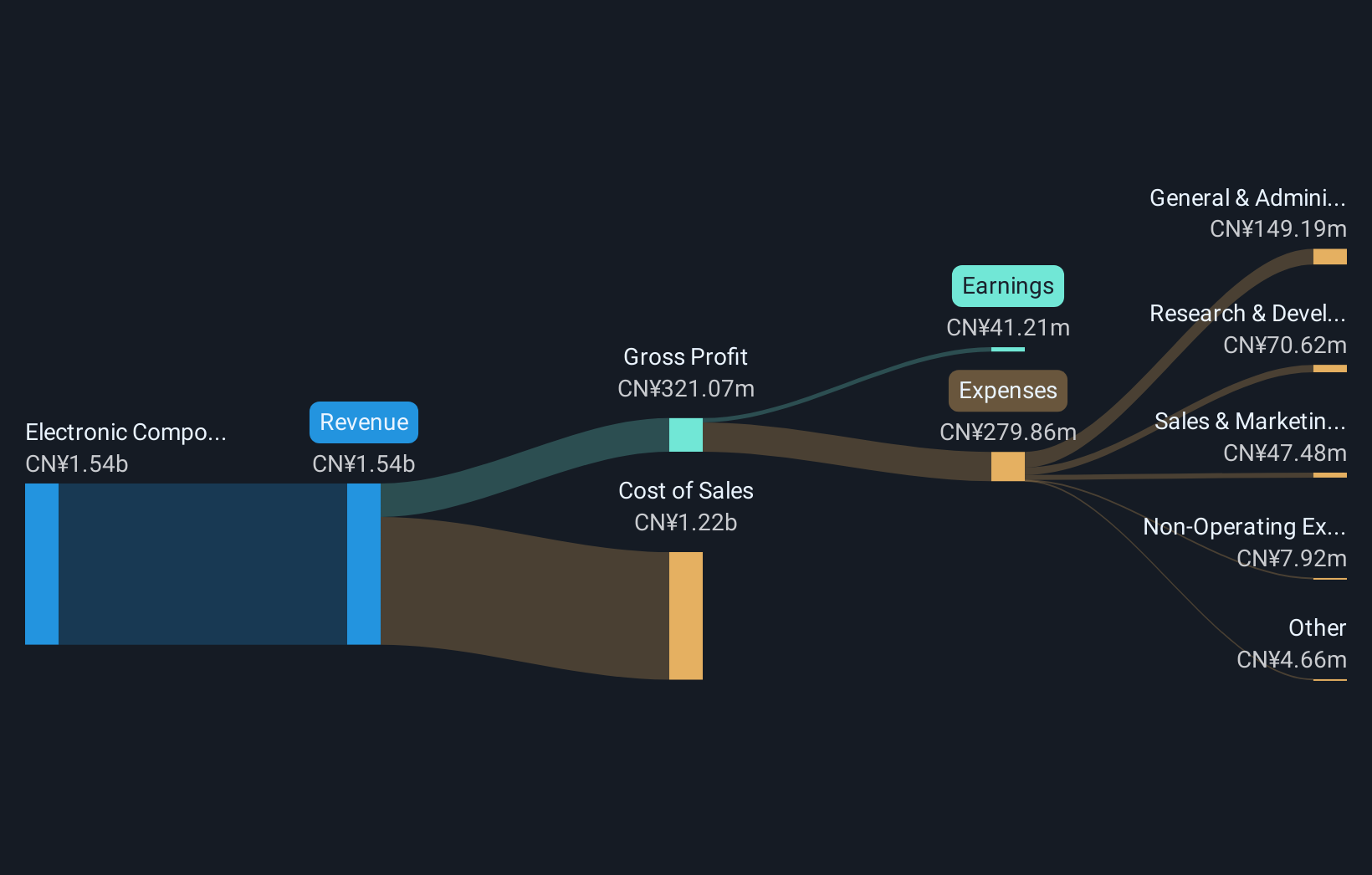

Operations: The company generates revenue primarily from its electronic components and parts segment, totaling CN¥1.54 billion.

Shenzhen Bromake New Material has demonstrated robust growth, with revenue soaring to CNY 1.16 billion, up from CNY 841.36 million year-over-year—a significant leap of 37.8%. This surge is complemented by a remarkable increase in net income, which quadrupled to CNY 28.16 million from CNY 7.41 million, reflecting an earnings growth of approximately 280%. The firm’s commitment to innovation is underscored by its R&D expenditures which have consistently aligned with industry demands, ensuring its competitive position in the high-growth tech sector remains strong amidst evolving market dynamics.

Turning Ideas Into Actions

- Delve into our full catalog of 245 Global High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報