A Look At Roivant Sciences (ROIV) Valuation After Brepocitinib Timeline Acceleration And Profitability Outlook Shift

Roivant Sciences (ROIV) is back in focus after recent analyst commentary related to its lead drug candidate, brepocitinib. The company now has accelerated timelines along with updated expectations around costs and future profitability.

See our latest analysis for Roivant Sciences.

Roivant’s shares have been volatile around the recent brepocitinib updates, with the latest share price at US$21.30, a 90 day share price return of 32.88% and a 1 year total shareholder return of 84.90%. This suggests momentum has been building as investors reassess both growth potential and risk.

If Roivant’s clinical progress has caught your attention, this can be a good moment to broaden your watchlist with other healthcare stocks that are driving change in treatment pipelines.

With Roivant now trading at US$21.30 and a recent 1 year total shareholder return of 84.90%, plus analyst targets sitting higher, the key question is whether the current price still leaves upside or already reflects future growth.

Most Popular Narrative Narrative: 16.9% Undervalued

With Roivant’s last close at US$21.30 and a narrative fair value of US$25.64, the current gap hinges on how future earnings power is framed.

The analysts have a consensus price target of $16.14 for Roivant Sciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

Want to see what justifies a richer fair value than the headline targets? The narrative leans on aggressive revenue expansion, shifting margins, and a premium future earnings multiple. Curious which assumptions really move the dial?

Result: Fair Value of $25.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if key brepocitinib or batoclimab trials disappoint, or if LNP litigation outcomes and costs land well outside current expectations.

Find out about the key risks to this Roivant Sciences narrative.

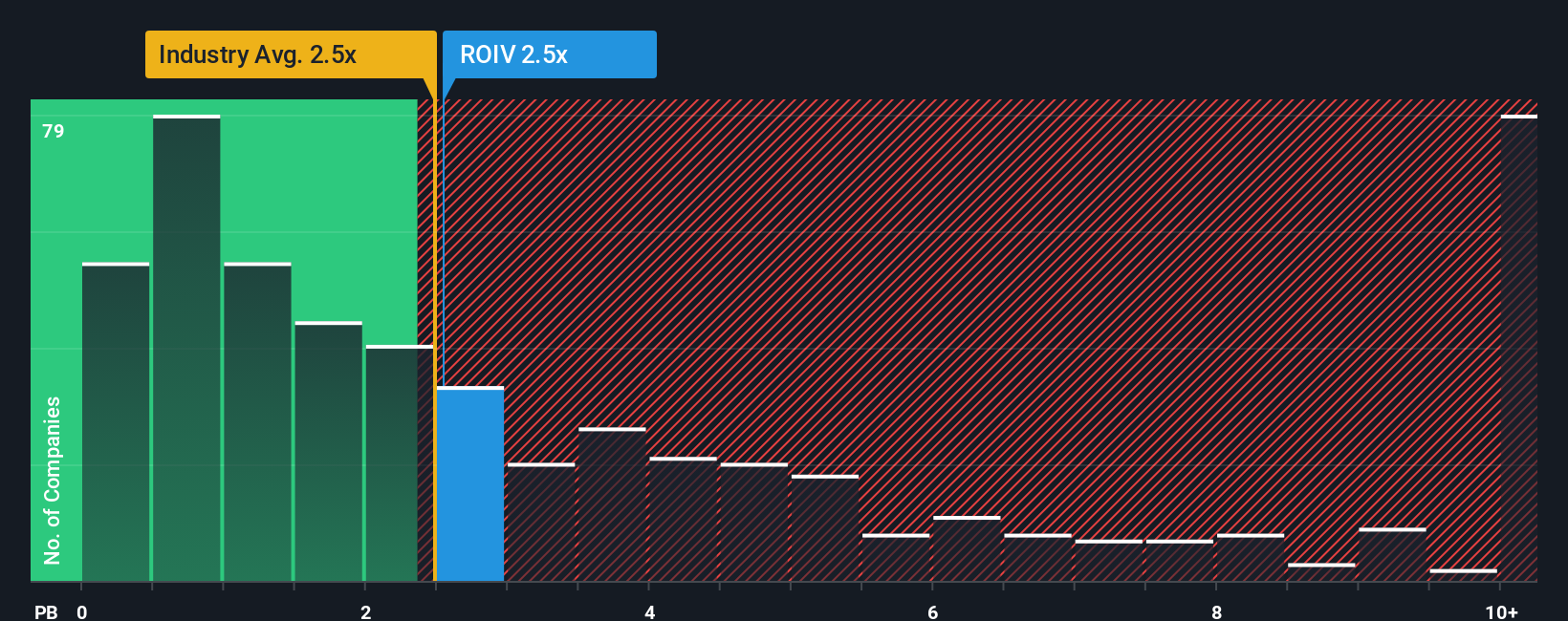

Another View: What The P/B Ratio Is Saying

That 16.9% gap to the narrative fair value is only one angle. On a simple P/B basis, Roivant trades at 3.4x book value versus 2.7x for the broader US Biotechs group and 8.5x for its peer set. So it is richer than the sector average but well below closer peers.

In plain terms, the market is already paying a premium to the wider industry for Roivant’s balance sheet and pipeline, yet not as much as for similar companies in its peer group. That mix can indicate valuation risk if expectations cool or an opportunity if Roivant eventually trades at a peer level multiple. Which side do you think is more likely to play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roivant Sciences Narrative

If the story here does not quite match your view, or you prefer to test the numbers yourself, you can build a custom thesis in just a few minutes: Do it your way.

A great starting point for your Roivant Sciences research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Roivant is on your radar, do not stop there. The best opportunities often come from widening your search across sectors, sizes, and themes.

- Spot emerging opportunities early by scanning these 3556 penny stocks with strong financials that pair smaller market caps with financial profiles that may be stronger than you expect.

- Tap into the future of automation and data by reviewing these 25 AI penny stocks that are already building real products and revenue around artificial intelligence.

- Hunt for value by filtering these 882 undervalued stocks based on cash flows that appear inexpensive on cash flow grounds and may warrant a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報