Assessing Tyler Technologies (TYL) Valuation After Midland County Dispatch Cloud Rollout

Why the Midland County dispatch rollout is drawing investor interest

Tyler Technologies (TYL) is in focus after Midland County Central Dispatch Authority in Michigan completed a nine month rollout of Tyler’s cloud hosted Enterprise Computer Aided Dispatch and Mobility solutions, replacing its prior CAD system.

See our latest analysis for Tyler Technologies.

The Midland dispatch rollout lands at a time when Tyler’s share price has been under pressure, with a 90 day share price return of a 14.77% decline and a 1 year total shareholder return of a 21.73% decline, although the 3 year total shareholder return of 40.89% points to stronger longer term momentum.

If this kind of public sector software story interests you, it could be a good moment to widen your watchlist with high growth tech and AI stocks.

With the stock down over the past year but carrying a value score of 2 and trading at a discount to the average analyst price target, you have to ask: is there genuine upside here, or is the market already pricing in future growth?

Most Popular Narrative: 32% Undervalued

Compared with Tyler Technologies’ last close at US$441.10, the most followed narrative points to a higher fair value anchored in recurring public sector software demand.

The analysts have a consensus price target of $678.778 for Tyler Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $800.0, and the most bearish reporting a price target of just $585.0.

Curious why this story supports a meaningfully higher value than today’s price? It hinges on compounding revenue, rising margins, and a rich future earnings multiple. Want to see how those ingredients fit together?

Result: Fair Value of $648.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if government budgets tighten more than expected, or if the timing of large deals remains uneven and clouds Tyler’s revenue visibility.

Find out about the key risks to this Tyler Technologies narrative.

Another angle on valuation

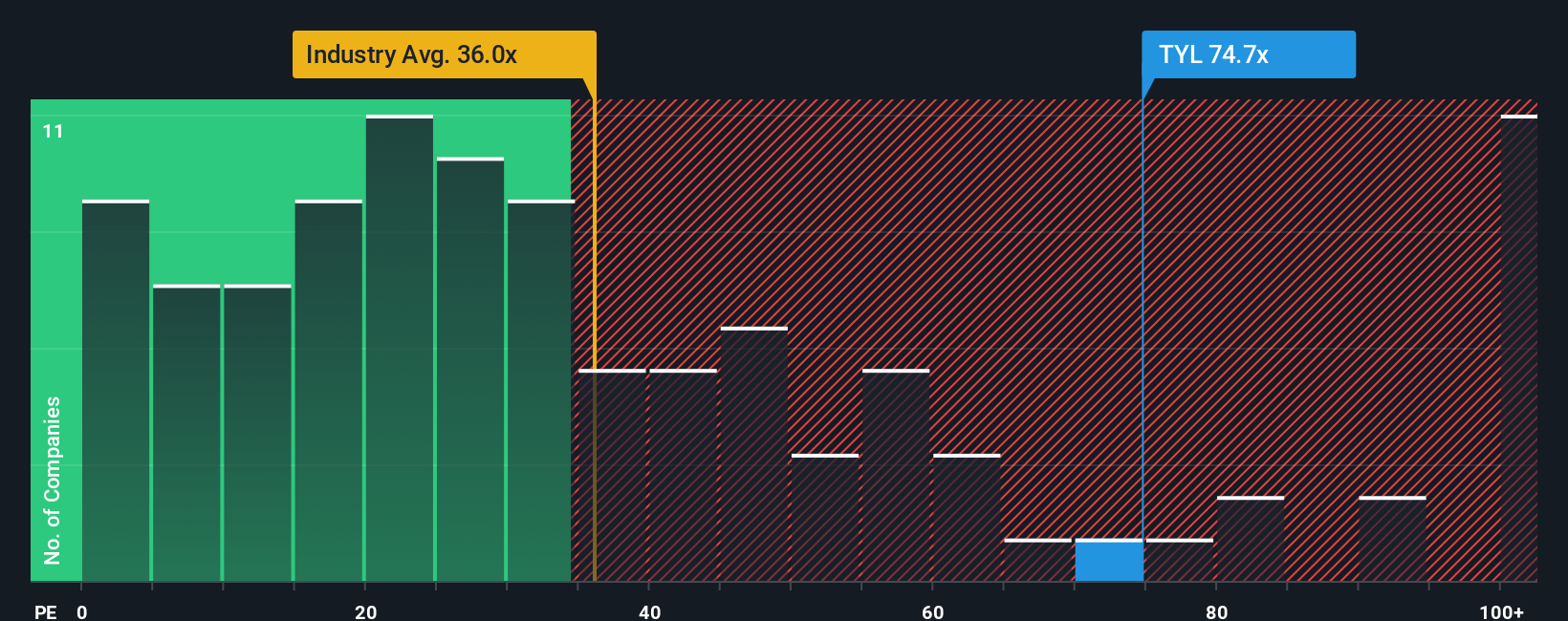

That 32% undervalued narrative sits awkwardly beside Tyler Technologies’ current P/E of 60.2x. The US software industry average is 31.7x and the fair ratio estimate is 31.8x, while close peers average 64.7x. Is this a quality premium, or simply valuation risk building up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you see the numbers differently, or simply prefer testing your own assumptions against the data, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your Tyler Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more stock ideas to pressure test your thinking?

If you stop with just one company, you could miss other setups that fit your style. Use the screener to compare, contrast, and sharpen your watchlist.

- Spot income potential by checking out these 14 dividend stocks with yields > 3% that may suit investors who want regular cash returns from established businesses.

- Hunt for mispriced opportunities with these 880 undervalued stocks based on cash flows that line up with your view on cash flows and long term performance.

- Get ahead of emerging themes through these 79 cryptocurrency and blockchain stocks that sit at the intersection of traditional markets and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報