A Look At Floor & Decor (FND) Valuation As Short-Term Gains Follow Longer-Term Weakness

Why Floor & Decor Is Back On Investors’ Radar

Floor & Decor Holdings (FND) has attracted fresh attention after a choppy stretch for the share price, with recent returns mixed across different time frames and investors reassessing what the current valuation implies.

See our latest analysis for Floor & Decor Holdings.

The recent 1-day share price return of 1.41% and 7-day gain of 4.09% come after a 90-day share price decline of 9.42%. The 1-year total shareholder return decline of 32.86% and 5-year total shareholder return decline of 38.58% indicate that short-term momentum has picked up, while longer-term performance has been weak.

If Floor & Decor’s recent moves have you reassessing opportunities in retail and beyond, this could be a useful moment to scan fast growing stocks with high insider ownership.

With Floor & Decor showing annual revenue and net income growth, alongside a 1-year total return decline of 32.86% and a value score of 1, you have to ask: is this weakness a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 17.9% Undervalued

With Floor & Decor’s fair value in the narrative set at US$77.82 against a last close of US$63.86, the valuation hinges on specific growth and margin assumptions rather than short term share price swings.

Analysts are assuming Floor & Decor Holdings's revenue will grow by 9.0% annually over the next 3 years.

Analysts assume that profit margins will increase from 4.6% today to 5.0% in 3 years time.

Want to see what turns those revenue and margin targets into a higher fair value? The narrative focuses on earnings power and a premium future profit multiple. Curious how those pieces fit together to support that US$77.82 figure?

Result: Fair Value of $77.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if weak existing home sales and elevated mortgage rates keep comparable sales under pressure, or if rapid store expansion hurts store level economics.

Find out about the key risks to this Floor & Decor Holdings narrative.

Another View: Multiples Paint A Different Picture

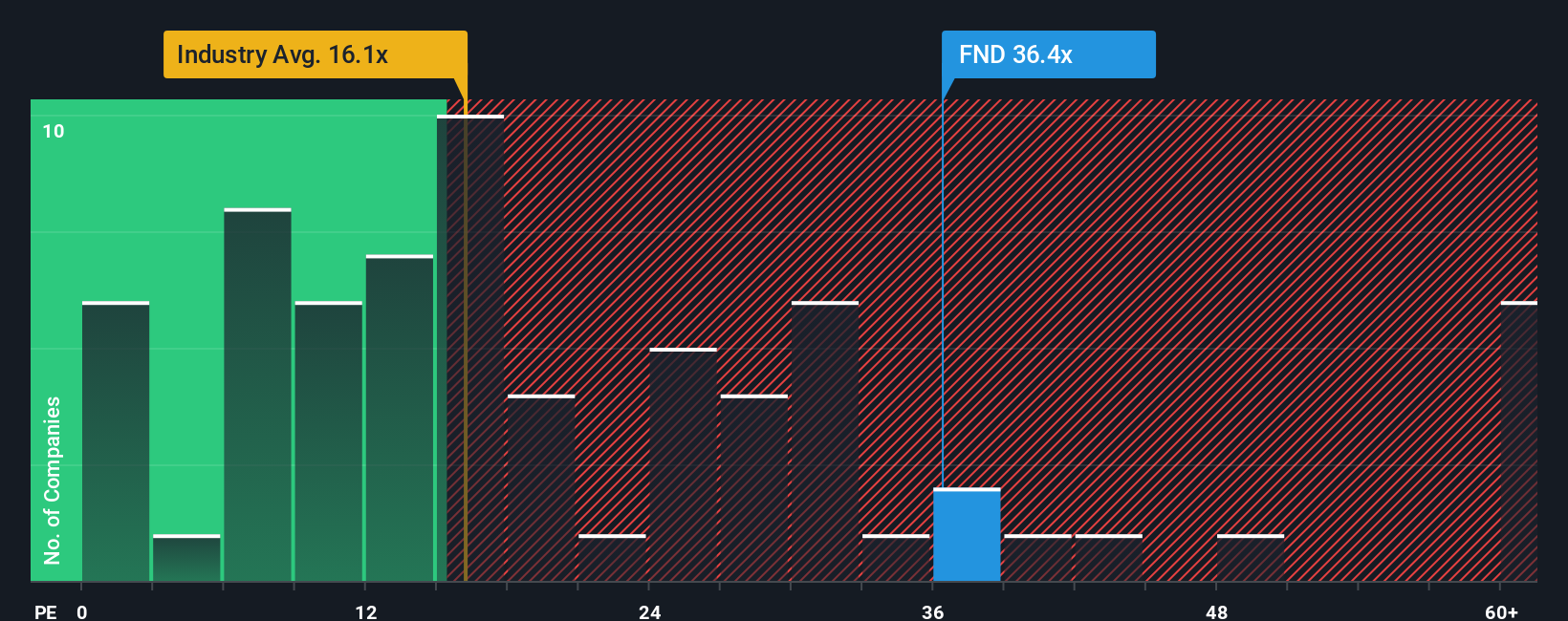

So far you have seen a narrative that treats Floor & Decor as 17.9% undervalued versus a US$77.82 fair value. The P/E based view tells a different story. At 31.7x earnings, the shares are priced well above the US Specialty Retail industry at 19.8x, peers at 14.1x, and the fair ratio of 16.8x. That gap suggests more valuation risk than the narrative alone implies. Which lens do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If you are not fully on board with this view or simply prefer to test the numbers yourself, you can build a fresh take in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking For More Investment Ideas?

If Floor & Decor has sparked your interest, do not stop there, broaden your watchlist with other focused ideas that could sharpen your overall investing approach.

- Target potential value opportunities by scanning these 880 undervalued stocks based on cash flows that currently trade below what their cash flows suggest.

- Tap into the growth story around artificial intelligence by reviewing these 25 AI penny stocks that tie real businesses to this technology theme.

- Add income focused ideas to your shortlist by checking out these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報