Tabcorp Holdings Limited's (ASX:TAH) Price Is Right But Growth Is Lacking

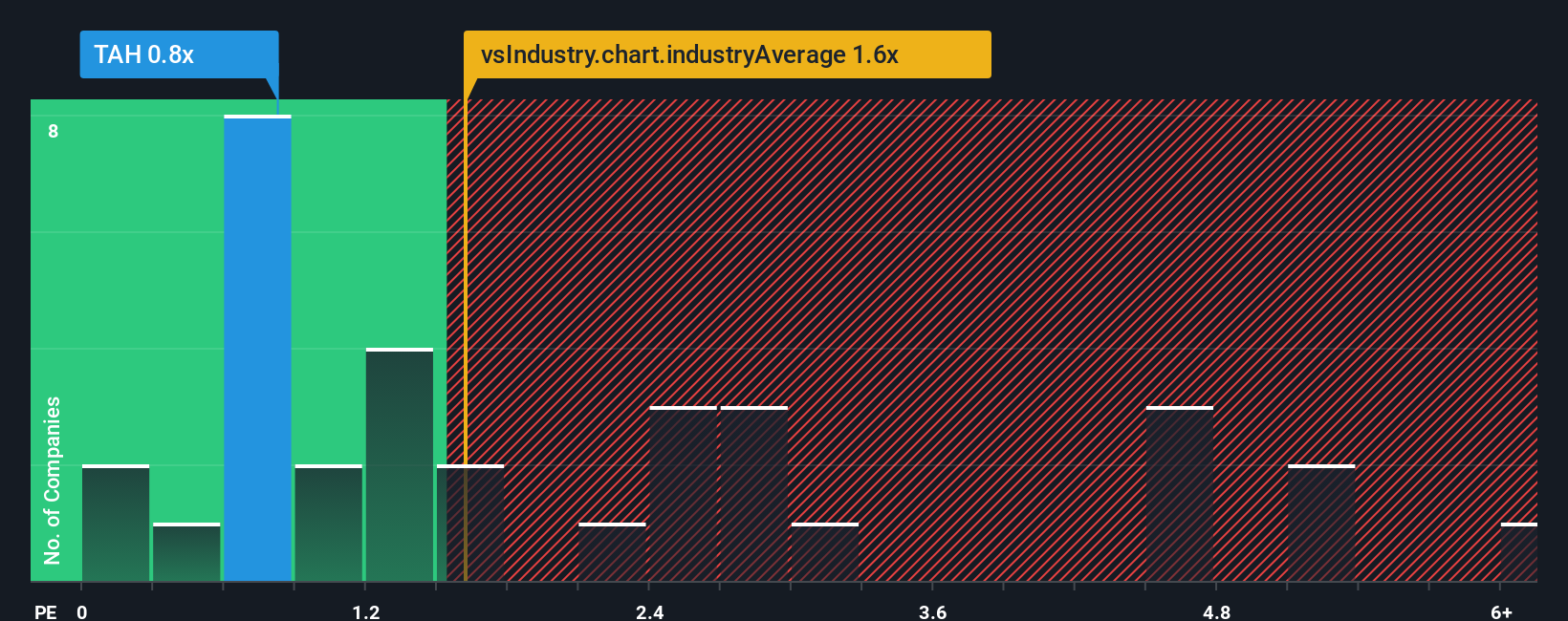

Tabcorp Holdings Limited's (ASX:TAH) price-to-sales (or "P/S") ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Hospitality industry in Australia have P/S ratios greater than 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tabcorp Holdings

How Has Tabcorp Holdings Performed Recently?

Recent times have been pleasing for Tabcorp Holdings as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Tabcorp Holdings will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Tabcorp Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Tabcorp Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen a 10% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 2.4% per annum over the next three years. With the industry predicted to deliver 6.5% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why Tabcorp Holdings is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Tabcorp Holdings' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Tabcorp Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Tabcorp Holdings with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報