Ambarella (AMBA) Valuation Check After CV7 Edge AI Chip And Developer Zone Reveal

Ambarella (AMBA) is back in focus after CES announcements for its CV7 edge AI vision chip and a new Developer Zone, giving investors fresh data points on how the stock aligns with its AI ambitions.

See our latest analysis for Ambarella.

The CES news appears to have reignited interest, with the 7 day share price return of 10.52% and 30 day share price return of 4.06% partly offsetting a 90 day share price return of 9.31%. The 1 year total shareholder return of 3.75% still reflects a mixed longer term picture for sentiment.

If Ambarella’s edge AI story has your attention, it can be useful to see what else is moving in related areas, starting with high growth tech and AI stocks.

With Ambarella trading at US$77.11, a value score of 1, recent revenue of US$373.85m and a net loss of US$79.664m, the key question is simple: is there a mispriced edge AI story here or is the market already baking in future growth?

Most Popular Narrative Narrative: 21.4% Undervalued

With Ambarella at US$77.11 against a narrative fair value of US$98.09, the current price sits well below that implied estimate, putting the focus squarely on what is baked into those long term cash flow assumptions and profitability targets.

Sharply increasing demand for AI-powered edge devices, including portable video, robotics (notably aerial drones), and edge infrastructure, has led to a rapid expansion of Ambarella's addressable markets, as evidenced by record edge AI revenue and multiple recent, diversified design wins. This is catalyzing strong, sustained revenue growth and positions Ambarella to benefit further as additional vertical applications for edge AI proliferate.

Want to see what sits behind that confidence in edge AI demand and higher margins? The narrative leans on rising revenue, a richer mix, and a future earnings multiple that assumes meaningful profit expansion. Curious which specific growth rates and margin shifts justify that gap to fair value? The full story lays out the numbers in detail.

Result: Fair Value of $98.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that edge AI optimism still has clear fault lines, especially if IoT-driven demand softens or rising R&D and support costs pressure margins longer than expected.

Find out about the key risks to this Ambarella narrative.

Another View: Multiples Paint a Tougher Picture

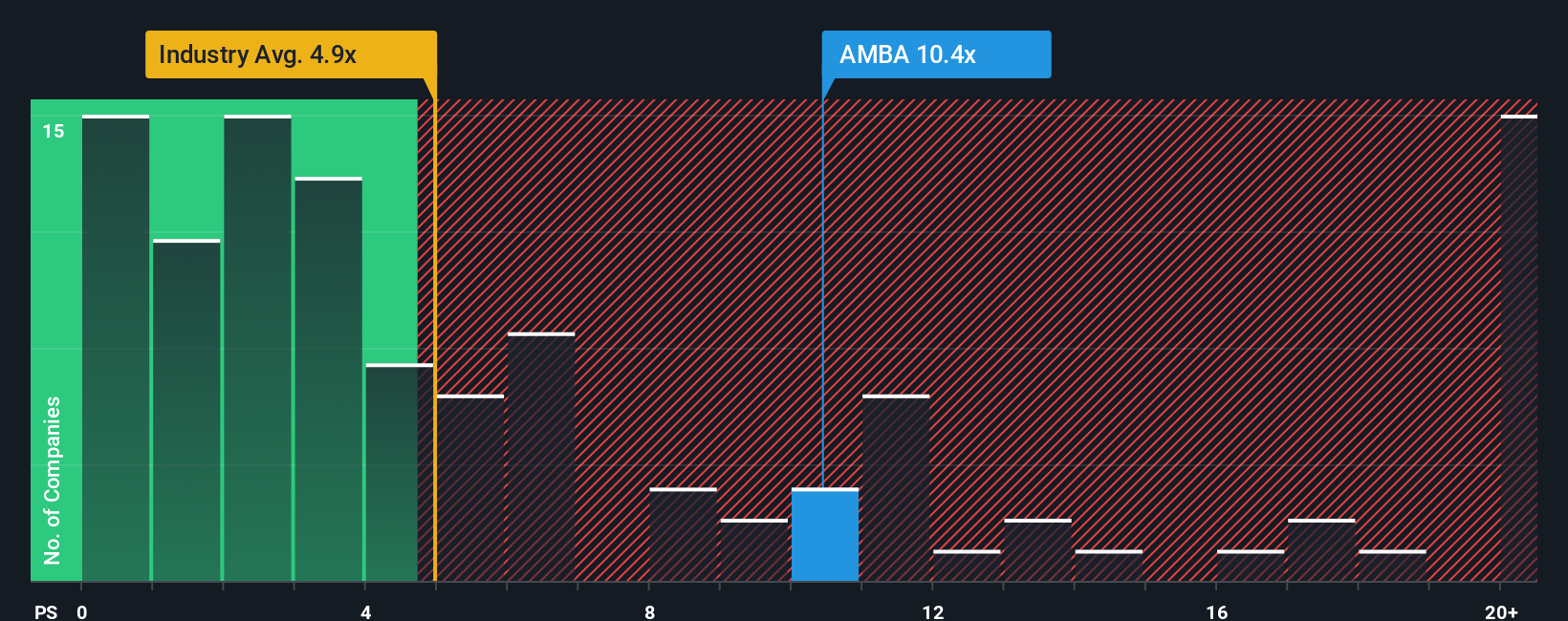

That 21.4% gap to the narrative fair value suggests upside, but the market is pricing Ambarella quite differently when you look at simple sales based metrics. The current P/S of 8.9x sits well above both the US Semiconductor industry average of 5.6x and the peer average of 5.6x.

The fair ratio is 5.7x, which is much closer to those benchmarks. If sentiment shifted toward that fair ratio, today’s pricing could look full rather than attractively mispriced, especially while the company is still loss making. Which lens do you trust more right now: the long term story or the current sales multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambarella Narrative

If you see the numbers differently or prefer to test your own assumptions, you can pull the data, stress test your view, and Do it your way in under three minutes.

A great starting point for your Ambarella research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one stock, you risk missing other angles the market is offering right now, so take a few minutes to scan broader opportunities.

- Spot potential value by reviewing these 881 undervalued stocks based on cash flows that align with your own expectations for cash flow and quality.

- Target future focused themes by checking out these 25 AI penny stocks that are closely tied to the growth of artificial intelligence.

- Broaden your watchlist with these 13 dividend stocks with yields > 3% that may complement growth names with regular income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報