Assessing KeyCorp (KEY) Valuation After Baird Downgrade Contrasts With More Optimistic Analyst Views

Baird’s downgrade of KeyCorp (KEY) to Underperform has put the regional bank in focus, especially because it contrasts with more upbeat views from other firms that have recently maintained or raised their expectations.

See our latest analysis for KeyCorp.

Despite the mixed analyst commentary, KeyCorp’s recent share price momentum has been firm. The 30 day share price return is 11.99%, the 90 day share price return is 19.24%, and the 1 year total shareholder return is 31.52%. This suggests sentiment has improved over time even as opinions on risk have become more divided.

If this kind of mixed sentiment has you thinking about diversification, it could be a good time to look at fast growing stocks with high insider ownership as potential ideas beyond the banking sector.

With shares up strongly over the past year and trading at a discount of about 9% to the average analyst price target, the real question now is whether KeyCorp is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 5.4% Undervalued

With KeyCorp last closing at US$21.57 against a narrative fair value around US$22.80, the story focuses on how future growth and margins develop.

The anticipated shift from net interest income (NII) headwinds to tailwinds, driven by a pivot in fixed asset repricing and the structure of swap and treasury maturities, is expected to significantly enhance NII in the forthcoming quarters. This would influence revenue growth positively. Improved deposit cost dynamics, with a more stable increase in deposit costs and a strategic focus on high value consumer and commercial deposits, aim to support net interest margins and overall profitability.

Curious how this fair value reflects revenue momentum, rising margins and a lower future P/E multiple than the narrative starts with? The full story connects these moving parts into one valuation roadmap.

Result: Fair Value of $22.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story still hinges on risks such as weaker loan demand or higher nonperforming loans, which could put pressure on earnings and capital flexibility.

Find out about the key risks to this KeyCorp narrative.

Another View: Multiples Paint a Tougher Picture

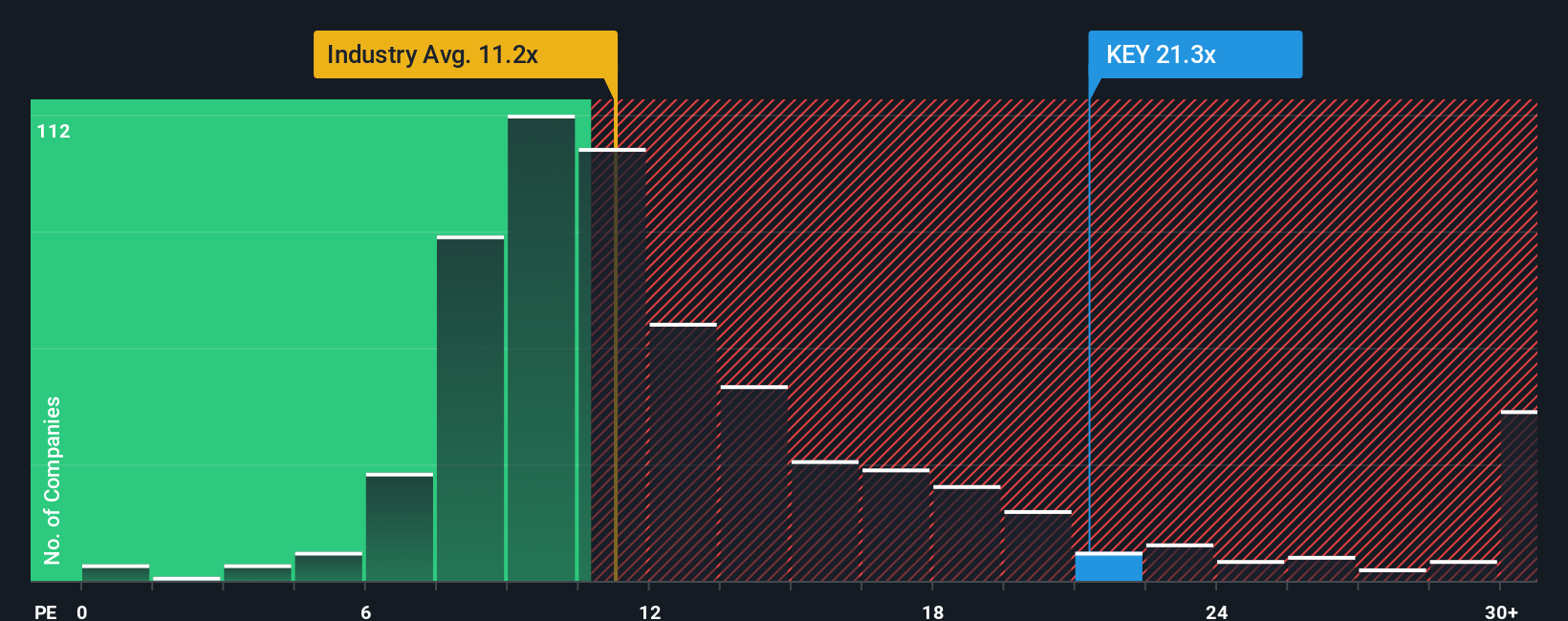

The narrative fair value and our DCF work both point to upside, but the earnings multiple tells a different story. KeyCorp trades on a P/E of 25.1x versus 11.8x for the US Banks industry, 14x for peers, and a fair ratio of 18.6x. That gap suggests less room for error if growth or margins fall short. So which signal do you trust more: the cash flow model or the richer earnings multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If parts of this story do not fully line up with your own view, or you prefer to work from the raw numbers yourself, you can build a version tailored to your assumptions in just a few minutes with Do it your way.

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If KeyCorp has sharpened your thinking, do not stop here. Widen your watchlist with focused stock ideas that match the kind of opportunities you care about most.

- Target reliable income streams by reviewing these 11 dividend stocks with yields > 3%. These may fit a yield focused approach without drifting too far up the risk curve.

- Spot potential mispricing by scanning these 877 undervalued stocks based on cash flows. These might trade below what their cash flows imply.

- Get ahead of emerging trends by checking out these 29 quantum computing stocks. These could benefit as quantum computing develops.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報