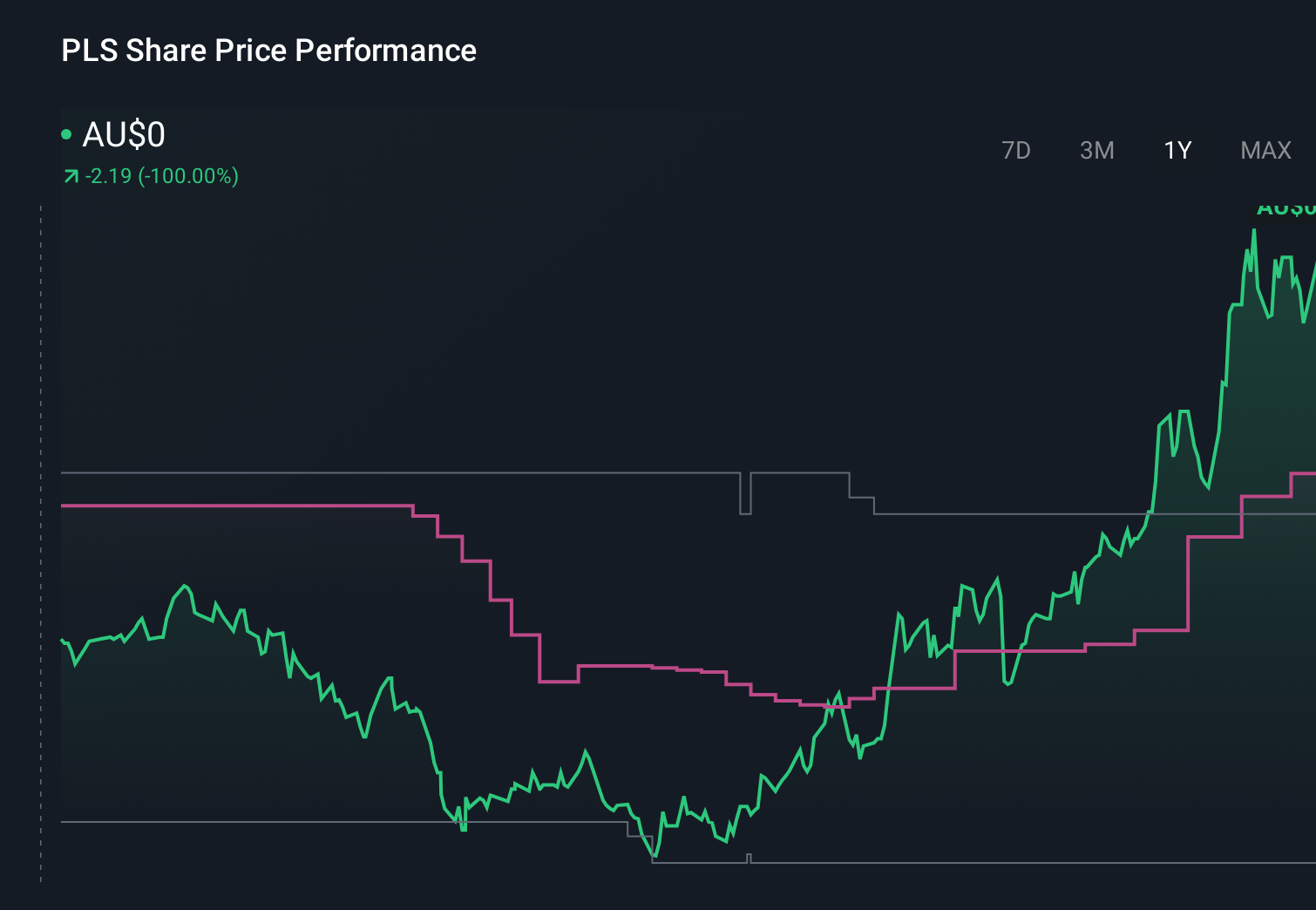

Why Pilbara Minerals (ASX:PLS) Is Up 15.8% After December‑Quarter Pilgangoora Report Release And What's Next

- Pilbara Minerals’ shares have moved sharply higher in recent days as investors looked ahead to the now‑released December‑quarter activities report, which details production, shipments, pricing and costs from its Pilgangoora hard‑rock lithium operation and related assets.

- The company’s progress at Pilgangoora and its lithium hydroxide joint venture with POSCO is drawing close scrutiny as investors assess how these assets may shape Pilbara’s future earnings profile within the broader green technology supply chain.

- We’ll now explore how the December‑quarter report, particularly Pilgangoora production trends, could influence Pilbara Minerals’ existing investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

PLS Group Investment Narrative Recap

To own PLS Group, you need to be comfortable with a pure-play lithium producer whose fortunes are closely tied to Pilgangoora and battery raw material pricing. The upcoming December quarter activities report looks like the key short term catalyst, as any shift in production, costs or realised prices could influence how investors view earnings risk after a year of weaker revenue and EBITDA. The recent share price strength does not materially change that focus.

Among recent announcements, the scheduled release of Q2 2026 results on 30 January stands out as most relevant, since it coincides with the December quarter report and will put Pilgangoora metrics into a fuller financial context. Together, these updates may clarify how current production levels, pricing and capital spending are feeding through to cash flow, which is front of mind given the recent net loss and ongoing investment program.

Yet while enthusiasm around Pilgangoora is building, investors should be aware of the risk that sustained lithium price weakness could...

Read the full narrative on PLS Group (it's free!)

PLS Group's narrative projects A$1.4 billion revenue and A$247.0 million earnings by 2028. This requires 23.0% yearly revenue growth and about a A$442.8 million earnings increase from A$-195.8 million today.

Uncover how PLS Group's forecasts yield a A$3.00 fair value, a 38% downside to its current price.

Exploring Other Perspectives

Seventeen members of the Simply Wall St Community value PLS Group between A$0.24 and A$3.39 per share, showing a wide spread of views on upside and downside. Set this against the current pressure on earnings from lithium price weakness and you can see why it helps to weigh several different opinions before deciding how PLS Group might fit into your portfolio.

Explore 17 other fair value estimates on PLS Group - why the stock might be worth as much as A$3.39!

Build Your Own PLS Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PLS Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free PLS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PLS Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報