Do Record Q4 Deliveries and Global Foray Change The Bull Case For Li Auto (LI)?

- In December 2025, Li Auto reported delivering 44,246 vehicles, bringing fourth-quarter deliveries to 109,194 and lifting cumulative deliveries above 1.54 billion units since inception.

- These record deliveries, alongside the company’s entry into Egypt, Kazakhstan, and Azerbaijan and the launch of its Livis AI glasses, highlight a broadened growth profile beyond its core China auto market.

- We’ll now examine how Li Auto’s record December deliveries and new international footprint could reshape its longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Li Auto Investment Narrative Recap

To own Li Auto today, you need to believe it can convert strong recent delivery execution and new overseas entries into a sustainable, profitable EV platform while managing heavy investment needs and intense competition. December’s record 44,246 deliveries and Q4 volumes at the top end of guidance help near term sentiment, but do not meaningfully reduce the key risks around margin pressure, cash burn, and the shift from EREVs to BEVs.

The most relevant recent development is Li Auto’s Q3 2025 earnings, which showed a sharp revenue decline and a swing to a net loss despite earlier growth. Set against December’s delivery rebound and the company’s expanding model lineup, those results underline how reliant the story still is on execution, pricing discipline, and the pay off from large AI and BEV investments.

Yet, even with record December deliveries, investors should be aware that rising R&D and capital spending could...

Read the full narrative on Li Auto (it's free!)

Li Auto's narrative projects CN¥232.1 billion revenue and CN¥15.2 billion earnings by 2028. This requires 17.4% yearly revenue growth and about CN¥7.1 billion earnings increase from CN¥8.1 billion today.

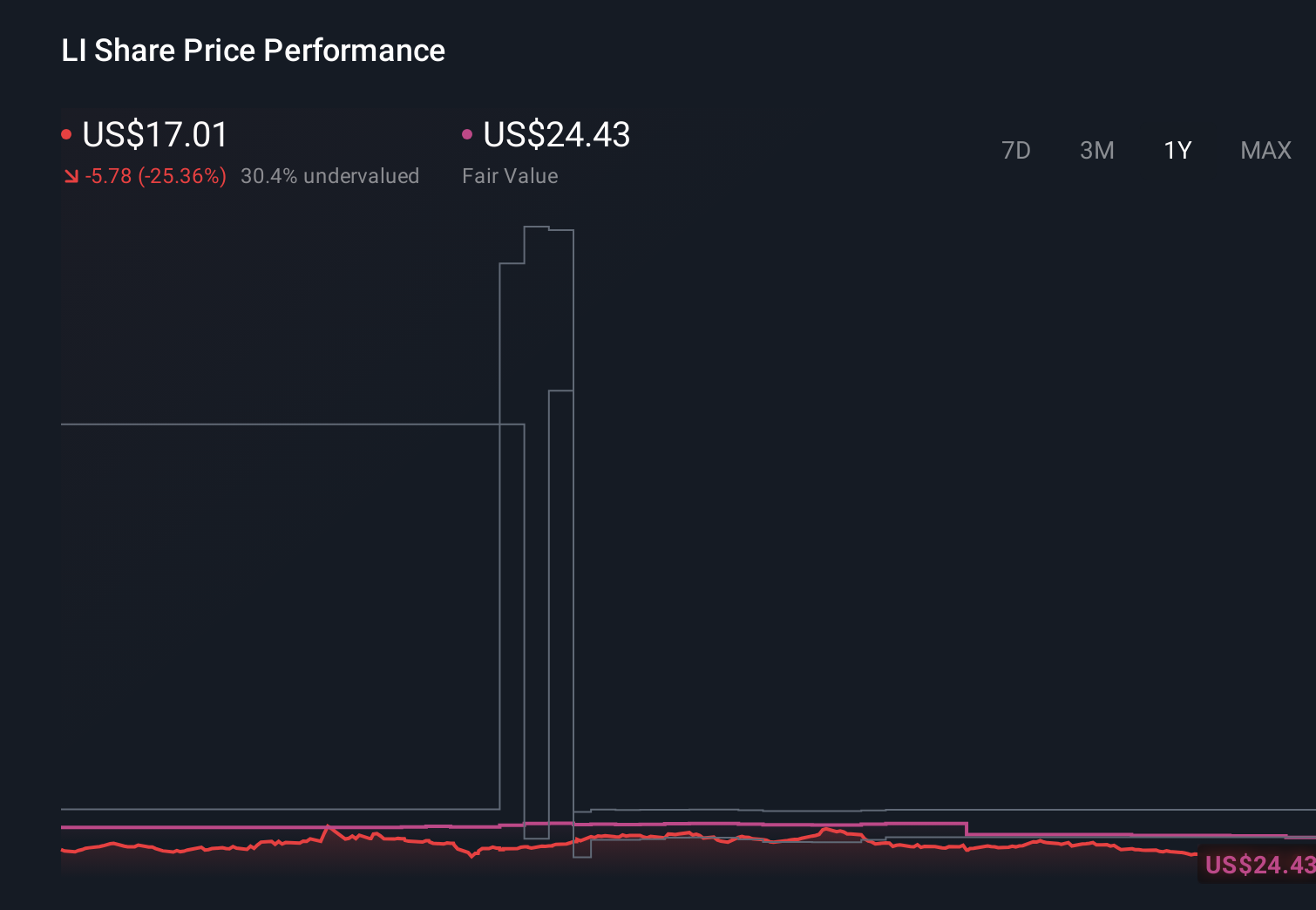

Uncover how Li Auto's forecasts yield a $24.43 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value Li Auto between US$21.96 and US$39.04 per share, showing a wide spread of expectations. When you set those views against the company’s heavy planned AI and BEV investments and recent margin pressure, it underlines how important it is to compare several perspectives on the risks to future performance.

Explore 8 other fair value estimates on Li Auto - why the stock might be worth over 2x more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報