US Market's Undiscovered Gems Three Promising Small Caps

As the U.S. market begins 2026 with major indexes reaching new highs, driven by a surge in oil stocks following geopolitical developments, investors are keenly observing the implications for small-cap stocks. Amid this backdrop, identifying promising small-cap companies can offer unique opportunities for growth, particularly those that demonstrate resilience and potential in shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Daily Journal (DJCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Daily Journal Corporation publishes newspapers and websites in California, Arizona, Utah, and Australia with a market cap of $759.32 million.

Operations: The company's revenue is primarily derived from its Journal Technologies segment, generating $69.94 million, and its Traditional Business segment, contributing $17.76 million.

Daily Journal, a smaller player in the software sector, has shown impressive earnings growth of 43.6% over the past year, outpacing the industry's 28.3%. With a debt-to-equity ratio that decreased from 22% to 5.9% over five years, its financial health seems robust. The company’s price-to-earnings ratio stands at just 6.8x compared to the broader US market's 19x, suggesting potential undervaluation. However, a significant one-off gain of US$134 million has impacted recent results. Leadership changes include Erik Nakamura as CFO amid investor activism challenges and executive retirements shaping its strategic direction forward.

- Dive into the specifics of Daily Journal here with our thorough health report.

Gain insights into Daily Journal's past trends and performance with our Past report.

Magic Software Enterprises (MGIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magic Software Enterprises Ltd. is a global provider of proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services with a market cap of $1.34 billion.

Operations: Magic Software Enterprises generates revenue through proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings. The company's financial performance is highlighted by a net profit margin of 6.5%.

Magic Software Enterprises, a nimble player in the tech space, has demonstrated robust financial health with its interest payments comfortably covered by EBIT at 22.8 times. Over the past five years, earnings have grown steadily by 10.4% annually, although recent growth of 14.8% lagged behind the broader software industry at 28.3%. The company boasts more cash than total debt and maintains high-quality earnings, underscoring its solid foundation. Recent updates include an upward revision in revenue guidance to $610-$620 million for 2025 and a declared quarterly dividend of $7.4 million, reflecting strong distributable profits and positive future prospects.

Nicolet Bankshares (NIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Nicolet Bankshares, Inc. is the bank holding company for Nicolet National Bank, offering a range of banking products and services to businesses and individuals across Wisconsin, Michigan, and Minnesota with a market cap of $1.84 billion.

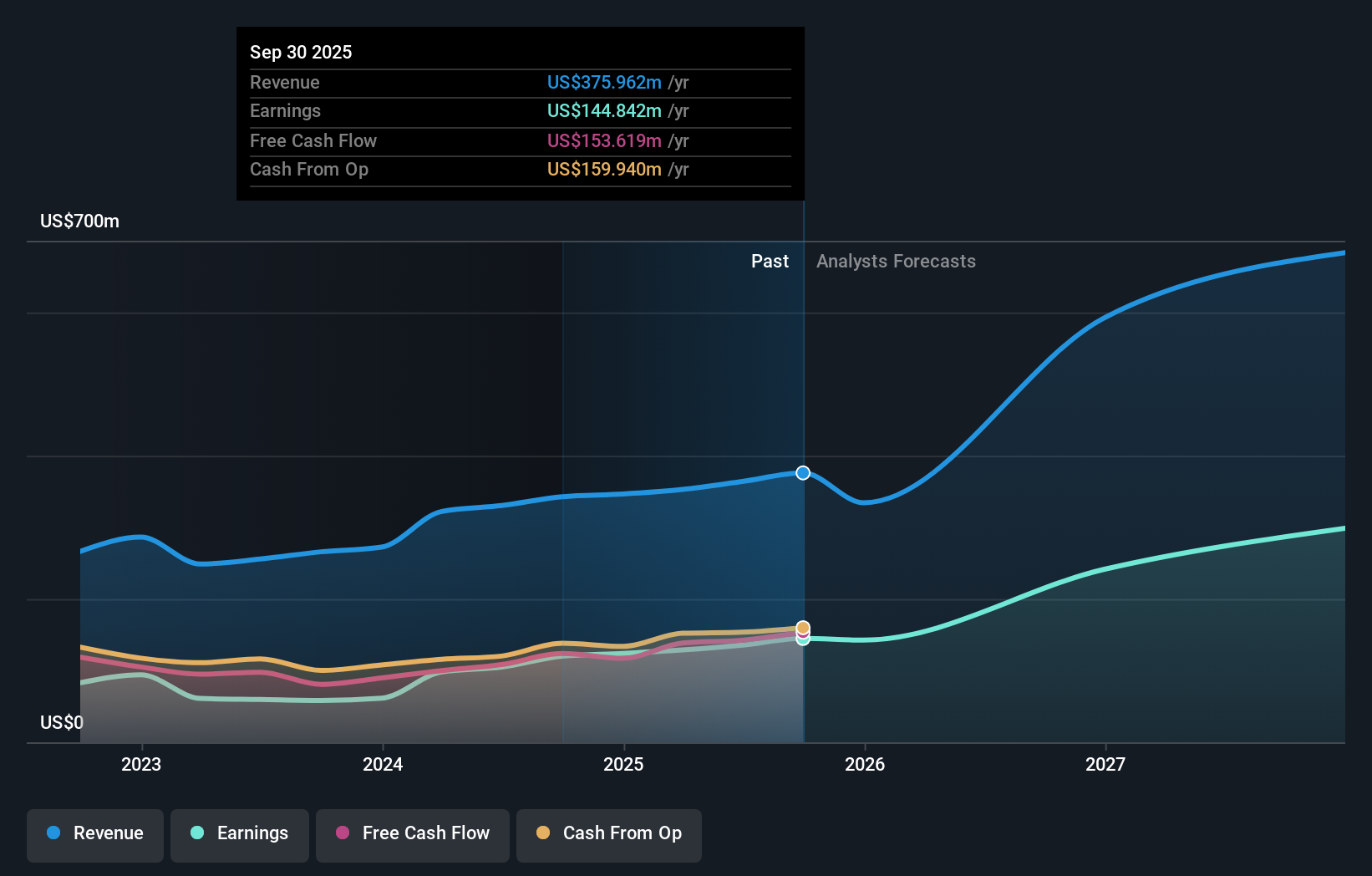

Operations: Nicolet Bankshares generates revenue primarily through its Consumer and Commercial Banking Services, totaling $375.96 million. The company's net profit margin reflects its profitability from these operations.

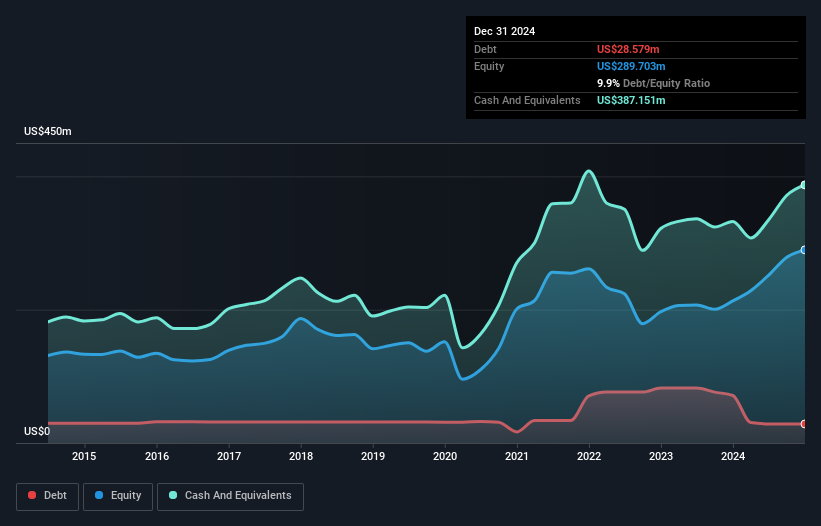

Nicolet Bankshares, with total assets of US$9 billion and equity of US$1.2 billion, showcases a robust financial standing. Its total deposits stand at US$7.6 billion against loans of US$6.8 billion, indicating a solid deposit base. The bank's earnings growth outpaced the industry with a 20.5% increase over the past year and is forecasted to grow annually by 34.71%. A sufficient allowance for bad loans at 0.4% supports its high-quality earnings profile while trading at 30.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in the banking sector.

- Click to explore a detailed breakdown of our findings in Nicolet Bankshares' health report.

Evaluate Nicolet Bankshares' historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 297 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報