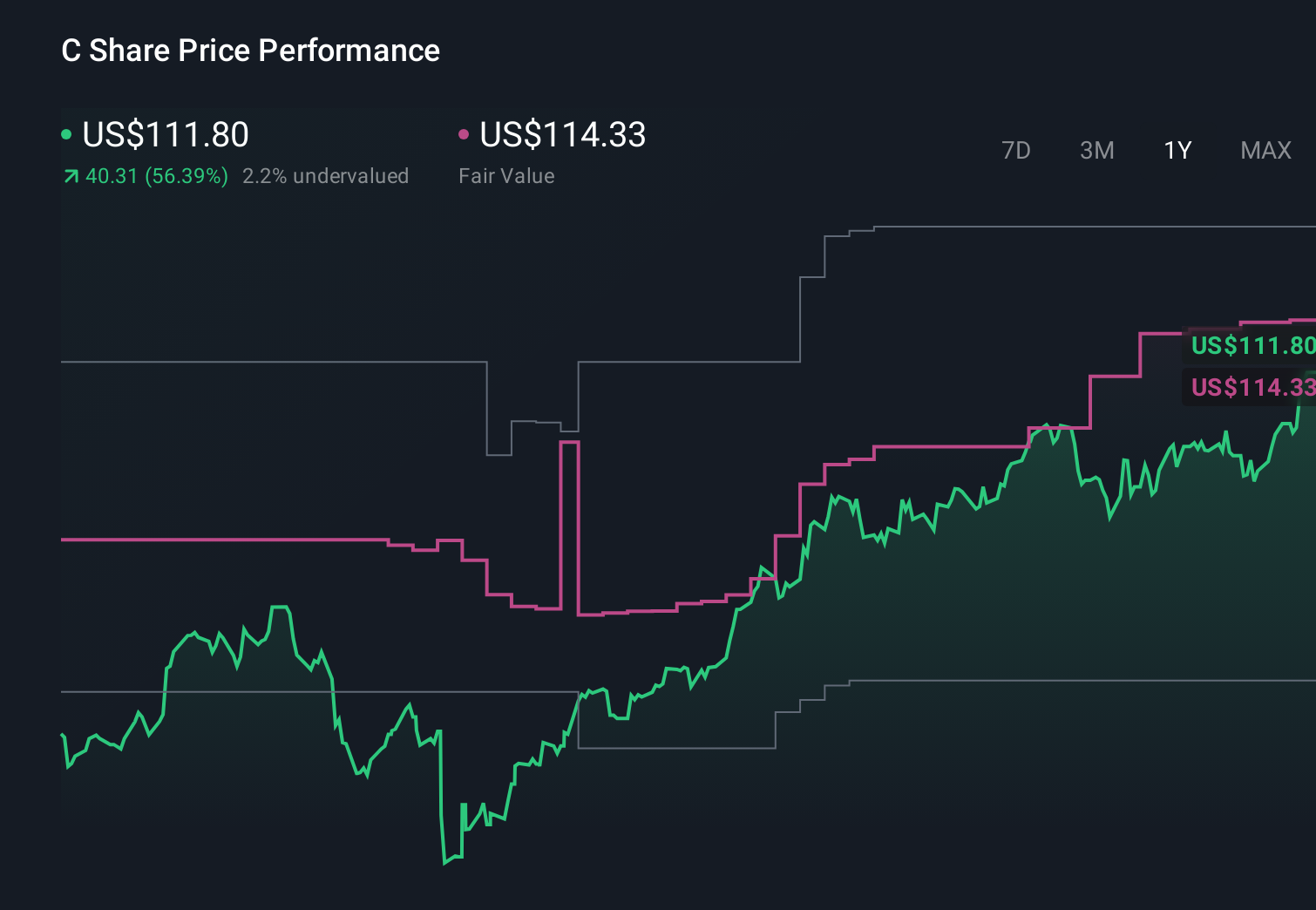

Citigroup (C) Is Up 5.2% After Russia Exit Deal Boosts Capital Ratios Despite Q4 2025 Loss

- Citigroup has approved the sale of its remaining Russian operations to Renaissance Capital, a move that is expected to trigger a roughly US$1.20 billion pre-tax loss in the fourth quarter of 2025 but also reduce risk-weighted assets and lift core capital ratios once completed.

- This exit, combined with fresh fixed-income issuance and new senior appointments in Asia Pacific, marks a further step in simplifying Citi’s footprint while reinforcing its global institutional focus.

- We’ll now examine how Citigroup’s Russia exit, with its immediate loss but potential capital benefits, reshapes the bank’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Citigroup Investment Narrative Recap

To own Citigroup today, you have to believe its ongoing simplification and institutional focus can offset pressure from regulation, margin headwinds and competition. The Russia exit crystallizes a roughly US$1.20 billion pre tax loss, but analysts see a likely boost to capital ratios as risk weighted assets fall. In the near term, the key catalyst remains execution on cost reduction and capital return, while the biggest risk is that elevated transformation and compliance costs keep returns below peers. The Russia news does not fundamentally change that trade off.

Among recent developments, Citi’s flurry of fixed income offerings in late 2025 stands out in this context. The new senior unsecured notes, spanning 2027 to 2046 maturities with both fixed and variable coupons, sit alongside the Russia exit as part of a broader balance sheet reshape. For investors focused on catalysts, the combination of liability management, capital build from RWA reduction and ongoing buybacks will matter at least as much as the headline loss.

Yet, behind the stronger capital story, investors should still be aware of the risk that prolonged regulatory scrutiny and transformation spending could...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion revenue and $17.2 billion earnings by 2028. This requires 6.8% yearly revenue growth and a $4.3 billion earnings increase from $12.9 billion today.

Uncover how Citigroup's forecasts yield a $116.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Before this Russia decision, the most optimistic analysts were assuming Citi could reach about US$91.3 billion in revenue and US$20.0 billion in earnings, so if you are weighing that against today’s news and worries about geopolitical and trade uncertainty, you are really choosing between a much more upbeat earnings path and a baseline view that may now need to be revisited.

Explore 11 other fair value estimates on Citigroup - why the stock might be worth as much as 89% more than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報