UiPath (PATH) Valuation Check As Index Inclusion And CEO Share Sales Shape Investor Focus

UiPath (PATH) has been in focus after two events hit at once: its inclusion in the S&P MidCap 400 index and CEO Daniel Dines selling shares under a pre arranged trading plan.

See our latest analysis for UiPath.

Those cross currents have come on top of a mixed tape for UiPath, with an 11.23% 90 day share price return and a 7.18% 30 day share price decline, while the 1 year total shareholder return of 31.29% and 3 year total shareholder return of 35.92% suggest momentum has been building over a longer horizon.

If UiPath’s recent moves have you thinking about where automation and AI might go next, it could be a good moment to look across high growth tech and AI stocks for other potential ideas.

So with UiPath trading around US$17.33, sitting close to both its analyst price target and an estimated intrinsic value, is the recent pullback setting up a buying opportunity, or are markets already pricing in future growth?

Most Popular Narrative: 5.7% Overvalued

With UiPath closing at US$17.33 against a most popular narrative fair value of US$16.40, the current price sits modestly above that estimate, setting the scene for a closer look at what is driving that gap.

New products and partnerships, including enhancements to orchestration capabilities, are viewed as strengthening UiPath's platform differentiation and long term revenue expansion potential. Improving indicators across parts of the software landscape tied to AI are seen as a supportive backdrop for UiPath to capture greater automation budgets as enterprises prioritize AI enabled tools.

Want to see what is behind that premium price tag? The narrative focuses on automation demand, richer AI features, and a future earnings multiple usually reserved for category leaders.

Result: Fair Value of $16.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, deal delays tied to geopolitics and government transitions, as well as revenue headwinds from the move to SaaS, could quickly challenge that premium narrative.

Find out about the key risks to this UiPath narrative.

Another View: What The Earnings Multiple Is Saying

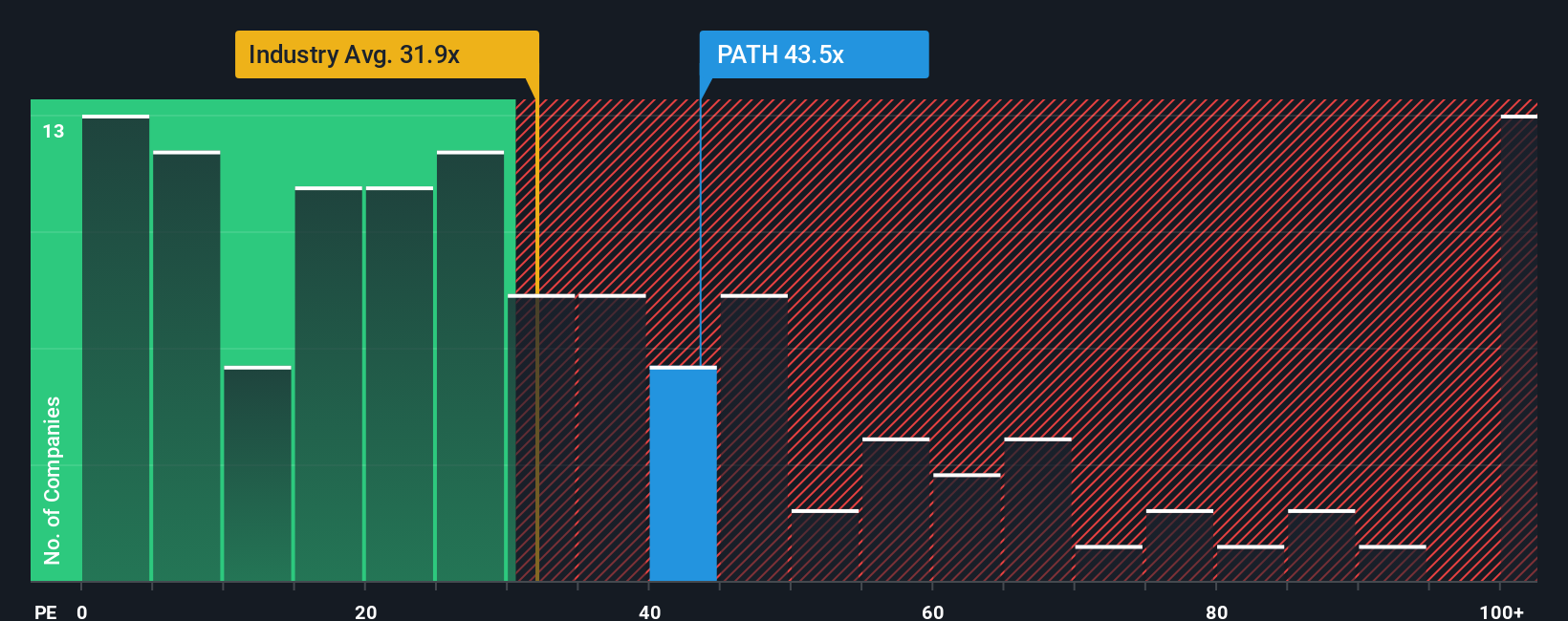

That 5.7% premium to the US$16.40 fair value estimate is only one lens. On current numbers, UiPath trades at a P/E of 40.4x, which is cheaper than peers at 58.6x, yet higher than the US Software industry at 32.3x and the fair ratio of 14.5x. This raises the question of whether investors are paying up for quality or simply accepting valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UiPath Narrative

If you see the numbers differently or just prefer to work through the data yourself, you can build a custom view in minutes. Do it your way

A great starting point for your UiPath research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready To Find Your Next Idea?

If UiPath has sparked your curiosity, do not stop here. A few minutes with the right screeners could surface opportunities you will wish you had seen earlier.

- Spot potential value gaps by scanning these 877 undervalued stocks based on cash flows that appear cheap against their cash flow profiles.

- Zero in on future facing themes by reviewing these 25 AI penny stocks tied to artificial intelligence.

- Boost your income focus by hunting through these 11 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報