Rising Backlog And AURORA Platform Momentum Could Be A Game Changer For MDA Space (TSX:MDA)

- MDA Space recently highlighted its multi-billion-dollar CAD backlog, updated 2025 guidance for strong revenue and adjusted EBITDA growth, and progress across its satellite systems, AURORA digital satellite platform, and robotics programs such as Canadarm3.

- An interesting angle is how the combination of this sizable backlog and advanced digital satellite and robotics capabilities reinforces MDA Space’s role in supplying critical infrastructure to the expanding space technology sector.

- Now we’ll examine how this growing CAD backlog and advanced AURORA satellite platform could reshape MDA Space’s existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

MDA Space Investment Narrative Recap

To own MDA Space, you need to believe that its CAD 4.4 billion backlog, AURORA digital satellite line, and robotics programs can translate into durable, high-value infrastructure work for government and commercial customers. The latest update reinforces the near term catalyst of converting that backlog into revenue and adjusted EBITDA in 2025, while contract and program execution remain the most important risks, particularly around large, long-cycle satellite and robotics projects.

Among recent announcements, the CAD 44.7 million RADARSAT Constellation Mission replenishment contract and related RADARSAT+ work stand out, because they sit directly on top of the backlog story and highlight ongoing demand for Earth observation capabilities. For investors watching catalysts, this kind of government program supports backlog visibility, but it also underlines how dependent the thesis is on timely delivery and cost control across multiple complex missions.

Yet investors should also weigh how concentrated, long-cycle contracts could affect results if timelines, customer needs, or regulatory approvals change...

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.6 billion revenue and CA$271.2 million earnings by 2028. This requires 24.5% yearly revenue growth and about CA$156.5 million earnings increase from CA$114.7 million today.

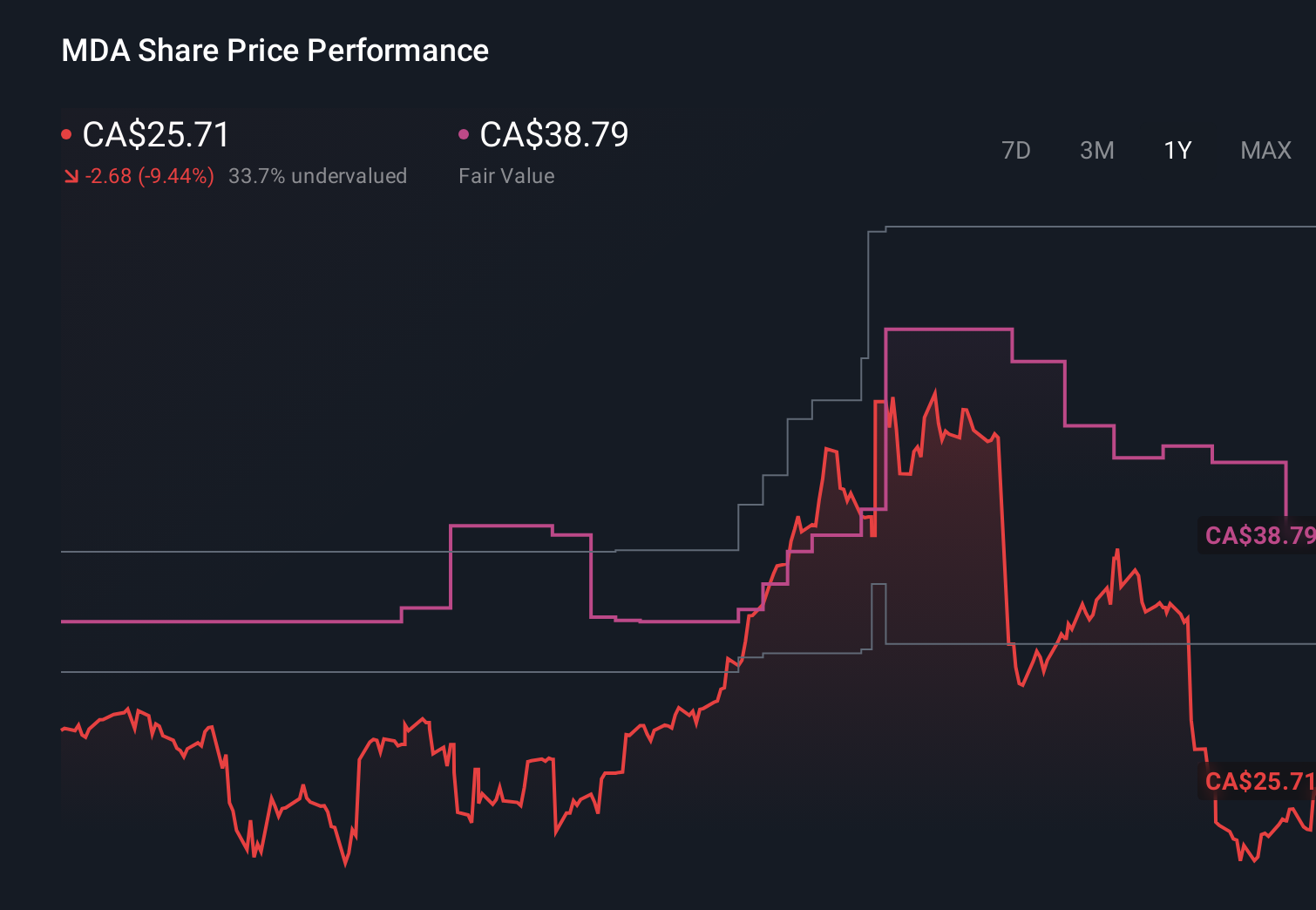

Uncover how MDA Space's forecasts yield a CA$40.19 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Seventeen members of the Simply Wall St Community currently see fair value for MDA Space anywhere between about CA$5.71 and CA$55, with many estimates clustered in the CA$20 to CA$35 range. When you compare that breadth of opinion with the reliance on large constellation and government contracts as key growth drivers, it becomes clear why examining several alternative views on the company’s prospects can be useful.

Explore 17 other fair value estimates on MDA Space - why the stock might be worth as much as 100% more than the current price!

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報