A Look At Zeon (TSE:4205) Valuation As The Board Weighs Treasury Share Cancellation

Board meeting focus and why it matters for Zeon shareholders

Zeon (TSE:4205) has called a board meeting for December 23, 2025, to consider cancelling treasury shares under Article 178 of the Companies Act, a corporate move that directly relates to shareholder value.

See our latest analysis for Zeon.

Zeon’s ¥1,843.5 share price comes after a 1-day share price return of 1.54%, building on a 30-day share price return of 7.21% and a 1-year total shareholder return of 30.14%. This indicates that momentum has been firming as the market weighs the planned treasury share cancellation and recent earnings trends.

If this kind of corporate action has your attention, it could be a good moment to see how other industrial names stack up and broaden your watchlist with fast growing stocks with high insider ownership.

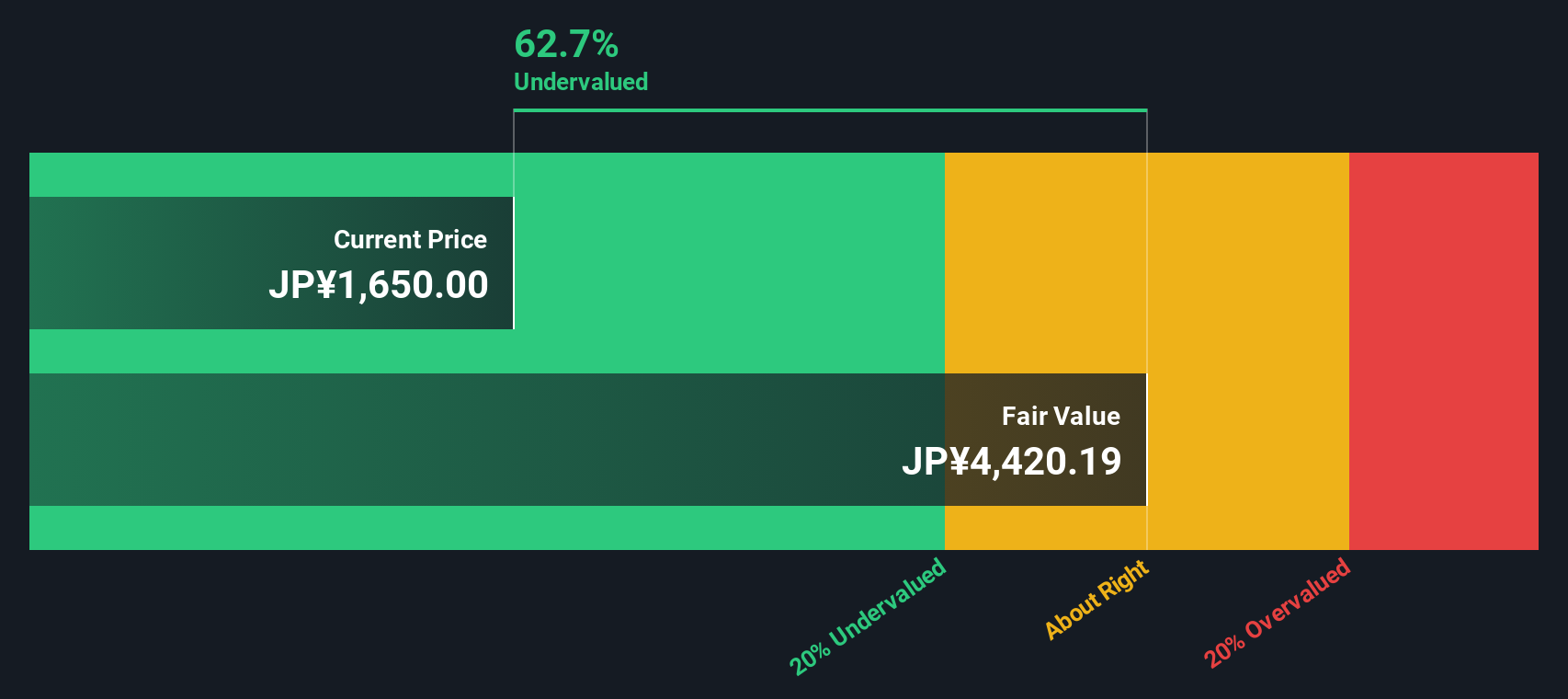

With Zeon trading around ¥1,843.5, carrying an intrinsic discount estimate of 63% and a value score of 5, the key question is whether this signals a potentially undervalued opportunity or if the market is already pricing in future growth.

Price-to-Earnings of 9.7x: Is it justified?

On a P/E of 9.7x at a last close of ¥1,843.5, Zeon screens as inexpensive compared to peers and industry averages, which raises a clear value question.

The P/E ratio compares the current share price to earnings per share. For a materials and chemicals company like Zeon it is a straightforward way to see what the market is willing to pay for current earnings.

Zeon looks to be on the cheaper side, with its 9.7x P/E sitting well below the peer average of 28.2x and below the estimated fair P/E of 13x. This suggests the market is pricing its earnings at a discount that could narrow if sentiment or earnings expectations shift.

Against the broader JP Chemicals industry, where the average P/E is 13x, Zeon again comes across as lowly rated on earnings. The current multiple implies the company is valued more conservatively than many sector names on this measure.

Explore the SWS fair ratio for Zeon

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, you still need to weigh risks such as the annual net income contraction of 2.22% and a slight premium to the ¥1,835.56 analyst price target.

Find out about the key risks to this Zeon narrative.

Another view: DCF sends a stronger signal

While the 9.7x P/E suggests Zeon appears inexpensive compared with peers, our DCF model indicates a larger gap. With the share price at ¥1,843.5 versus an estimated fair value of ¥4,931.04, it implies that Zeon may be trading at a significant discount. So which metric should carry more weight, the earnings multiple or discounted cash flow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zeon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zeon Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a full view in just a few minutes with Do it your way.

A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Zeon?

If Zeon has sparked your interest, do not stop there. You are more likely to spot opportunities when you regularly scan a wider set of stocks.

- Target potential mispricings by checking out these 879 undervalued stocks based on cash flows, where you can focus on companies that look cheap relative to their cash flows.

- Ride structural tech trends by scanning these 25 AI penny stocks, filtered for names tied to artificial intelligence themes.

- Strengthen your income ideas with these 14 dividend stocks with yields > 3%, zeroing in on companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報