AtaiBeckley (ATAI) Valuation Check As US Redomiciliation Marks A New Phase

AtaiBeckley (ATAI) has completed its redomiciliation from the Netherlands to a Delaware incorporated U.S. entity, with shareholders approving the move and receiving a one for one exchange into the new common stock.

See our latest analysis for AtaiBeckley.

The redomiciliation headlines come against a mixed trading backdrop, with the latest share price at $4.00 and a 1 year total shareholder return of about 129% contrasting with a 90 day share price return decline of 28%. This suggests earlier momentum has cooled even as interest around the story has picked up.

If AtaiBeckley has you rethinking where growth might come from next, it could be a good moment to cast a wider net and check out healthcare stocks.

With the share price sitting at $4.00, a price target of $12.40 and a value score of 3, the key question is whether AtaiBeckley is still trading at a discount or if the market is already pricing in future growth.

Price to Book of 9.1x: Is it justified?

On a P/B of 9.1x at a US$4.00 share price, AtaiBeckley sits in a very different spot compared with both its peers and our DCF estimate.

P/B compares the market value of the company to its net assets on the balance sheet, which can be useful for asset light, research heavy biopharma names. At 9.1x book value, investors are paying several times the company’s accounting equity, which often reflects expectations about future pipelines rather than current earnings.

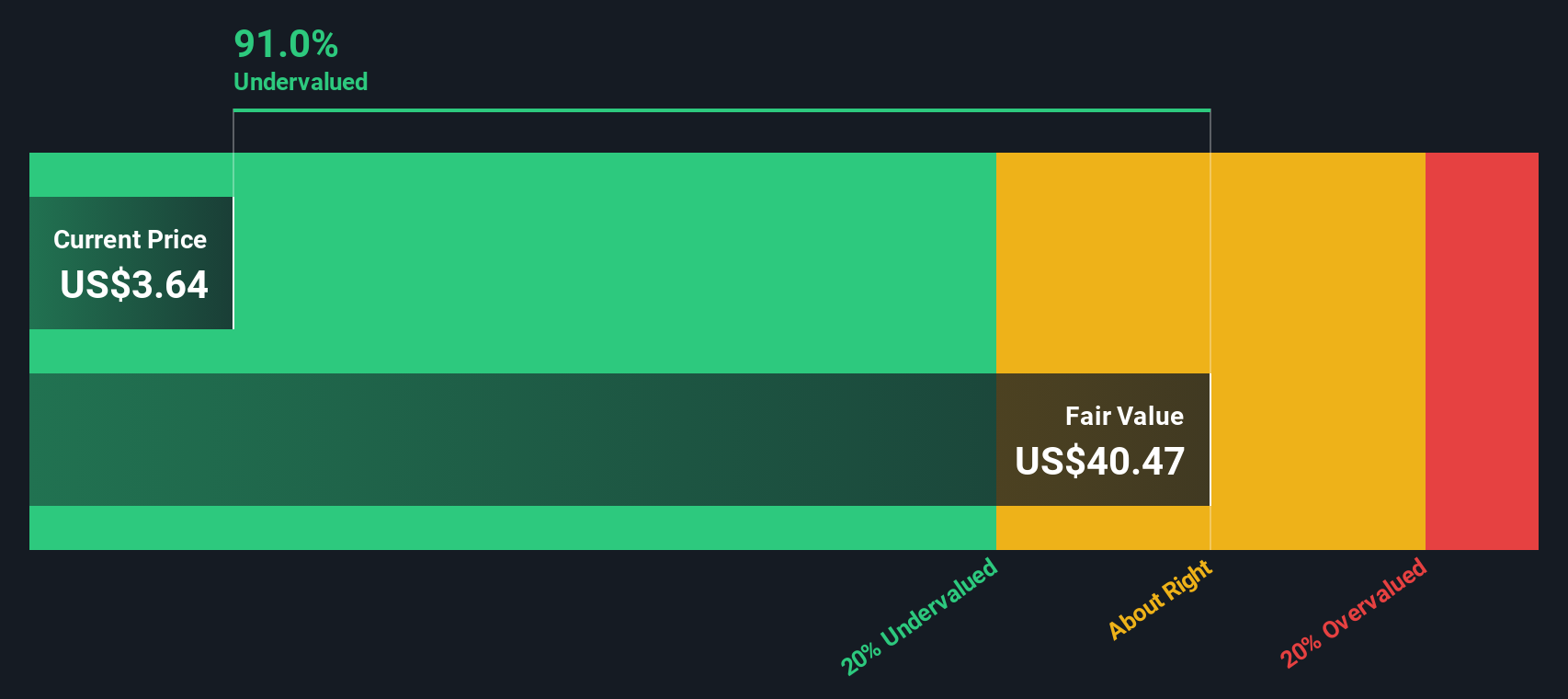

According to our DCF statement, AtaiBeckley at US$4.00 is trading around 91.2% below an estimated fair value of US$45.37. This means the current P/B multiple is being applied to a business that our model values significantly higher on a cash flow basis. That gap suggests the market and the SWS DCF model are capturing very different views of future cash generation and the potential of the clinical stage portfolio.

Compared with the US Pharmaceuticals industry average P/B of 2.5x, AtaiBeckley’s 9.1x looks much richer, indicating the market is assigning a much higher price tag to each dollar of book equity than it does for the typical peer. Yet, the same stock is described as trading far below our DCF fair value, so the multiple the market may eventually move toward could be quite different from where it is today.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 9.1x (UNDERVALUED)

However, you also have to weigh clear risks, including clinical trial setbacks across multiple Phase 2 programs and the company’s current net loss of about US$154.2 million.

Find out about the key risks to this AtaiBeckley narrative.

Another View: Our DCF Model Tells a Different Story

While the 9.1x P/B ratio suggests AtaiBeckley is expensive relative to the US Pharmaceuticals industry average of 2.5x, our DCF model points the other way, with the shares trading around 91.2% below an estimated fair value of US$45.37. Which signal should carry more weight for you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AtaiBeckley for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AtaiBeckley Narrative

If you would rather weigh the data yourself or think the story looks different, you can build your own view in just a few minutes by starting with Do it your way.

A great starting point for your AtaiBeckley research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger watchlist, do not stop at one stock. Use targeted screeners to surface opportunities that match what you care about most.

- Hunt for growth potential at lower price points by checking out these 3554 penny stocks with strong financials that already show solid financial foundations.

- Spot companies applying artificial intelligence to real healthcare problems by reviewing these 29 healthcare AI stocks that connect medical expertise with data driven tools.

- Focus on income potential by scanning these 11 dividend stocks with yields > 3% that may support a higher yield component in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報