Vinci (ENXTPA:DG) Valuation Check After Strong 1 Year Return And Steady Recent Share Performance

Why Vinci is on investors’ radar today

With no single headline event driving Vinci (ENXTPA:DG) into focus, investors are paying attention to its recent share performance and current valuation signals, looking to gauge how the construction and concessions group is positioned.

See our latest analysis for Vinci.

Vinci’s share price has been broadly steady in recent weeks, but the 90 day share price return of 2.95% sits against a 1 year total shareholder return of 23.93%, hinting that earlier momentum has cooled while long term holders have still been rewarded.

If Vinci’s recent gains have you thinking about where else capital could work for you, now might be a good time to widen the search with fast growing stocks with high insider ownership.

So with a €120.40 share price, a 24% 1 year total return and mixed recent short term moves, is Vinci quietly trading below what it is worth, or is the market already pricing in any future growth?

Most Popular Narrative: 11.3% Undervalued

With Vinci last closing at €120.40 and the most followed narrative pointing to a fair value near €135.74, attention naturally turns to what is driving that gap.

Accelerating global infrastructure investment, notably for decarbonization and energy transition projects, is associated with significant order intake and backlog growth (order book at record highs, major wins in renewables, high-voltage transmission, and PPP electrical distribution). This is cited as supporting forward revenue visibility.

Curious what underpins this valuation call? It focuses on steady revenue expansion, firmer margins, and a richer earnings multiple than today. Want the full playbook behind those assumptions and how they compare over the next few years? The detailed narrative lays out the step by step numbers behind that fair value.

Result: Fair Value of €135.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on French motorway concessions beyond 2031 and on future tax policy, where tougher terms or higher charges could materially strain Vinci’s high margin cash flows.

Find out about the key risks to this Vinci narrative.

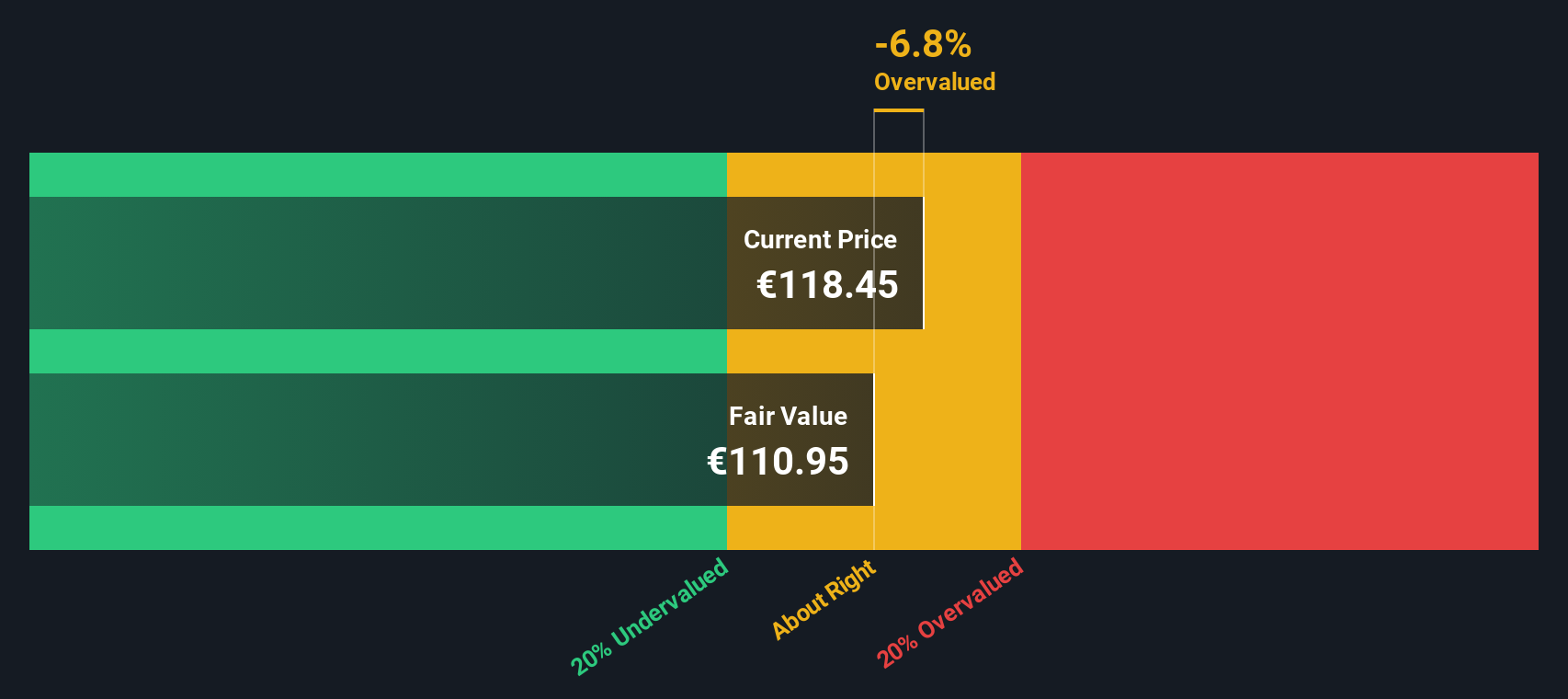

Another View: SWS DCF Sends A Different Signal

The popular narrative points to Vinci trading about 11.3% below a fair value of roughly €135.74. However, our DCF model indicates a different picture. Based on that analysis, the current €120.40 price sits above an estimated fair value of €108.24, which suggests there may be less room for error if the long term story softens.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vinci for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vinci Narrative

If you interpret the numbers differently or simply want to test your own perspective, you can build a personalised Vinci story in just a few minutes with Do it your way.

A great starting point for your Vinci research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vinci has sharpened your thinking, do not stop here. The Screener can quickly surface other angles that might fit your goals before the market moves on.

- Target potential mispricings by focusing on these 877 undervalued stocks based on cash flows, so you can line up candidates where expectations and current prices may be out of sync.

- Spot emerging themes in automation and data by searching through these 25 AI penny stocks that are tied to real business models, not just hype.

- Strengthen your income watchlist with these 11 dividend stocks with yields > 3%, highlighting higher yielding names you might want to investigate further.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報