TSX Value Stocks Priced Below Estimated Intrinsic Worth In January 2026

As we enter 2026, the Canadian market is navigating a landscape marked by significant economic shifts, with interest rates having receded from their peaks and employment trends showing unexpected strength. In this environment, identifying undervalued stocks becomes crucial for investors seeking to optimize returns, as these stocks offer potential value when priced below their estimated intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$125.75 | CA$225.25 | 44.2% |

| Neo Performance Materials (TSX:NEO) | CA$17.23 | CA$31.21 | 44.8% |

| kneat.com (TSX:KSI) | CA$5.00 | CA$9.27 | 46.1% |

| Kits Eyecare (TSX:KITS) | CA$19.39 | CA$38.57 | 49.7% |

| Kinaxis (TSX:KXS) | CA$166.53 | CA$326.69 | 49% |

| EQB (TSX:EQB) | CA$104.22 | CA$186.65 | 44.2% |

| Endeavour Mining (TSX:EDV) | CA$70.96 | CA$123.76 | 42.7% |

| Dexterra Group (TSX:DXT) | CA$11.78 | CA$22.84 | 48.4% |

| Black Diamond Group (TSX:BDI) | CA$15.03 | CA$28.39 | 47.1% |

| Almonty Industries (TSX:AII) | CA$13.22 | CA$23.51 | 43.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc operates as a multi-asset gold producer in West Africa with a market capitalization of approximately CA$17.12 billion.

Operations: The company's revenue segments include $1.03 billion from the Ity Mine, $516.60 million from the Mana Mine, $959.90 million from the Houndé Mine, $599.40 million from the Lafigué Mine, and $791.10 million from the Sabodala Massawa Mine.

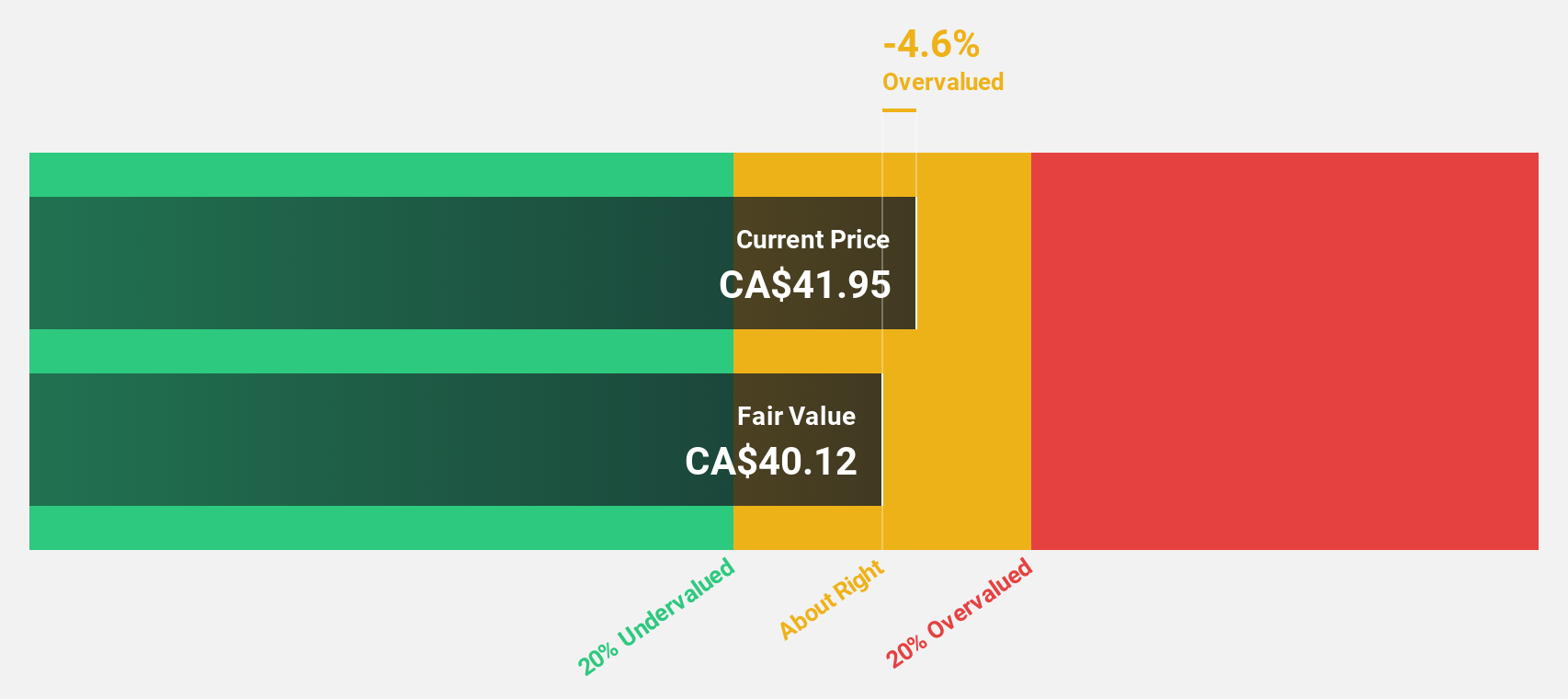

Estimated Discount To Fair Value: 42.7%

Endeavour Mining is trading at CA$70.96, significantly below its estimated fair value of CA$123.76, indicating it may be undervalued based on cash flows. The company's earnings are expected to grow 35.2% annually, outpacing the Canadian market's growth rate of 11.6%. Despite recent insider selling, Endeavour has shown strong financial performance with a net income of US$611.3 million for the first nine months of 2025 compared to a loss last year and completed share buybacks worth US$44.9 million.

- Insights from our recent growth report point to a promising forecast for Endeavour Mining's business outlook.

- Get an in-depth perspective on Endeavour Mining's balance sheet by reading our health report here.

EQB (TSX:EQB)

Overview: EQB Inc., operating through its subsidiary Equitable Bank, offers personal and commercial banking services to retail and commercial customers in Canada, with a market cap of CA$3.89 billion.

Operations: The company generates revenue of CA$1.12 billion from its banking services provided to retail and commercial clients across Canada.

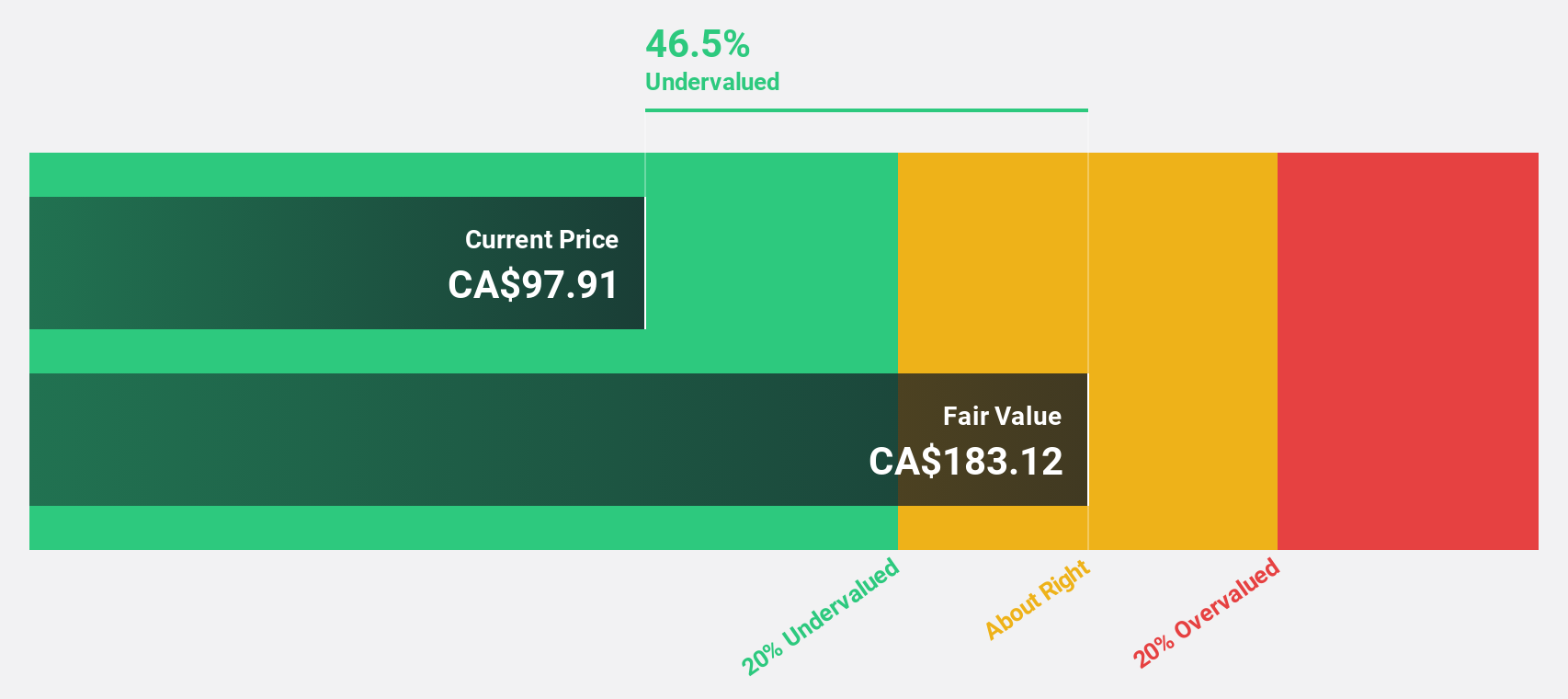

Estimated Discount To Fair Value: 44.2%

EQB is trading at CA$104.22, considerably below its estimated fair value of CA$186.65, suggesting potential undervaluation based on cash flows. The company has announced a share buyback plan to repurchase up to 5.94% of its issued shares, which could enhance shareholder value. Despite a recent quarterly net loss of CA$4.76 million, EQB's earnings and revenue are forecasted to grow significantly faster than the Canadian market over the coming years.

- Our earnings growth report unveils the potential for significant increases in EQB's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of EQB.

Kits Eyecare (TSX:KITS)

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$623.21 million.

Operations: The company generates revenue primarily from the sale of eyewear products, amounting to CA$193.40 million.

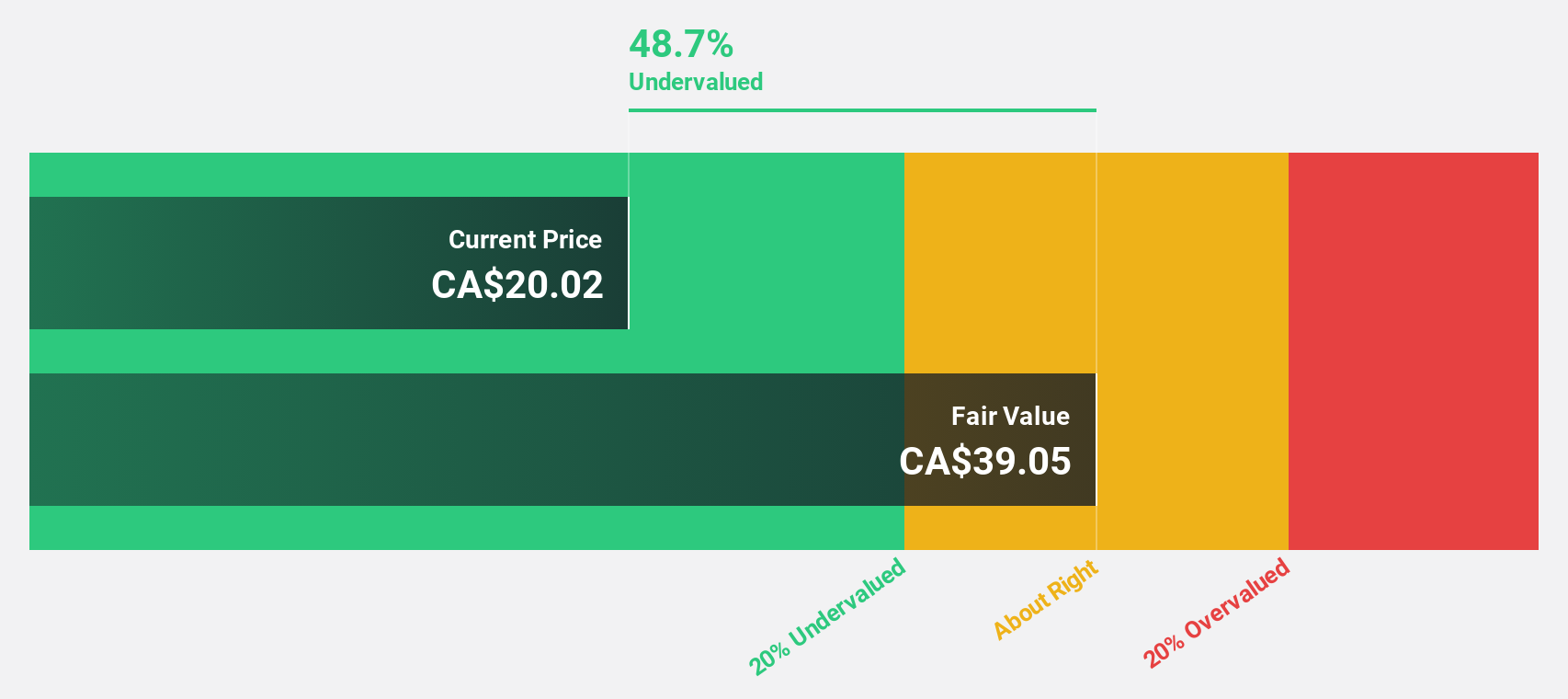

Estimated Discount To Fair Value: 49.7%

Kits Eyecare is trading at CA$19.39, significantly below its estimated fair value of CA$38.57, highlighting potential undervaluation based on cash flows. Recent product innovations like the Pangolin Gen-3 AI-enabled eyewear and expansion into Toronto enhance growth prospects. The company's revenue and earnings are forecasted to grow substantially faster than the Canadian market, with no outstanding long-term debt further strengthening its financial position for future developments.

- In light of our recent growth report, it seems possible that Kits Eyecare's financial performance will exceed current levels.

- Take a closer look at Kits Eyecare's balance sheet health here in our report.

Where To Now?

- Take a closer look at our Undervalued TSX Stocks Based On Cash Flows list of 29 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報