Assessing Accenture (ACN) Valuation After Recent Share Price Momentum And Mixed Narrative Signals

Accenture (ACN) is back on investor radars after recent share price moves, with the stock closing at $275.93. You might be weighing how its valuation lines up with its fundamentals today.

See our latest analysis for Accenture.

That 4.53% 1 day share price return and 9.07% 90 day share price return suggest some positive momentum building, even though the 1 year total shareholder return decline of 20.96% shows a weaker recent longer term picture.

If Accenture’s move has you thinking about where technology and AI trends could lead next, it may be a good time to scan high growth tech and AI stocks for other potential ideas.

With Accenture trading at $275.93, around a 21% discount to one intrinsic value estimate and a small discount to the average analyst target, you have to ask: Is there real upside here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 36.3% Overvalued

According to FCruz, the narrative fair value of Accenture at US$202.38 sits well below the recent US$275.93 share price, which sets up a clear valuation gap to unpack.

Fundamental1) Valuation & Quality

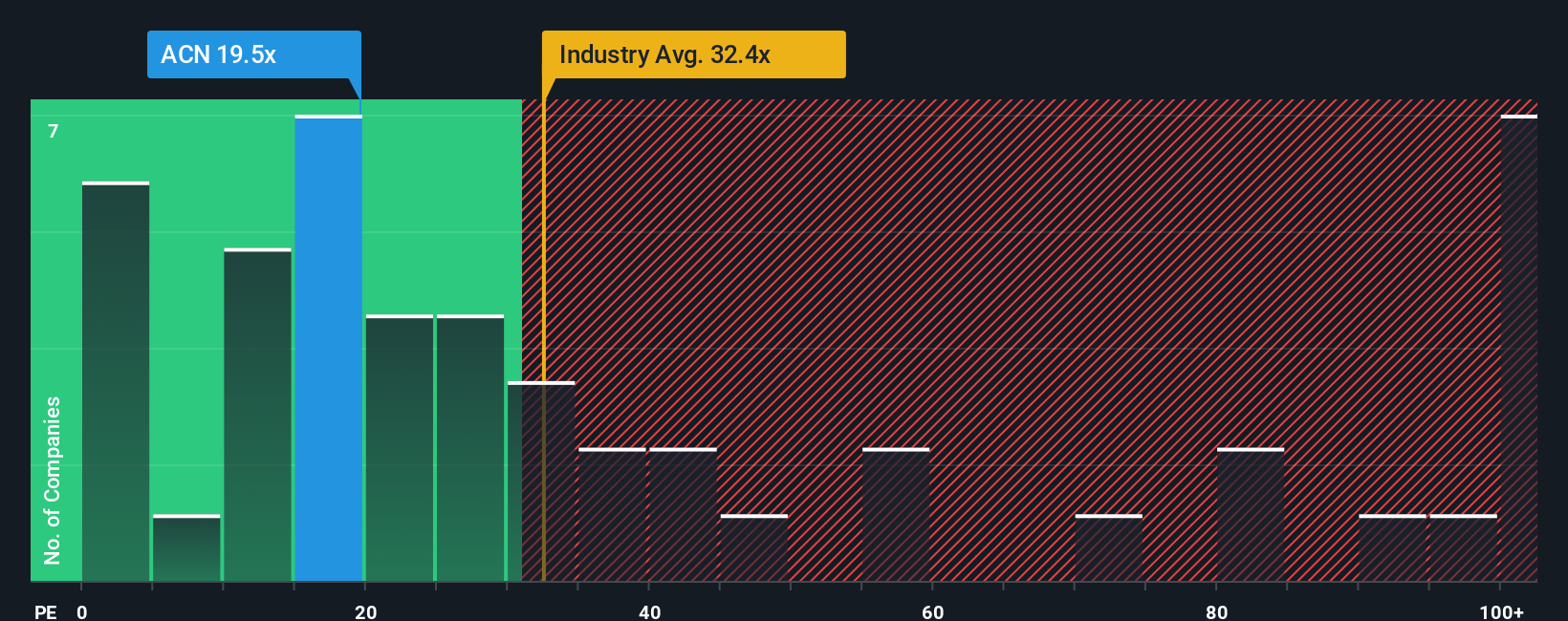

• Multiples: TTM P/E ~20.3x, Forward P/E ~18.1x, EV/EBITDA ~13.3x, P/S ~2.36x, P/B ~5.21x (all trending well below 2024 peaks).

• Scale & Efficiency: Revenue (TTM) ~US$68.5B, Operating margin ~16.8%, Net margin ~11.6%, ROE ~26.9%. Read-through: After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name.2) Growth, Margins & EPS

Curious how a company with this size, margin profile and projected earnings power still screens as overvalued in this narrative? The tension sits in the revenue trajectory, the assumed profit conversion, and the future earnings multiple that FCruz thinks investors may be willing to pay. The full breakdown shows exactly how those moving parts stack up against today’s share price.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to watch for weaker bookings trends and delays in consulting decisions, which could challenge the bullish earnings and margin assumptions behind this narrative.

Find out about the key risks to this Accenture narrative.

Another View: Multiples Point in the Other Direction

FCruz’s narrative says Accenture looks 36.3% overvalued at US$275.93, but the pricing signals are not all one way. A P/E of 22.3x sits below the US IT industry at 30.1x, below peers at 25.3x, and below a fair ratio of 35.9x. That kind of gap can be read as either a cushion or a warning, depending on how you see future growth and sentiment shifting from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Accenture Narrative

If you see the numbers differently or want to stress test your own view, you can build a custom Accenture story in minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Looking for more investment ideas?

If Accenture has sharpened your thinking, do not stop there. Use the screener to surface fresh ideas that fit how you like to invest.

- Target potential mispricing by scanning these 882 undervalued stocks based on cash flows that might offer a more appealing entry point than widely followed large caps.

- Ride long term tech shifts by zeroing in on these 25 AI penny stocks that tie directly into artificial intelligence themes you already follow.

- Lock in income-focused ideas with these 13 dividend stocks with yields > 3% that could complement growth names and balance out your portfolio risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報