Emerging Middle East Stocks to Watch in January 2026

As the Middle East markets experience gains across most Gulf bourses, buoyed by rising expectations of U.S. Federal Reserve rate cuts, investors are keenly observing the region's economic landscape and its impact on small-cap stocks. With indices in Dubai and Abu Dhabi showing positive momentum amid robust non-oil private sector growth, identifying promising stocks involves looking for companies that can leverage these favorable conditions while navigating potential challenges such as fluctuating oil prices.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 21.36% | 25.28% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Burjeel Holdings (ADX:BURJEEL)

Simply Wall St Value Rating: ★★★★★☆

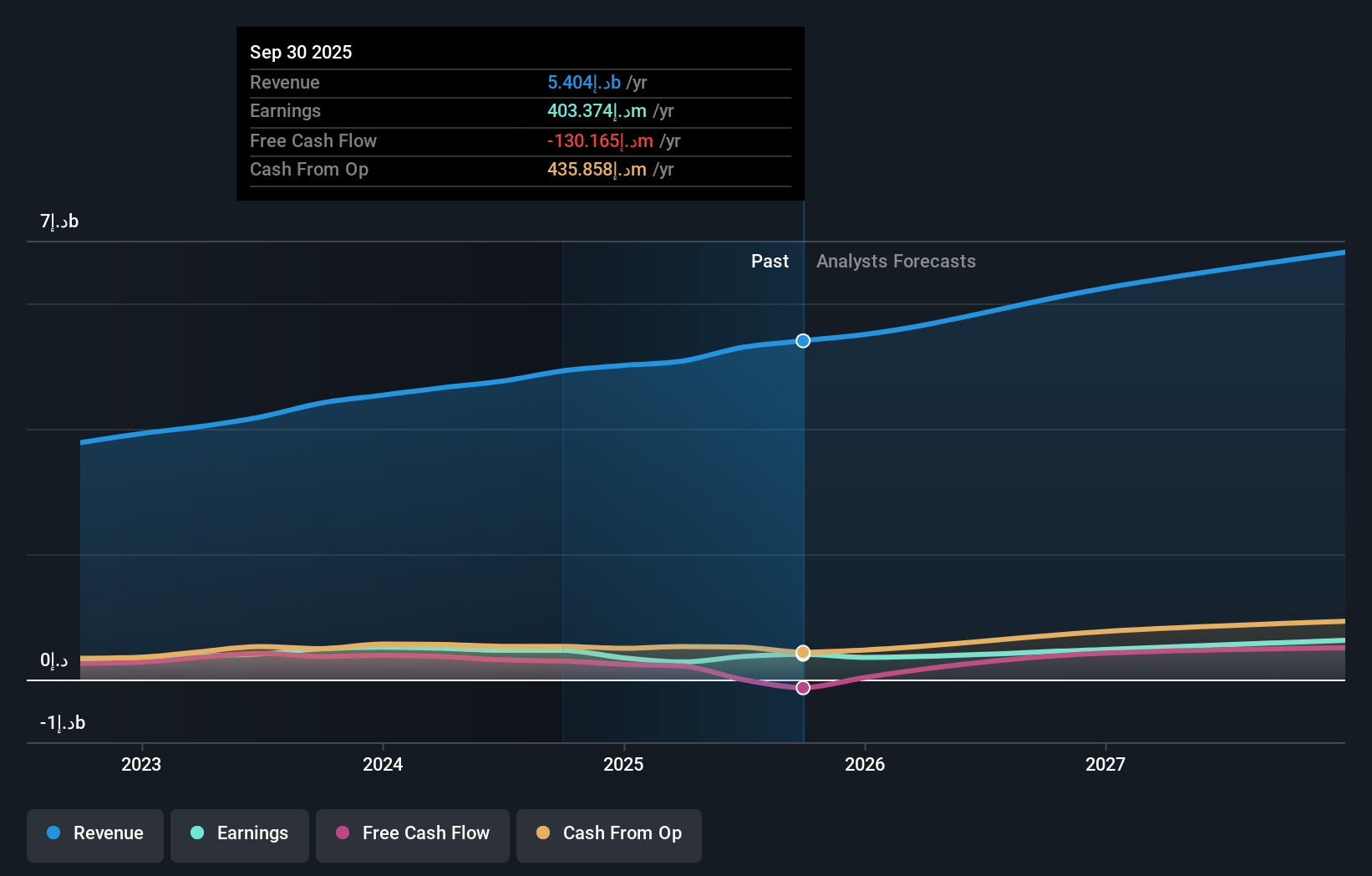

Overview: Burjeel Holdings PLC, along with its subsidiaries, operates multi-specialty hospitals and medical centers across the United Arab Emirates, Oman, and Saudi Arabia, with a market capitalization of AED 6.87 billion.

Operations: Burjeel Holdings generates significant revenue primarily from its hospitals, which account for AED 4.96 billion, followed by medical centers contributing AED 442.61 million. Pharmacies add AED 65.10 million to the revenue stream.

Burjeel Holdings, operating across the UAE, Oman, and Saudi Arabia, is making strategic moves into high-value medical specialties like oncology and fertility care. Despite a high net debt to equity ratio of 78.7%, the company has reduced its debt significantly from 2883.7% over five years. Its price-to-earnings ratio stands at 17x, below the industry average of 19.5x, suggesting potential value for investors. Recent earnings reveal third-quarter sales of AED1.42 billion against AED1.32 billion last year and net income rising to AED165 million from AED131 million previously, indicating positive financial momentum despite competitive pressures in the healthcare sector.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★★★

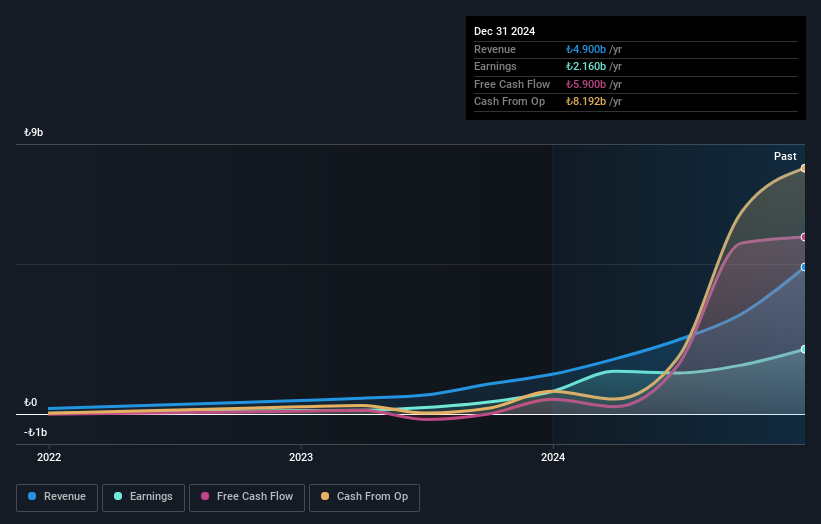

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Türkiye, offering interest-free and maturity-free car financing, with a market capitalization of TRY48.60 billion.

Operations: Katilimevim generates revenue primarily from financial services in the consumer segment, amounting to TRY11.36 billion. The company's net profit margin is a notable aspect of its financial performance.

Katilimevim Tasarruf Finansman Anonim Sirketi, a nimble player in the financial sector, has shown remarkable growth with earnings surging by 284% over the past year, outpacing the Consumer Finance industry's 13.7%. Its debt-free status eliminates concerns about interest coverage, while its price-to-earnings ratio of 7.8x suggests it is undervalued compared to the Turkish market average of 18.4x. Recent third-quarter results highlighted net income soaring to TRY 2,465.93 million from TRY 459.13 million a year prior, indicating robust profitability and high-quality earnings despite recent share price volatility.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi (IBSE:SONME)

Simply Wall St Value Rating: ★★★★★☆

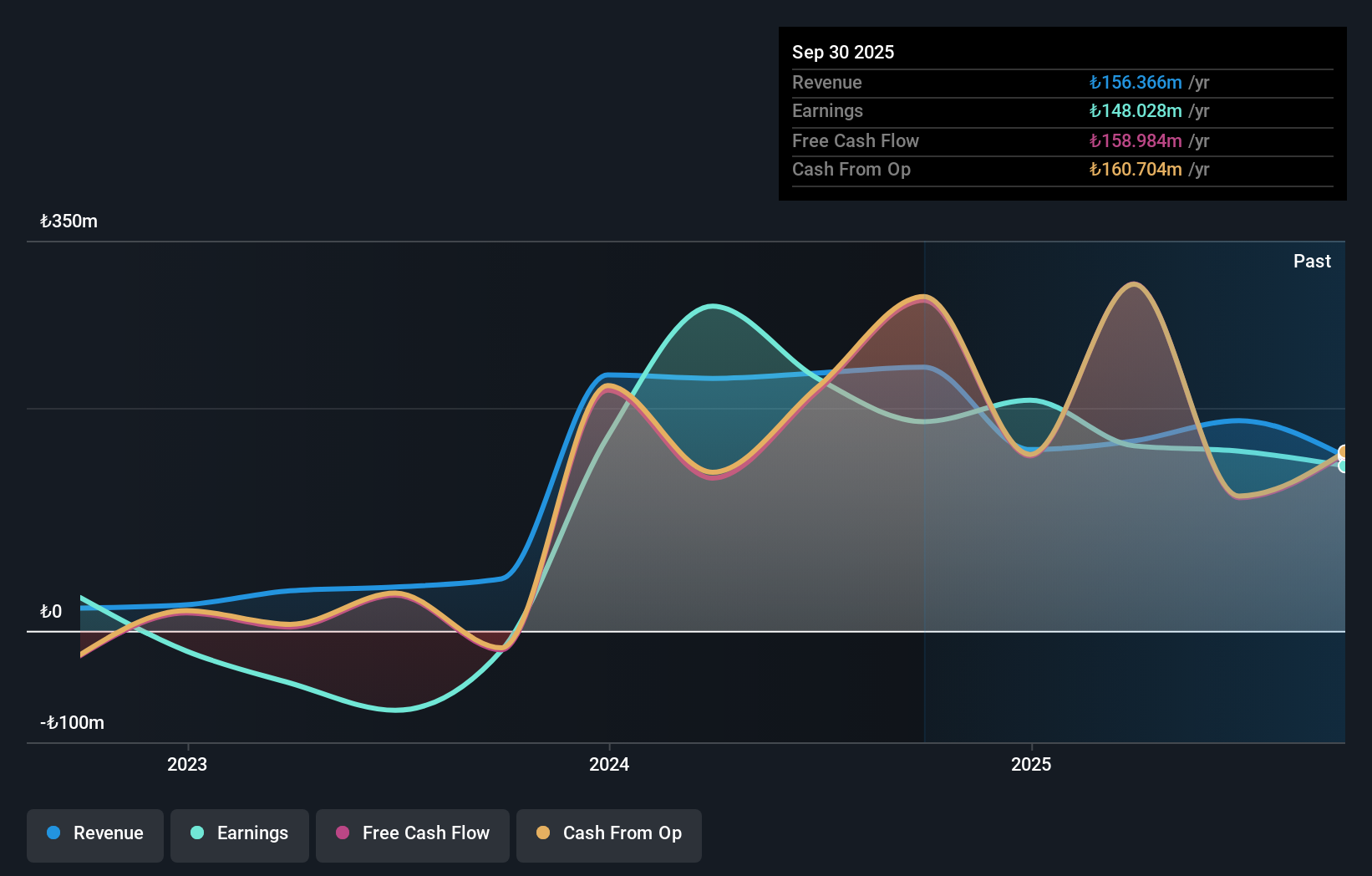

Overview: Sönmez Filament Sentetik Iplik ve Elyaf Sanayi A.S. operates in the synthetic yarn and fiber industry, with a market capitalization of TRY12.78 billion.

Operations: Sönmez Filament derives revenue from its real estate rental segment, generating TRY127.31 million.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi, a smaller player in the industry, is navigating through some challenges. Despite being debt-free and generating positive free cash flow, recent earnings have taken a hit. The company reported TRY 12 million in sales for Q3 2025, down from TRY 13.64 million the previous year, with net income dropping to TRY 8.74 million from TRY 25.27 million. Over nine months ending September 2025, they faced a net loss of TRY 34.25 million compared to last year's profit of TRY 29.72 million. Earnings per share also saw a decline from TRY 0.34 to TRY 0.12 this quarter.

Make It Happen

- Investigate our full lineup of 186 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報