A Look At Air Products And Chemicals (APD) Valuation After Hydrogen Megaproject Announcements

Hydrogen megaprojects put Air Products and Chemicals (APD) in focus

Recent hydrogen megaproject announcements, including Air Products and Chemicals (APD) work on the Louisiana Clean Energy Complex and Saudi Arabia’s NEOM Green Hydrogen Project, have put the stock back on many investors’ radar.

See our latest analysis for Air Products and Chemicals.

Those hydrogen announcements have arrived during a mixed period for investors, with the share price at $258.36 and a year to date share price return of 3.15% contrasted against a 1 year total shareholder return decline of 7.36%. This suggests momentum has been rebuilding more recently.

If projects like NEOM have you thinking about long term themes, it could be worth scanning beyond industrial gases and checking out fast growing stocks with high insider ownership.

With APD trading at $258.36, showing a small year to date gain but a 1 year total return decline and only a 2.1% intrinsic discount, the question is whether there is meaningful upside potential or if any future growth is already reflected in the price.

Most Popular Narrative Narrative: 11.8% Undervalued

With Air Products and Chemicals last closing at US$258.36 against a narrative fair value of about US$292.86, the valuation hinges heavily on long duration clean energy projects and margin expansion assumptions.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Curious what kind of revenue path and margin step up would justify that higher fair value, even with a lower future P/E than today? The narrative leans on a detailed earnings build that connects these hydrogen and ammonia projects to future profits. If you want to see exactly how those moving parts add up to that valuation, the full story lays out the numbers behind the confidence.

Result: Fair Value of $292.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story still depends on big pieces falling into place, and delays or weaker returns on projects like LA Blue or NEOM could quickly challenge it.

Find out about the key risks to this Air Products and Chemicals narrative.

Another Angle On Valuation

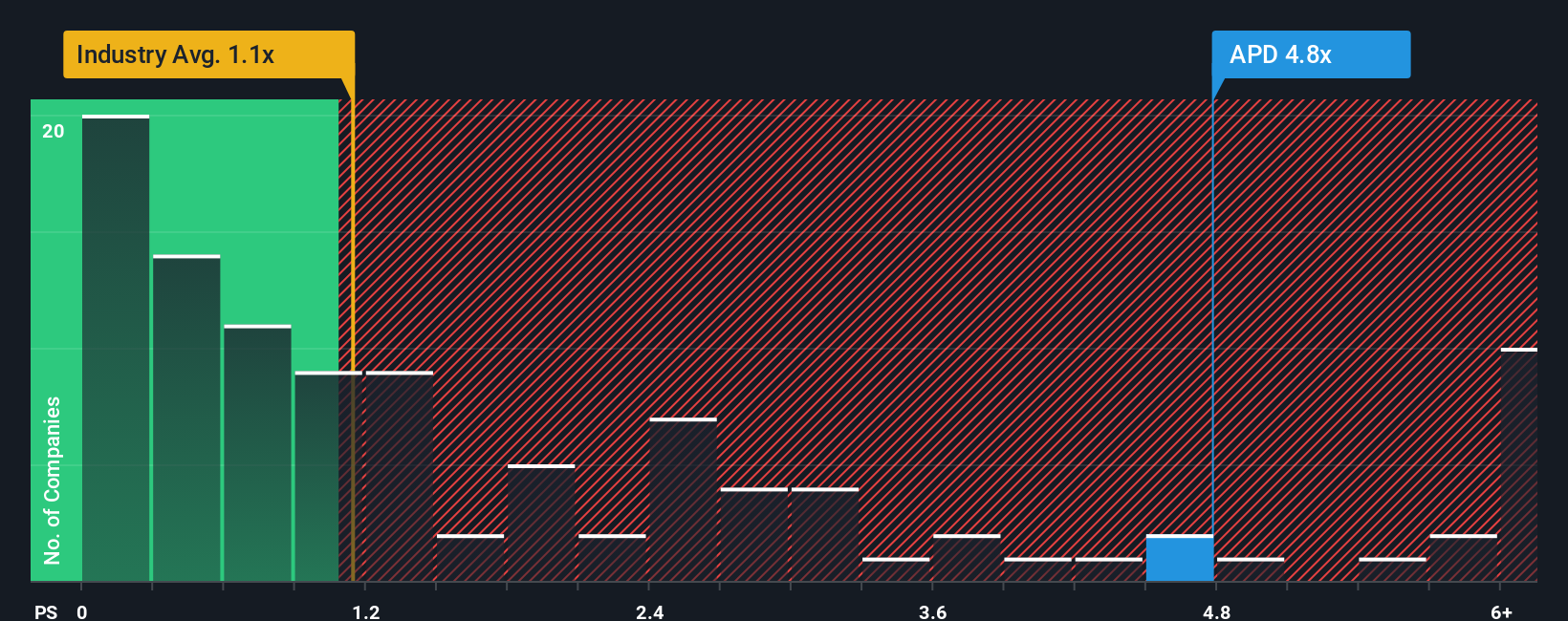

The narrative model sees Air Products and Chemicals as about 12% undervalued, yet the current P/S of 4.8x tells a tighter story. That is richer than the US Chemicals industry at 1.1x, peers at 4.3x, and above a fair ratio of 2.5x, which points to higher valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If this story does not quite fit how you see APD, you can review the numbers yourself and build a custom view in minutes with Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If APD has sharpened your interest, do not stop here. A few minutes with the right screeners can surface opportunities you will not want to miss.

- Target reliable income by reviewing these 11 dividend stocks with yields > 3% that focus on cash returns above a 3% yield.

- Hunt for mispriced opportunities with these 877 undervalued stocks based on cash flows built around discounted cash flow estimates.

- Position yourself early in niche trends by scanning these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報