Union Pacific (UNP) Valuation Check As Q4 Earnings Approach And Profit Outlook Stays Cautiously Positive

Union Pacific (UNP) heads into its upcoming fourth quarter earnings report with heightened attention, as investors weigh forecasts for slightly higher profit alongside recent share gains and generally positive sentiment from Wall Street analysts.

See our latest analysis for Union Pacific.

Recent news around Union Pacific’s upcoming earnings and its contested merger plans with Norfolk Southern comes at a time when momentum looks restrained, with a 1-year total shareholder return of 3.75% alongside relatively muted short term share price moves.

If this kind of rail story has you thinking about what else is on the move, it could be a good moment to look across auto manufacturers for fresh ideas.

With Union Pacific shares up just 3.75% over the past year yet reportedly trading at a 42% intrinsic discount and below the average analyst target, investors may ask whether this represents a real opening or whether the market is already pricing in future growth.

Most Popular Narrative: 10.3% Undervalued

With Union Pacific last closing at $233.62 against a narrative fair value near $260.48, the gap centers on steady earnings power and premium pricing resilience.

Union Pacific is implementing multiple efficiency enhancements, such as energy management systems for locomotives and optimization tools, which are expected to improve operational efficiency and net margins. The company is expanding capacity with new infrastructure, such as facilities in Houston and Phoenix, which could support future growth and positively impact revenue.

Curious what revenue path, margin profile and future P/E all have to look like to back that fair value? The narrative leans on disciplined pricing, high single digit growth and a richer earnings multiple than today. Want to see how those moving parts line up year by year and what that implies for Union Pacific’s profit engine by the late 2020s?

Result: Fair Value of $260.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on trade and tariff policies remaining manageable and on Intermodal volumes not declining further, as either factor could pressure revenue and margins.

Find out about the key risks to this Union Pacific narrative.

Another View: What P/E Says About The Price

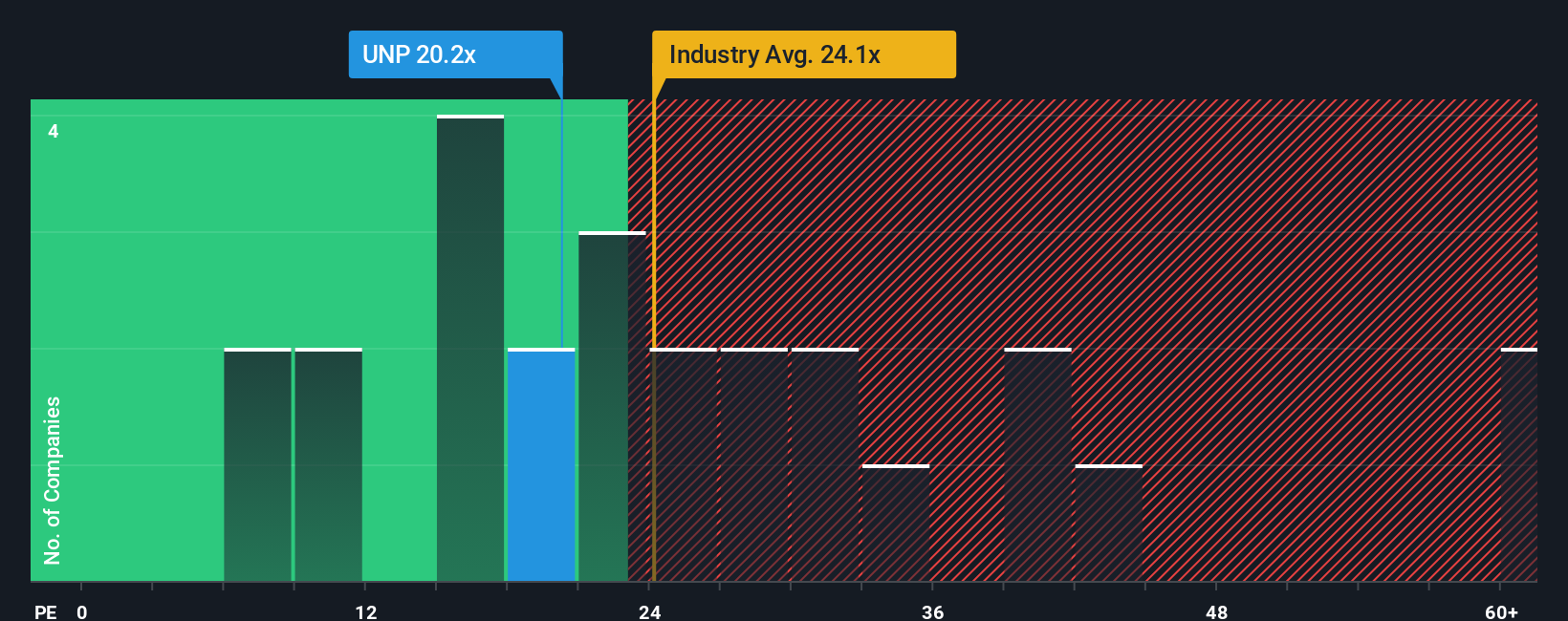

While the narrative fair value of about $260.48 points to Union Pacific as 10.3% undervalued, the P/E view is more cautious. The shares trade on a 19.7x P/E, richer than peers at 18x but below the US Transportation industry at 33.4x and under an estimated fair ratio of 21.6x. That mix hints at some valuation cushion, but also suggests less clear upside than a big discount headline might imply. How much weight do you give this gap when you think about risk and reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Union Pacific Narrative

If you look at these numbers and come to a different conclusion, or just prefer to work from your own assumptions, you can build a full narrative yourself in under a few minutes, starting with Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Union Pacific caught your eye, do not stop here. Use the Simply Wall Street Screener to spot other angles before the market moves without you.

- Target potential mispricings by scanning these 877 undervalued stocks based on cash flows that the market may be overlooking right now.

- Ride the wave of new technology themes by checking out these 25 AI penny stocks that are tied to artificial intelligence.

- Position yourself for income ideas by reviewing these 11 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報