US stock outlook | The three major stock index futures have mixed ups and downs, and the market focuses on CES 2026: AI bull market narrative continues to dominate the stock market

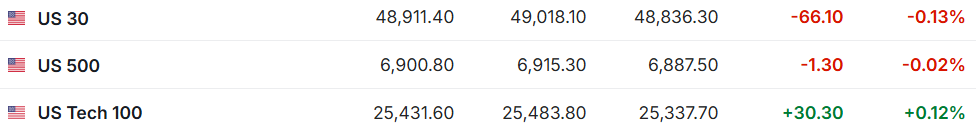

1. Before the US stock market on January 6 (Tuesday), futures for the three major US stock indexes had mixed ups and downs. As of press release, Dow futures were down 0.13%, S&P 500 futures were down 0.02%, and NASDAQ futures were up 0.12%.

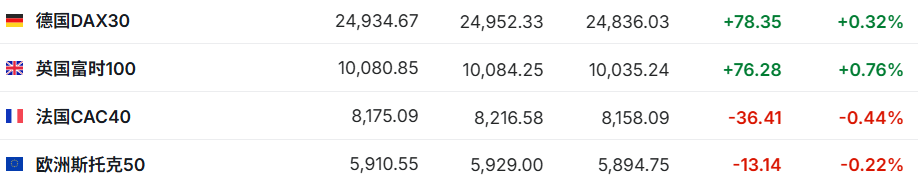

2. As of press release, the German DAX index rose 0.32%, the UK FTSE 100 index rose 0.76%, the French CAC40 index fell 0.44%, and the European Stoxx 50 index fell 0.22%.

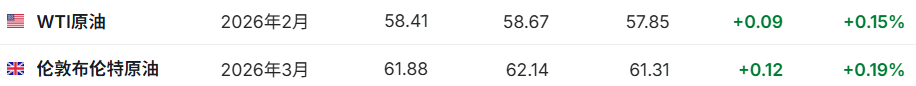

3. As of press release, WTI crude oil rose 0.15% to $58.41 per barrel. Brent crude rose 0.19% to $61.88 per barrel.

Market news

From Nvidia Rubin leading the “AI Factory Era” to AMD's MI500 “1000x Roadmap”: the “AI Bull Market Narrative” continues to dominate the stock market. At the CES opening event in early 2026, in the face of the global capital market's fears that “the AI bubble is about to burst” and the anxiety that Moore's Law will gradually fail, Huang Renxun used a new cabinet-level AI GPU computing power infrastructure platform called Vera Rubin. In addition, AMD CEO Su Zifeng brought an MI455X AI GPU with a 10-fold performance improvement compared to the MI355X and announced the “up to a thousand times performance jump”, to jointly send a positive signal to global investors: AI computing power Demand continues to expand exponentially, and the AI infrastructure construction process is still in the early to middle stages.

Are EVs declining in tide and autonomous driving taking over? CES 2026 opens, and car companies are betting on the “next wave” of AI to take over the steering wheel. At the CES (International Consumer Electronics) Technology Trade Show held in Las Vegas this week, autonomous driving technology based on cutting-edge AI models seems to dominate, and investors are also betting that artificial intelligence will inject vitality into a traditional manufacturing industry that has long been plagued by slow iteration of core technologies, high investment costs, safety incidents, and regulatory reviews. At a time when traditional car manufacturers are putting the brakes on comprehensive electric vehicle (EV) transformation plans due to factors such as fierce competition and drastic cuts in government low-carbon subsidies, a large number of suppliers and start-ups in the automotive industry chain are lining up to showcase their latest autonomous driving hardware and software platforms.

The Venezuelan incident did not shake up US stocks, but the trading logic is accumulating risks in 2026. If Wall Street bulls want to achieve double digit returns for the fourth year in a row in 2026, many conditions will need to be met. Trade tension between the US and neighboring countries continues to be high, and the economy is showing signs of fatigue. Interest rates are still high after three interest rate cuts, and the artificial intelligence boom is far from winning. Geopolitics is another major variable. Although the US military action in Venezuela did not have an impact on domestic financial market sentiment, the surprise reminder to investors that in a world that has experienced generational geopolitical changes, any trading logic may be overwhelmed. Up to now, the raid to arrest Venezuelan President Nicolas Maduro has had a lackluster response on Wall Street. The S&P 500 index rose 0.6% on Monday, and crude oil prices rose slightly. Some safe-haven assets have risen, particularly gold and US bonds.

Is Chevron (CVX.US) seizing opportunities to rebuild Venezuelan oil? Huge amounts of capital and political risk have caused US oil companies to fall into a “high-risk game.” After the US launched a “beheading” military operation against Venezuela last weekend and forcibly arrested Venezuelan President Nicolas Maduro, US President Trump called on American oil companies to rebuild Venezuela's energy industry. However, while this is easy, it is very difficult to do. According to the US Energy Information Administration (EIA), Venezuela has the world's largest proven reserves of crude oil, amounting to 303 billion barrels. However, to restore the country's crude oil production to the peak of 3.5 million barrels per day reached in the 90s, the US oil giants will still face a long and expensive path. Arne Roman Rasmussen, chief analyst and head of research at Global Risk Management, put it bluntly: “This is a high-risk area for oil companies to invest in.”

Ignoring multiple adverse factors, Xiaomo executives are firmly optimistic about the 2026 IPO and M&A market. Despite multiple negative factors in the global economy and geopolitics, a J.P. Morgan Chase executive said the agency is optimistic about promoting more initial public offerings (IPOs) and deals this year. Matthieu Wiltz, co-head of Europe, Middle East and Africa (EMEA) at J.P. Morgan Chase, said in an interview on Tuesday: “The current market sentiment is positive. We see that the reserve projects for the two major business lines of mergers and acquisitions and IPOs are very substantial. Market demand is strong — judging by customer feedback, they are really willing to enter the market and seize current opportunities.” According to compiled data, J.P. Morgan Chase ranked third among global IPO underwriters last year. Although the market stagnated for a while after the US tariff policy was announced in April last year, the total transaction volume increased 47% throughout the year.

Individual stock news

Locking in Nvidia's mass production dividend: Ultra Micro Computer (SMCI.US) expands Vera Rubin liquid cooling support. During the CES show in January 2026, Ultra Microelectronics announced the expansion of its liquid-cooled AI infrastructure support to accelerate delivery of data center solutions tailored to the Nvidia (NVDA.US) Vera Rubin platform. On Monday local time, Nvidia announced that its next generation system — Grace Blackwell's successor, the Vera Rubin platform — has entered full mass production, with ultra-microcomputers participating as one of its partners in the infrastructure and storage sector.

Microsoft (MSFT.US) acquires AI data engineering platform Osmos to further strengthen the Fabric platform ecosystem. On January 5, local time, Microsoft (MSFT.US) announced that it had completed the acquisition of Osmos. Osmos is an agent-based artificial intelligence data engineering platform focused on streamlining complex data workflows. Currently, the specific financial details of this acquisition have not been disclosed to the outside world. What is clear, however, is that Osmos will be fully integrated into the Microsoft Fabric platform. As a cloud analysis platform driven by artificial intelligence, Microsoft Fabric can highly integrate multiple functions such as data integration, data engineering, data warehousing, and data science into a unified platform.

Intel (INTC.US) Panther Lake architecture computer unveiled at CES, can it regain lost market share? At the Las Vegas International Consumer Electronics Show (CES), Intel unveiled a laptop with a new processor design, which is a key part of the chipmaker's strategy to regain market competitiveness. The chip giant announced on Monday that new notebooks to be launched by major global computer manufacturers will be equipped with Intel processors using Panther Lake architecture and advanced manufacturing processes. The company said that consumer-grade notebooks equipped with the new chip will be pre-ordered from now and will be available globally from January 27. Jim Johnson, senior vice president of Intel, said that the next generation of notebooks will bring consumers leaps and bounds in performance, especially when running artificial intelligence software. The company first revealed Panther Lake technology at an event in October last year.

Qualcomm (QCOM.US) enters the mid-range PC market: releases Snapdragon X2 Plus processing, challenging Intel and AMD. Qualcomm, the world's largest mobile phone chip maker, said it is further promoting its market layout as the core processor for personal computers. The company said its new X2 Plus processor is a stripped down version of the existing product line and is intended to be the main component of a more affordable laptop. The chipmaker announced on Monday that it will offer two versions, one with 10 computing cores and the other with 6 computing cores. These cores feature an updated third-generation Oryon design. According to Qualcomm, one of its biggest selling points is the integration of a powerful neural processing unit that can speed up the response speed of AI software without excessive battery consumption.

Bud.US (BUD.US) spent $3 billion to buy back shares in the US metal can factory. Budweiser InBev announced that it will buy back 49.9% of its US metal can factory from a consortium of institutional investors led by Apollo Global Management (APO.US) and providing consulting services at a price of approximately US$3 billion. Budweiser InBev said in a statement that the metal can factory business covers 7 production facilities distributed in 6 US states and is a key strategic component of the company's US supply chain system. Budweiser InBev, which owns brands such as Times Beer and Budweiser, will use its own cash to complete the acquisition.

Key economic data and event forecasts

21:00 Beijing time: 2027 FOMC voting committee and Richmond Federal Reserve Chairman Barkin delivered a speech.

05:30 a.m. Beijing time the next day: US API crude oil inventory changes for the week ending January 2 (10,000 barrels).

The TBD “Tech Spring Festival Gala” 2026 Consumer Electronics Show (CES) will be held in Las Vegas.

Nasdaq

Nasdaq 華爾街日報

華爾街日報