A Look At Lucid Group (LCID) Valuation As Production And Deliveries Strengthen In Q4 2025

Lucid Group (LCID) reported a sharp pickup in operations for 2025, with Q4 output of 8,412 vehicles and 5,345 deliveries, as Gravity SUV expansion and eased supply constraints reshaped expectations around the stock.

See our latest analysis for Lucid Group.

The stronger production and delivery figures arrive after a difficult stretch for shareholders, with the 1 year total shareholder return down 63.24% and the 3 year total shareholder return down 83.74%. At the same time, the 1 day share price return of 4.84% and 7 day share price return of 7.25% suggest short term momentum has picked up from a low base.

If Lucid’s recent move has you rethinking the EV space, it could be a good moment to size up other auto names using our auto manufacturers.

With Lucid still loss making, a value score of 0, and the stock trading about 52% below the average analyst price target of US$17.72, you have to ask: is this a reset level, or is the market already factoring in any future growth?

Most Popular Narrative Narrative: 36.6% Undervalued

With the fair value estimate at US$18.43 versus a last close of US$11.69, the most followed narrative sees a meaningful valuation gap that hinges on Lucid turning its technology edge and partnerships into future earnings power.

The newly announced Uber and Nuro partnership, including a planned $300 million Uber investment and a commitment to deploy at least 20,000 Lucid Gravity vehicles as robotaxis over six years, is expected to open a large and fast-growing autonomous fleet market to Lucid. This is described as a driver of significant revenue expansion and potential margin improvement via technology licensing and high-volume fleet sales.

Want to see what has to happen for that robotaxi order book, higher margin premium EVs, and long run profit lift to line up with today’s valuation gap? The narrative walks through the revenue build, margin shift, and future earnings multiple that all need to click into place.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on Lucid improving from very negative gross margins and managing ongoing capital needs, which could lead to further dilution or pressure on future earnings per share.

Find out about the key risks to this Lucid Group narrative.

Another View: What The Market Is Paying Today

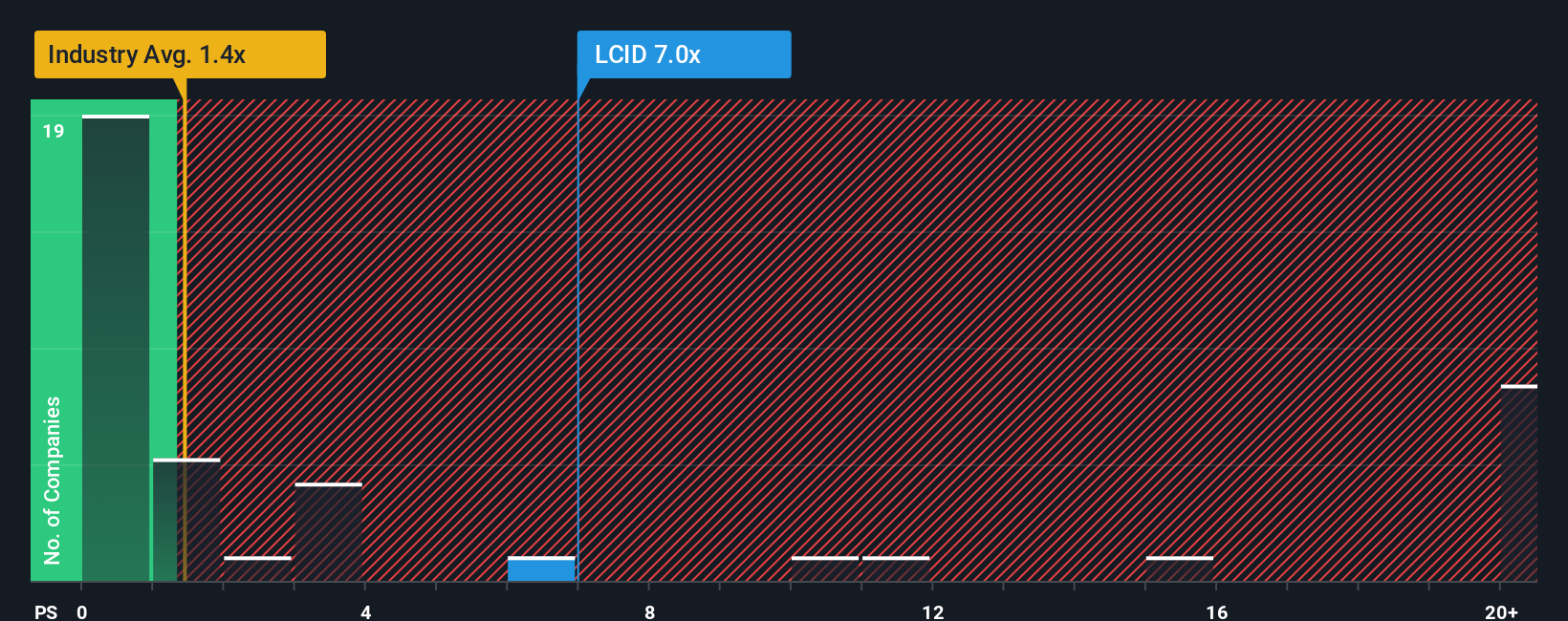

The AI narrative leans on a fair value of about US$18.43, yet today’s pricing tells a different story. Lucid trades on a P/S ratio of 3.6x, compared with 0.6x for the US Auto industry and 1.4x for peers, and a fair ratio estimate of 0x.

That gap means the current share price already implies far richer sales expectations than the sector and peer group, with little support from the fair ratio. For you, the question is whether those expectations feel earned or whether it leaves less room for error if the story takes longer to play out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If you see the numbers differently, or prefer to dig into the data on your own terms, you can build a fresh view in minutes with Do it your way

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Lucid has sharpened your focus, do not stop here. Expanding your watchlist across different themes can help you stress test your thinking and spot new opportunities.

- Target potential value setups by scanning these 880 undervalued stocks based on cash flows that align with your preferred balance of quality and price.

- Hunt for growth stories in cutting edge tech by sorting through these 25 AI penny stocks where artificial intelligence is central to the business model.

- Add a different return profile by weighing income opportunities in these 14 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報