Assessing BHP Group (ASX:BHP) Valuation After Recent Share Price Momentum

Recent performance snapshot

BHP Group (ASX:BHP) has attracted investor attention after a recent move that left the stock with a 1 day return of 1.6% and about 4.7% over the past week.

Over the past month and past 3 months, BHP has delivered returns of roughly 5.3% and 12.7% respectively, while its 1 year total return stands at about 27.3%, all in A$ terms.

See our latest analysis for BHP Group.

That recent 1 day share price return of 1.6% and stronger short term gains sit alongside a 1 year total shareholder return of 27.3%, which suggests momentum has been building rather than fading.

If BHP's move has you thinking about other opportunities in resources and beyond, it could be a good moment to widen your search with fast growing stocks with high insider ownership.

With BHP now trading around A$47.22 and its analyst price target sitting closer to A$44.86, the stock does not look obviously cheap on these numbers. This raises the question of whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 5.1% Overvalued

BHP's most followed narrative puts fair value around A$44.94 per share compared with the last close of A$47.22, setting up a modest valuation gap to unpack.

The analysts have a consensus price target of A$42.871 for BHP Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$46.55, and the most bearish reporting a price target of just A$35.82.

Curious what has to happen on revenues, margins and earnings per share to support that valuation, all under an 8% discount rate and higher future P/E expectations?

Result: Fair Value of $44.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could shift quickly if Chinese steel demand weakens, or if cost overruns on projects like Jansen squeeze margins more than analysts expect.

Find out about the key risks to this BHP Group narrative.

Another angle on value

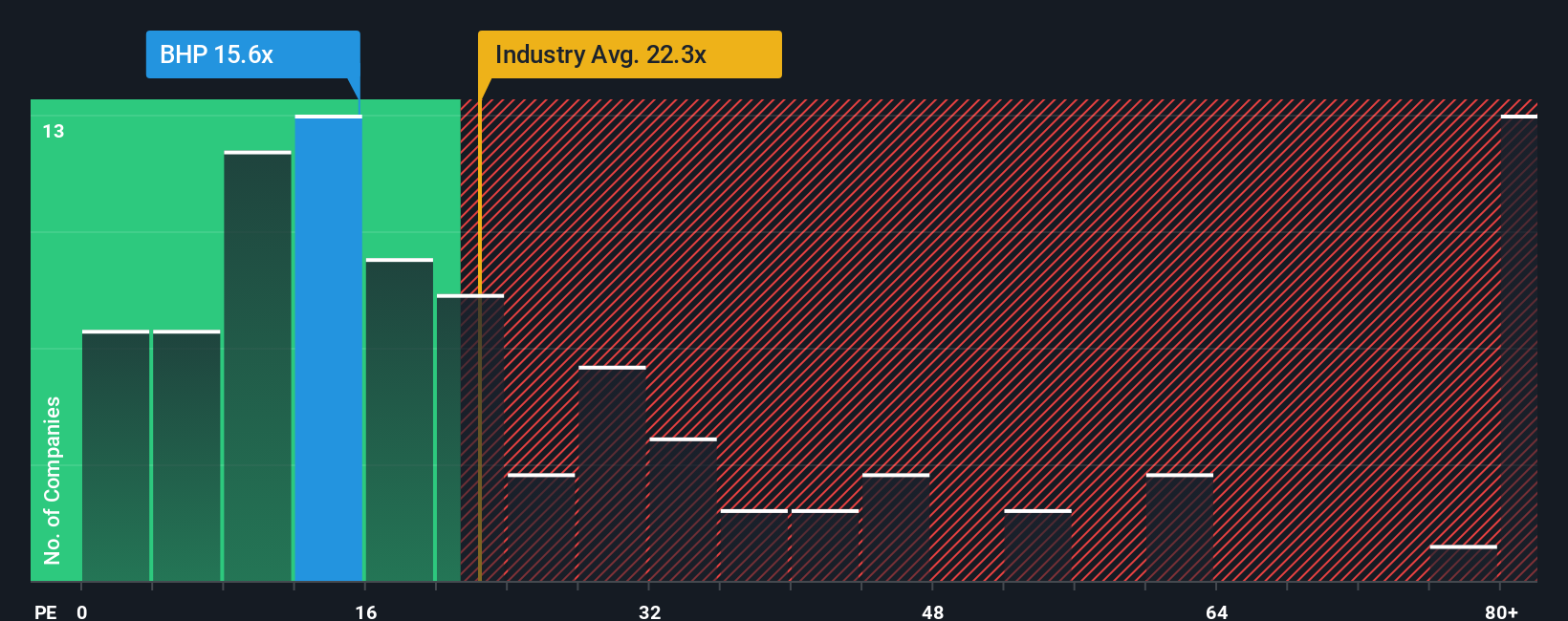

While the narrative model flags BHP as about 5.1% overvalued versus its A$44.94 fair value estimate, the current P/E of 17.9x paints a different picture. It sits below the Australian market at 21.6x, the local Metals and Mining industry at 25.3x, and the peer average at 21.7x, and is also below the 30.2x fair ratio that our work suggests the market could move toward. That gap points to less valuation risk than you might expect for a global miner, so the key question is whether earnings quality and growth can keep investors comfortable with that discount.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BHP Group Narrative

If you look at these numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If BHP has sharpened your interest, do not stop here. Use the screener to spot fresh ideas that fit your style before the market moves on.

- Capture potential value by checking out these 876 undervalued stocks based on cash flows that currently trade on cheaper cash flow expectations than many investors might assume.

- Supercharge your growth watchlist with these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Position yourself early in emerging themes by scanning these 79 cryptocurrency and blockchain stocks that are building businesses around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報