Assessing BorgWarner (BWA) Valuation After Morgan Stanley Rating Shift And 2025 Outlook Update

Morgan Stanley’s rating change on BorgWarner (BWA), along with its updated 2025 outlook and cautious stance on electric vehicles, has put fresh attention on how the company balances combustion, hybrid and remanufactured parts opportunities.

See our latest analysis for BorgWarner.

The rating change comes after a period of improving momentum, with BorgWarner’s recent 30-day share price return of 10.6% and 90-day share price return of 11.8%, alongside a 1-year total shareholder return of 50.6% suggesting that interest has been rebuilding.

If this shift in sentiment has you looking beyond BorgWarner, it may be a moment to scan other auto names through auto manufacturers and see what else stands out.

With BorgWarner trading at $47.89, a 4.6% gap to the average analyst target of $50.08 and an estimated 32.6% intrinsic discount, you have to ask whether this is a genuine value gap or if the market is already factoring in expectations for future growth.

Most Popular Narrative Narrative: 4.4% Undervalued

Compared with the last close of $47.89, the most followed narrative points to a fair value near $50, suggesting only a modest valuation gap.

Ongoing operational restructuring and cost controls, alongside battery business consolidation measures, are yielding improvements in adjusted operating margins and free cash flow, indicating enhanced profitability and the potential for structurally higher net margins as the company pivots to electrified products.

Curious what kind of revenue path and margin reset sit behind that valuation? The narrative leans on gradual top line growth, stronger profitability, and a lower future earnings multiple. The exact mix of those moving parts is where the real story lives.

Result: Fair Value of $50.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if dependence on combustion products bites harder than expected or if the Battery and Charging Systems segment faces prolonged demand softness.

Find out about the key risks to this BorgWarner narrative.

Another View: Market Ratios Flash A Different Signal

So far, the story leans on a fair value of about $50.08 and a 32.6% intrinsic discount based on future cash flows and earnings. If you look at the market ratios instead, the picture is less forgiving.

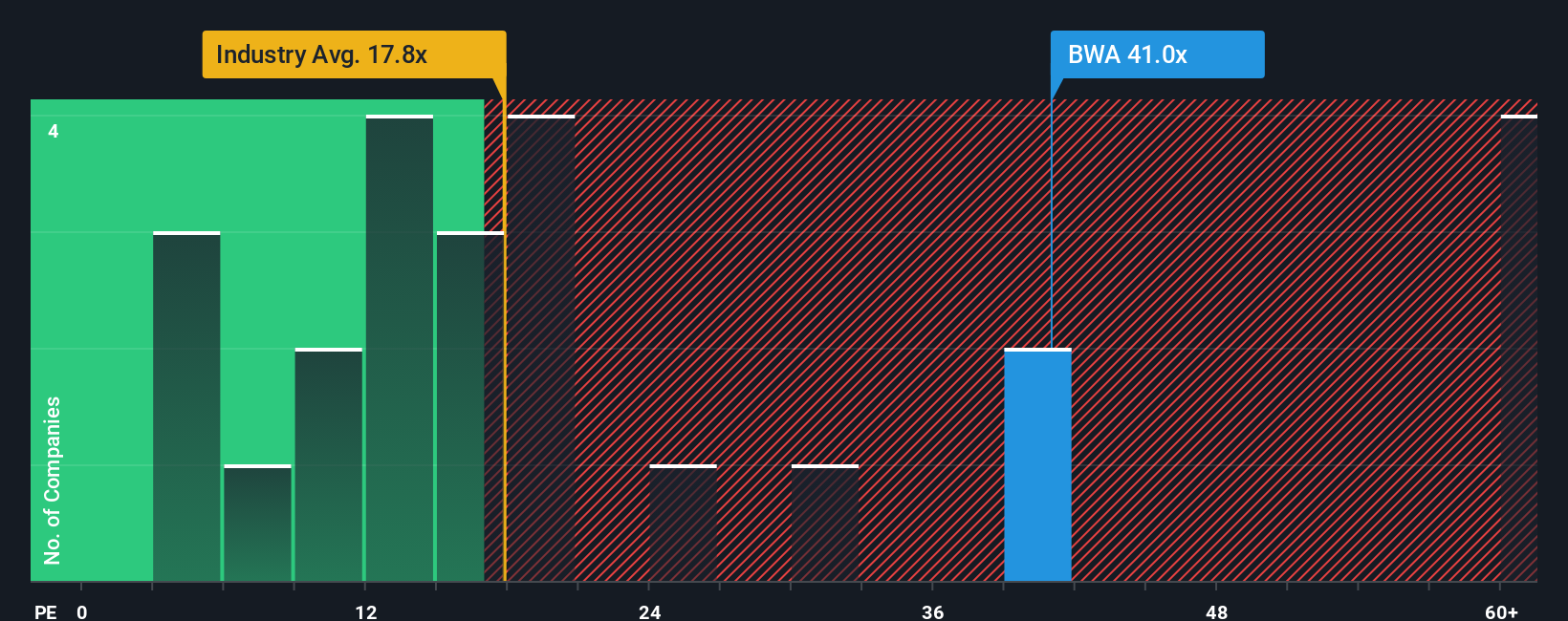

BorgWarner currently trades on a P/E of 75.3x, compared with 19x for the US Auto Components industry, 25.5x for peers, and a fair ratio of 16.1x. That kind of gap can mean the market is already pricing in a lot of good news. This raises the question: is this a value gap or valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BorgWarner Narrative

If you see the data differently or simply want to test your own assumptions, you can build a fresh BorgWarner story in minutes, starting with Do it your way.

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BorgWarner has caught your eye, do not stop there. Cast a wider net with a few focused screens that can surface very different kinds of opportunities.

- Target potential mispricings by running through these 877 undervalued stocks based on cash flows that may be trading at a discount to their fundamentals.

- Tap into fast moving themes by checking these 25 AI penny stocks that are tied to artificial intelligence trends.

- Strengthen your income watchlist by reviewing these 11 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報