American Superconductor (AMSC) Valuation Check After Recent Share Price Weakness

American Superconductor (AMSC) has attracted fresh attention after a mixed pattern in recent returns, with a 7.4% decline over the past day and an approximately 49% drop over the past 3 months.

See our latest analysis for American Superconductor.

The recent 1 day and 90 day share price declines sit alongside a relatively flat year to date share price return, while the 1 year and multi year total shareholder returns remain positive. This suggests momentum has recently faded after a very strong run.

If AMSC’s swings have caught your eye, it could be a good moment to broaden your search with high growth tech and AI stocks and see what else is moving in related areas.

With American Superconductor trading around $30.75, an intrinsic value estimate implying a 40% discount, and a value score of 3, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 49.6% Undervalued

With American Superconductor last closing at $30.75 against a narrative fair value of US$61, the current setup hinges on how future margins and growth hold up.

High factory utilization and capacity expansion plans, combined with operational leverage from past and potential acquisitions, are driving improved efficiency and margin profile, with the potential for further net income growth as scale increases. Ongoing development and successful deployment of proprietary, higher-margin grid and materials technologies, including integration of recent acquisitions, are increasing content per project, supporting gross margin expansion and scalable earnings.

Curious what kind of revenue climb and margin shift need to line up for that valuation gap to make sense? The narrative leans on faster growth, rising profitability and a rich future earnings multiple that looks very different to today. The exact mix of assumptions may surprise you.

Result: Fair Value of $61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could look very different if semiconductor and energy orders roll over, or if high R&D and SG&A spending stop pulling their weight.

Find out about the key risks to this American Superconductor narrative.

Another View on Value

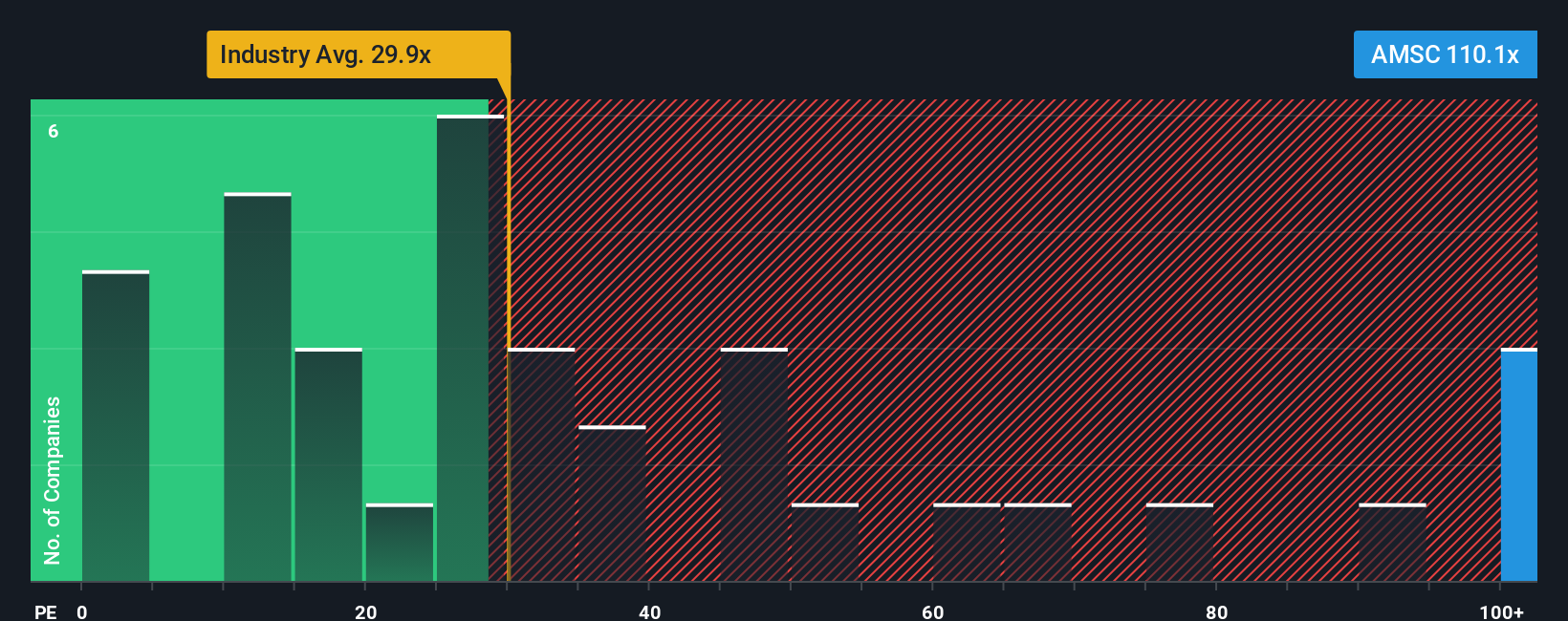

Those fair value estimates that flag American Superconductor as 40.2% undervalued sit awkwardly next to its current P/E of 91.8x. This multiple is well above the estimated fair ratio of 47.1x, the US Electrical industry at 31.7x, and peers at 37.7x. Is the premium signaling real quality, or is valuation risk building up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Superconductor Narrative

If you look at the numbers and come to a different conclusion, or prefer to test your own inputs, you can build a personalized view in minutes with Do it your way.

A great starting point for your American Superconductor research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If American Superconductor is on your radar, do not stop there. Use the screener to spot other opportunities that could suit your style and risk tolerance.

- Target potential mispricings by checking out these 873 undervalued stocks based on cash flows that line up current prices with underlying cash flow strength.

- Ride powerful tech trends by scanning these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Hunt for early stage opportunities with these 3552 penny stocks with strong financials that still meet basic financial quality checks before they appear on everyone’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報