NeoVolta Leads The Charge With These 3 Penny Stock Contenders

As the Dow Jones Industrial Average hits an all-time high for the second consecutive day, investors are closely watching market dynamics and seeking opportunities in lesser-known segments. Penny stocks, while often considered a relic of past trading days, still hold potential for those willing to explore smaller or newer companies with solid financials. This article highlights three penny stock contenders that exemplify strong balance sheets and fundamentals, offering a chance to uncover hidden value in today's robust market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.66 | $615.06M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8438 | $146.58M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.235 | $548.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.32 | $581.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.66 | $376.37M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.9891 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $86.09M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

NeoVolta (NEOV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NeoVolta Inc. designs, manufactures, and sells energy storage systems in the United States with a market cap of $127.49 million.

Operations: The company's revenue is derived entirely from its electric equipment segment, totaling $14.49 million.

Market Cap: $127.49M

NeoVolta Inc. is navigating the penny stock landscape with a focus on energy storage systems, showing significant revenue growth from US$0.59 million to US$6.65 million year-over-year for the first quarter ending September 2025. Despite being unprofitable, it has reduced losses over five years and recently raised US$13 million through private placements to bolster its cash runway. NeoVolta's strategic collaboration with Luminia LLC could potentially secure an estimated US$39 million in equipment revenue, aligning with its expansion into commercial and utility-scale markets while leveraging domestic incentives and rebates in California's energy sector.

- Unlock comprehensive insights into our analysis of NeoVolta stock in this financial health report.

- Evaluate NeoVolta's prospects by accessing our earnings growth report.

Lineage Cell Therapeutics (LCTX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lineage Cell Therapeutics, Inc. is a clinical-stage biotechnology company focused on developing novel cell therapies for neurological and ophthalmic conditions, with a market cap of $409.53 million.

Operations: The company's revenue is primarily derived from its Research and Development of Therapeutic Products segment, totaling $10.82 million.

Market Cap: $409.53M

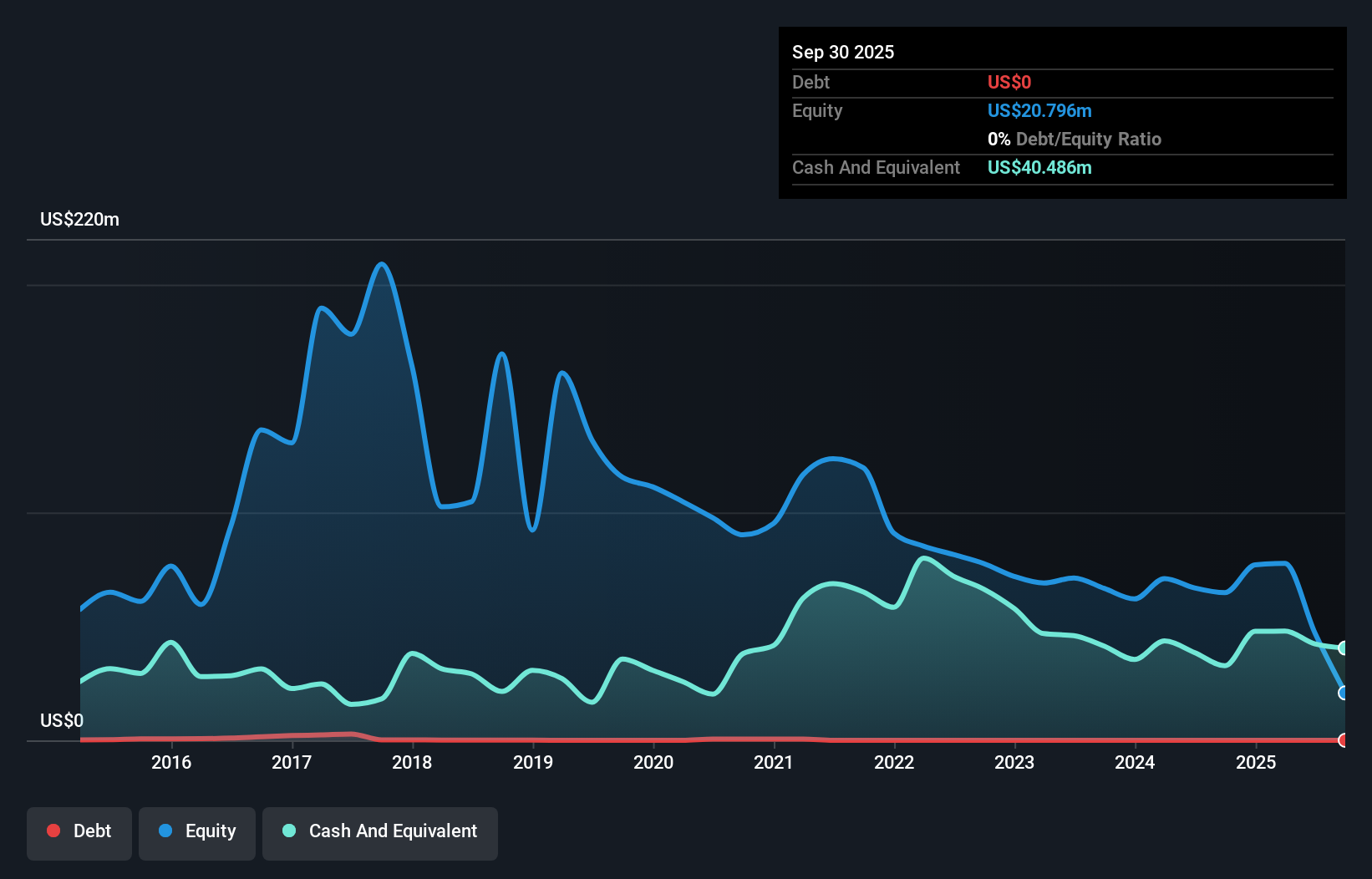

Lineage Cell Therapeutics is a clinical-stage biotech company with a market cap of US$409.53 million, currently navigating the challenges typical of penny stocks. The company reported third-quarter revenue of US$3.68 million, slightly down from the previous year, while net losses significantly widened to US$29.78 million compared to US$3.03 million previously. Despite being unprofitable and having short-term assets exceeding liabilities by US$32.9 million, Lineage maintains a stable cash runway for over a year without debt concerns and has not diluted shareholders recently, suggesting financial prudence amidst its ongoing development efforts in cell therapies.

- Click here and access our complete financial health analysis report to understand the dynamics of Lineage Cell Therapeutics.

- Understand Lineage Cell Therapeutics' earnings outlook by examining our growth report.

CI&T (CINT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CI&T Inc. offers strategy, design, and software engineering services globally with a market cap of $581.58 million.

Operations: The company generated $467.91 million from its computer services segment.

Market Cap: $581.58M

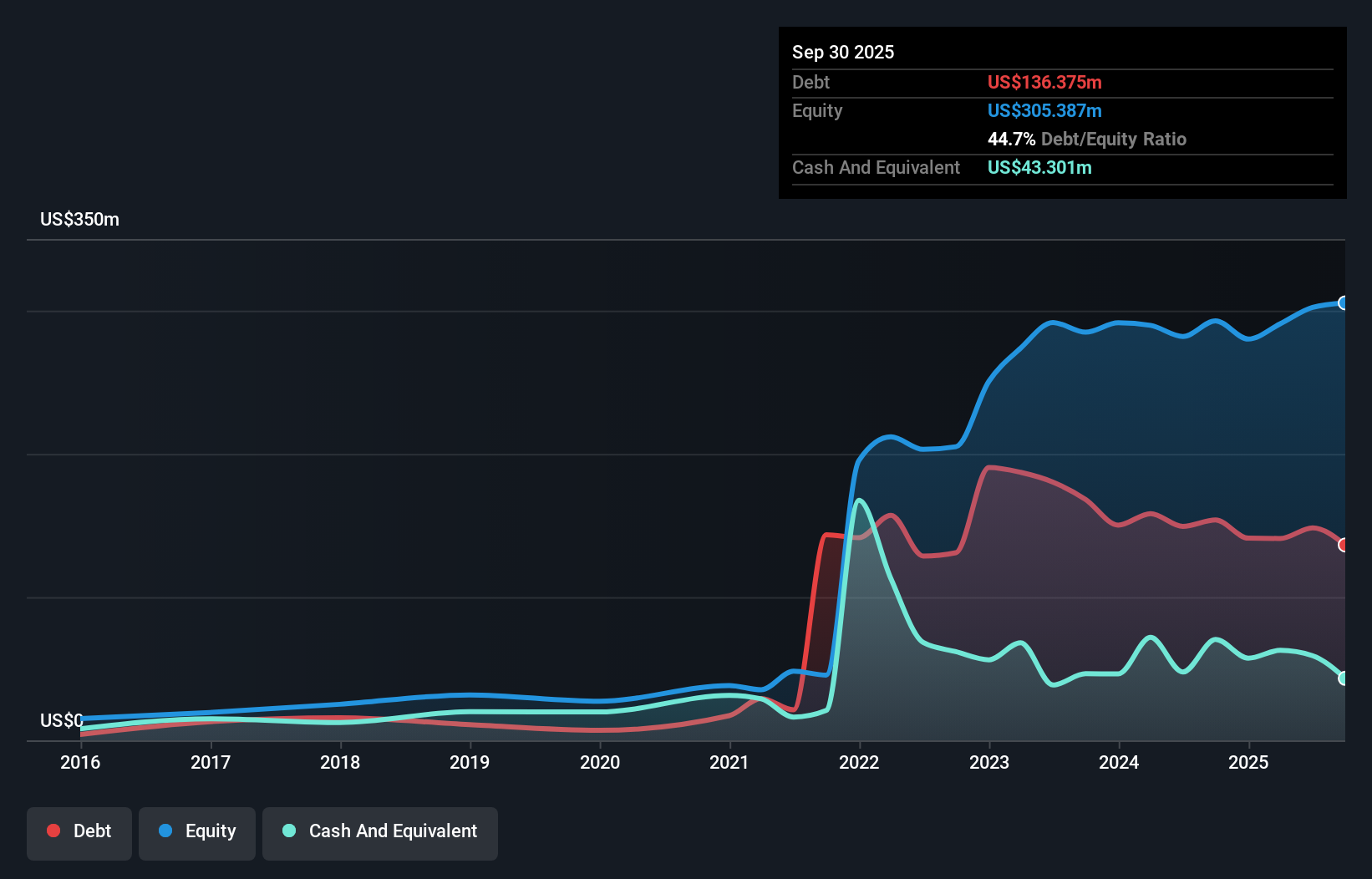

CI&T Inc., with a market cap of US$581.58 million, demonstrates solid financial health for a penny stock, as evidenced by its short-term assets exceeding liabilities and satisfactory debt coverage by operating cash flow. The company's earnings grew 45% over the past year, outpacing industry growth and reflecting improved profit margins. Recent collaborations, such as expanding Ford's Wings platform in South America using AI tools, highlight CI&T's strategic capabilities and innovation. Despite stable weekly volatility and no significant shareholder dilution recently, the company trades below analyst price targets but offers potential value based on current evaluations.

- Jump into the full analysis health report here for a deeper understanding of CI&T.

- Gain insights into CI&T's future direction by reviewing our growth report.

Make It Happen

- Discover the full array of 340 US Penny Stocks right here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報