Jensen Huang Says Tesla FSD Is '100% State-Of-The-Art,' Explains How Nvidia's Alpamayo Is Different

Nvidia Corp (NASDAQ:NVDA) CEO Jensen Huang has hailed the progress made by Tesla Inc.'s (NASDAQ:TSLA) Full Self-Driving (FSD) system, saying that the Elon Musk-led EV giant’s approach was “hard to criticize.”

FSD Is State-Of-The-Art, Says Jensen Huang

Huang, in an interview with Bloomberg's Ed Ludlow on Tuesday, was asked about the differences between Nvidia's approach to self-driving in comparison with Tesla's FSD. Huang shared that the outlier between Alpamayo and Tesla’s FSD was the former’s combination of vision, radar, and LiDAR tech. However, he then added that despite its combination of sensors and cameras, the technology was "rather similar" to Tesla's.

"I think I think Elon’s approach is about state of the art, as anybody knows, of autonomous driving robotics," Huang said. The Nvidia chief also said that he would "encourage" Tesla in its self-driving pursuits.

Musk Hails Tesla's AI4 Chip

The comments coincide with Musk hailing the automaker's AI4 chip, sharing that Tesla would be spending double the planned $10 billion amount it intends to spend on training Nvidia hardware had it not been for its own in-house AI chipset.

He also lamented the auto industry's lack of investment in AI and autonomous driving technology. Interestingly, Tesla rival Lucid Group Inc. (NASDAQ:LCID) recently showcased its robotaxi prototype.

Musk Wishes Success For Nvidia

Musk, following the reveal of Nvidia's self-driving technology, shared that the distribution for the technology could pose a challenge for the chipmaker in its autonomous goal, but ultimately wished the company success in its approach to self-driving technology.

The billionaire also revealed that it could take some time for the technology to pose a competitive challenge to Tesla's FSD system, sharing that the timeframe could stretch to 5 or 6 years.

Nvidia's xAI Investment

On the other hand, Nvidia is a "strategic investor" in Musk's artificial intelligence enterprise, xAI, as the company announced it raised over $20 billion in Series E funding. Other investors in xAI include the likes of Cisco Investments (NASDAQ:CSCO), the Qatar Investment Authority, as well as Abu Dhabi’s MGX.

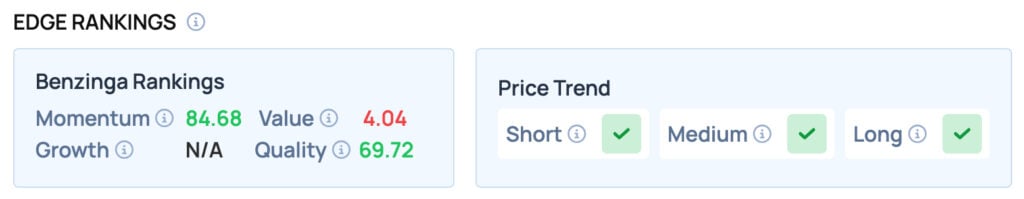

Tesla scores well on the Momentum and Quality metrics, but offers poor Value. It also has a favorable price trend in the Short, Medium, and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Price Action: TSLA declined 4.14% to $432.96 at market close, but it gained 0.46% during the after-hours session, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Photo courtesy: Shutterstock

Nasdaq

Nasdaq 華爾街日報

華爾街日報