How Investors Are Reacting To Iridium Communications (IRDM) S&P 600 Addition And Evolving SpaceX Orbit Plans

- In early 2026, Iridium Communications gained attention after SpaceX’s Starlink unit said it would lower satellite orbits to improve space safety, while Iridium was also added to the S&P 600 index, prompting fresh institutional demand.

- This combination of a potentially safer orbital environment and increased index-driven ownership highlights how external ecosystem shifts can influence Iridium’s positioning in satellite communications.

- Against this backdrop of improved perceived space safety from Starlink’s orbit changes, we’ll explore how these developments interact with Iridium’s existing investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Iridium Communications Investment Narrative Recap

To own Iridium, you need to believe in resilient demand for global, mission critical satellite connectivity as IoT, government and safety use cases expand. The Starlink orbit decision and S&P 600 inclusion support sentiment around operational safety and liquidity, but do not materially change Iridium’s key near term catalyst of broadening IoT and PNT adoption, or its biggest current risk that slowing IoT service revenue growth could weigh on the company’s long term expansion.

Among recent announcements, Iridium’s steady dividends, including the planned increase to US$0.15 per share in 2025, stand out in the context of these developments. For many shareholders, a consistent capital returns framework helps offset concerns about uneven service revenue trends and potential competitive pressure from emerging direct to device offerings, and provides a tangible counterweight to the volatility that can follow sector wide news such as changes in competitors’ constellation plans.

Yet, despite the excitement around safer orbits and index inclusion, investors should be aware that slowing IoT service growth could...

Read the full narrative on Iridium Communications (it's free!)

Iridium Communications' narrative projects $982.9 million revenue and $174.8 million earnings by 2028. This requires 4.7% yearly revenue growth and about a $61.6 million earnings increase from $113.2 million today.

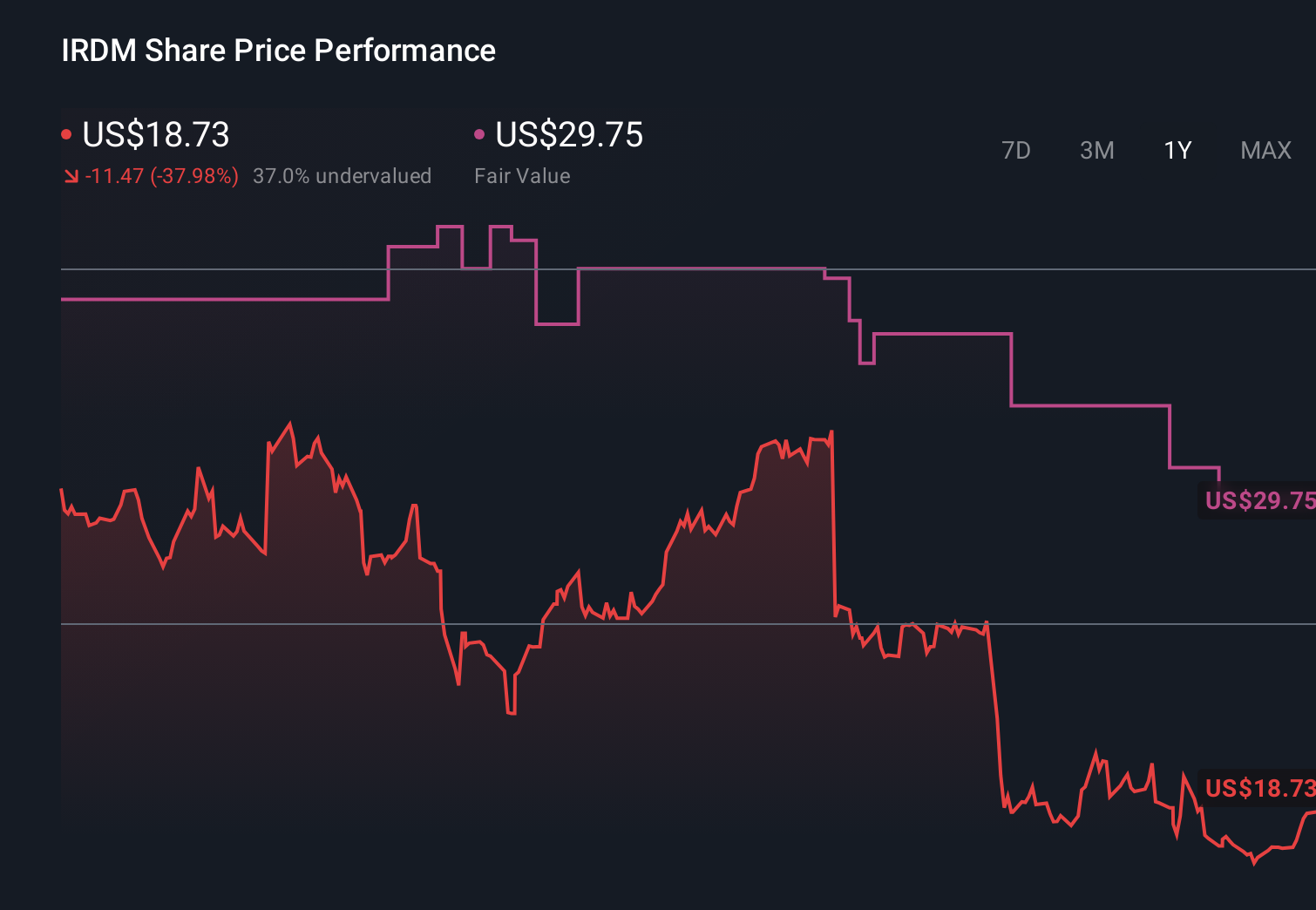

Uncover how Iridium Communications' forecasts yield a $29.75 fair value, a 64% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently place Iridium’s fair value between US$16 and about US$69, underscoring sharply different expectations. Set against concerns about slowing IoT service growth, this spread invites you to weigh how diverse assumptions about future adoption might affect the company’s performance over time.

Explore 7 other fair value estimates on Iridium Communications - why the stock might be worth 12% less than the current price!

Build Your Own Iridium Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Iridium Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iridium Communications' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報