European Dividend Stocks To Consider In January 2026

As the European markets continue to show strength, with the STOXX Europe 600 Index reaching new highs and closing out 2025 with a robust annual return, investors are increasingly turning their attention to dividend stocks as a means of capitalizing on this positive economic backdrop. In such an environment, selecting dividend stocks that not only offer attractive yields but also demonstrate stability and growth potential can be an effective strategy for income-focused investors looking to benefit from Europe's improving economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.95% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.03% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.99% | ★★★★★☆ |

| Credito Emiliano (BIT:CE) | 4.88% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.19% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.21% | ★★★★★★ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

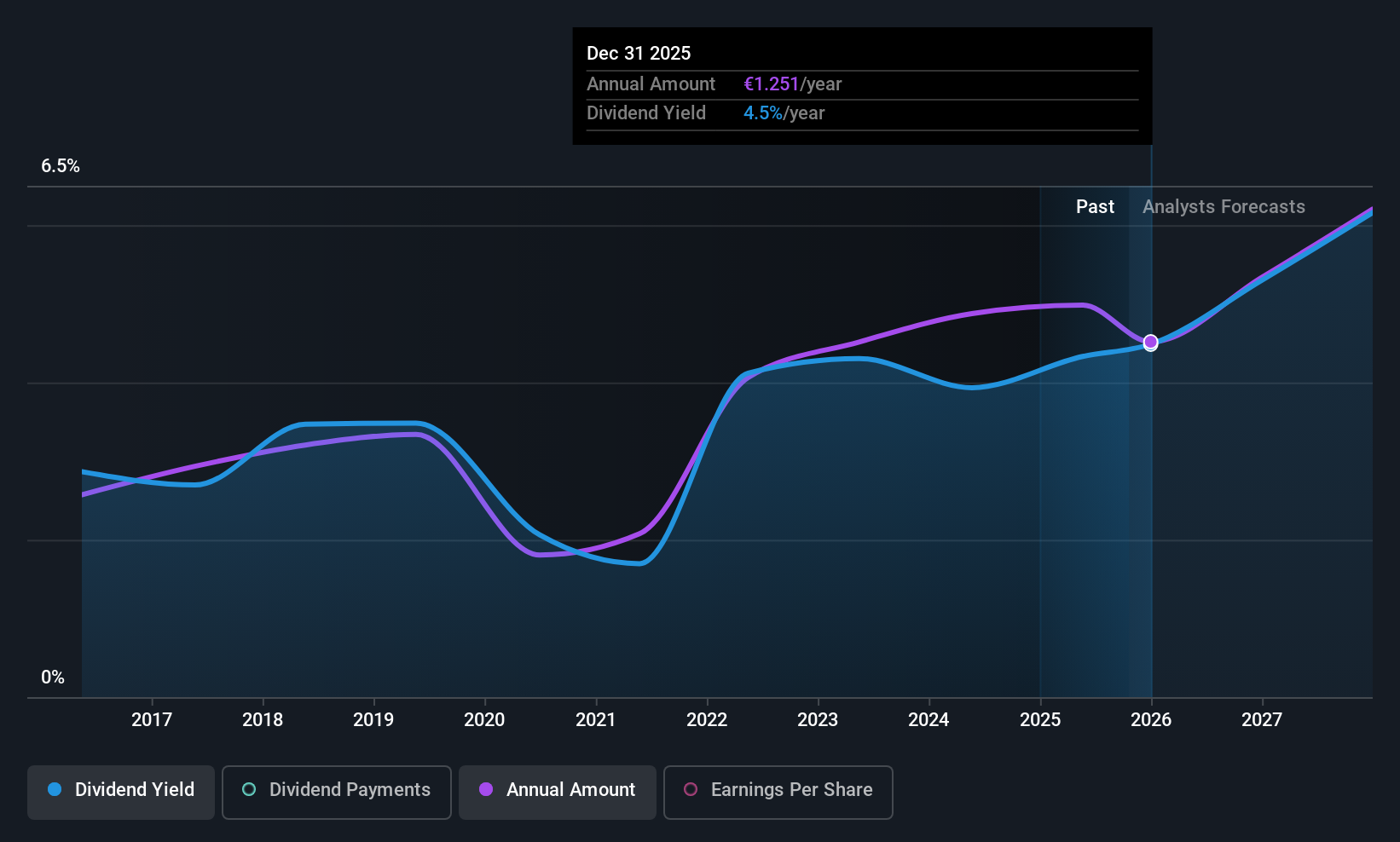

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions is a global manufacturer and seller of tires, with a market cap of €20.14 billion.

Operations: Compagnie Générale des Établissements Michelin Société en commandite par actions generates revenue from three main segments: €6.37 billion from Road Transportation and Related Distribution, €5.74 billion from Specialty Business and Related Distribution, and €14.63 billion from Automotive, Two-wheel and Related Distribution.

Dividend Yield: 4.7%

Compagnie Générale des Établissements Michelin's dividend profile shows mixed signals. While its dividends have grown over the past decade, they have been volatile and unreliable, with significant annual drops. The current payout ratios—62.5% of earnings and 76.6% of cash flows—indicate coverage by profits and cash flows, but the dividend yield is lower than France's top quartile payers. Recent sales figures showed a decline to €19.28 billion from €20.17 billion year-on-year, reflecting potential revenue challenges ahead.

- Click here and access our complete dividend analysis report to understand the dynamics of Compagnie Générale des Établissements Michelin Société en commandite par actions.

- Our valuation report here indicates Compagnie Générale des Établissements Michelin Société en commandite par actions may be undervalued.

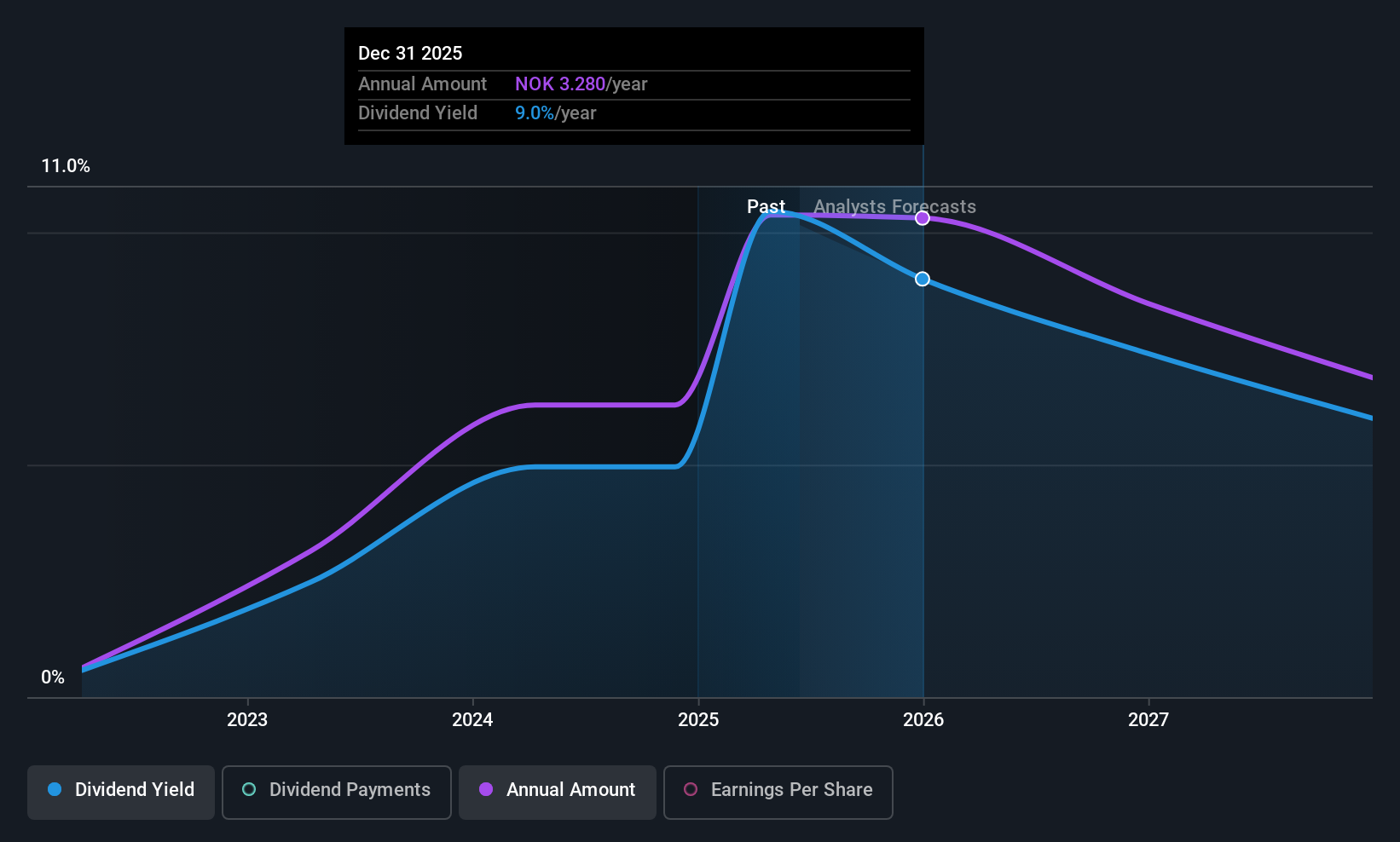

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, and Brazil, with a market cap of NOK15.52 billion.

Operations: Aker Solutions ASA's revenue is primarily derived from its segments, with Renewables and Field Development generating NOK45.07 billion and Life Cycle contributing NOK14.93 billion.

Dividend Yield: 10.3%

Aker Solutions' dividend profile is complex. The company offers a high dividend yield, ranking in the top 25% of Norwegian payers, but its dividends have been volatile and unreliable over the past decade. Despite this instability, current payout ratios—63.1% of earnings and 67.6% of cash flows—suggest dividends are covered by profits and cash flows. Recent contracts with ConocoPhillips and ExxonMobil could bolster future revenue streams, yet earnings are forecasted to decline significantly in coming years.

- Take a closer look at Aker Solutions' potential here in our dividend report.

- Our valuation report unveils the possibility Aker Solutions' shares may be trading at a discount.

Komercní banka (SEP:KOMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komercní banka, a.s., along with its subsidiaries, offers a range of retail, corporate, and investment banking services mainly in the Czech Republic and Central and Eastern Europe, with a market cap of CZK228.52 billion.

Operations: Komercní banka's revenue segments include CZK20.50 billion from retail banking, CZK15.75 billion from corporate banking, and CZK5.25 billion from investment banking services.

Dividend Yield: 7.5%

Komercní banka's dividend yield ranks in the top 25% of Czech payers, though its dividends have been volatile and unreliable over the past decade. Currently, the payout ratio is 87.5%, indicating coverage by earnings, with forecasts suggesting sustainability in three years at a 76.8% payout ratio. Recent earnings show net income growth to CZK 13.58 billion from CZK 12.54 billion year-on-year, highlighting improved financial performance despite a low allowance for bad loans at 74%.

- Unlock comprehensive insights into our analysis of Komercní banka stock in this dividend report.

- The analysis detailed in our Komercní banka valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 188 more companies for you to explore.Click here to unveil our expertly curated list of 191 Top European Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報