A Look At Carlisle Companies (CSL) Valuation After Mixed Short And Long Term Returns

What Carlisle Companies’ recent performance tells you

Carlisle Companies (CSL) has drawn investor attention after a stretch of mixed returns, with the stock up over the past week and month but showing a negative 1 year total return.

That contrast, alongside recent revenue of US$5,015.1m and net income of US$770.1m, has some investors revisiting how this building envelope manufacturer fits into a diversified portfolio.

See our latest analysis for Carlisle Companies.

At a share price of US$333.01, Carlisle’s recent 7 day share price return of 2.72% sits against a 1 year total shareholder return decline of 7.9% and a 5 year total shareholder return of 125.32%. This points to short term momentum building after a weaker year, while the longer term record remains positive.

If Carlisle’s recent move has you rethinking where growth and income might come from next, it could be a good moment to widen your watchlist with fast growing stocks with high insider ownership.

So with Carlisle’s shares recovering in the short term, but a weaker 1 year total return and an intrinsic value estimate above the current US$333.01 price, is this a genuine opening or is the market already pricing in future growth?

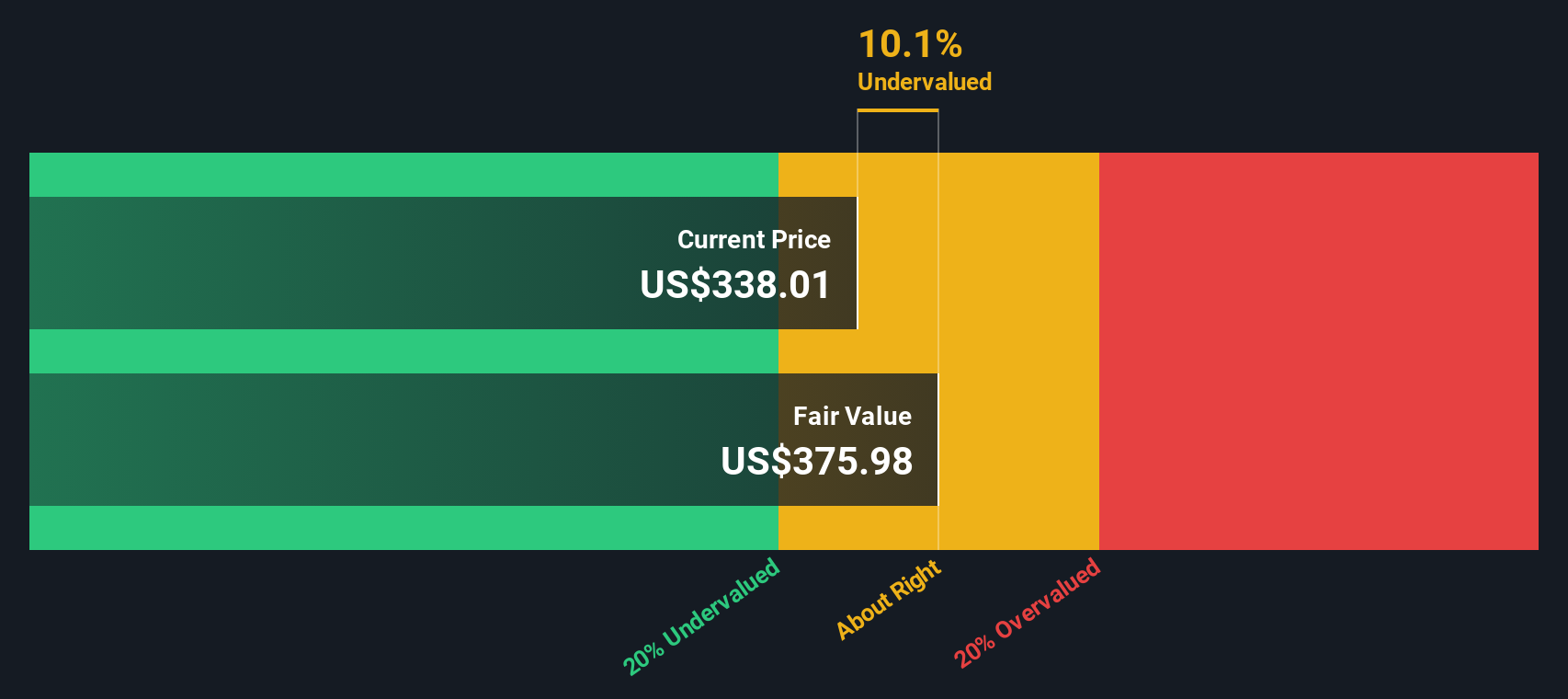

Most Popular Narrative: 9.9% Undervalued

With Carlisle Companies’ fair value in the widely followed narrative set at US$369.50 against a last close of US$333.01, the valuation gap centers on earnings power and capital returns.

Continued investment in automation, digital transformation, and operational efficiency programs (e.g., Carlisle Operating System) are driving productivity improvements and significant cost savings, expected to result in at least 200+ basis points of long-term margin expansion for underperforming segments, positively impacting net margins and free cash flow.

Want to see what happens when recurring reroofing demand, rising margins and shrinking share count all feed into one earnings forecast? The full narrative connects those dots.

Result: Fair Value of US$369.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh softer construction markets and limited pricing power, which could pressure margins and challenge the earnings assumptions behind that undervalued label.

Find out about the key risks to this Carlisle Companies narrative.

Another View: What Earnings Quality and Debt Say About Value

While the popular narrative sees Carlisle Companies as roughly 9.9% undervalued against a US$369.50 fair value, our DCF model points in a different direction. On that measure, the shares at US$333.01 sit above an estimated fair value of US$293.23, which flags potential downside rather than upside.

That gap, combined with high debt and a current net margin of 15.4% compared with 17.8% last year, raises a simple question for you as an investor: are you more comfortable backing the earnings power story or the cash flow realism of the DCF?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carlisle Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carlisle Companies Narrative

If you are not fully on board with these views or prefer to work through the numbers yourself, you can build a complete Carlisle story in minutes by starting with Do it your way.

A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond Carlisle?

If Carlisle has sharpened your thinking, do not stop here. Broaden your opportunity set now so you are not relying on just one story.

- Target potential value gaps by scanning these 880 undervalued stocks based on cash flows where current prices sit below what their cash flows might justify.

- Tap into fast growing technology trends by reviewing these 25 AI penny stocks that are tied to artificial intelligence themes across sectors.

- Add diversification with income potential by screening these 14 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報