Is It Too Late To Consider Deutsche Bank (XTRA:DBK) After A 104% One Year Rally?

- If you are wondering whether Deutsche Bank's share price still offers value after a strong run, this article will walk through what the current market price might be implying.

- The stock last closed at €33.81, with returns of 3.2% over 7 days, 8.7% over 30 days, 0.7% year to date and 104.1% over 1 year, which naturally raises questions about how much of the story is already reflected in the price.

- Recent coverage around Deutsche Bank has focused on its position in European financials and how investors are reassessing large banks as part of their portfolios. That context helps explain why the share price and sentiment have been under closer scrutiny.

- On our valuation check framework the company scores 4 out of 6. Next we will look at how traditional valuation approaches line up with that score, before finishing with a way of thinking about value that goes beyond the usual ratios.

Approach 1: Deutsche Bank Excess Returns Analysis

The Excess Returns model looks at how efficiently Deutsche Bank can earn returns on its equity compared with the return that shareholders are assumed to require. Instead of focusing on cash flows, it asks whether each euro of capital is expected to earn more or less than that equity cost over time.

For Deutsche Bank, the inputs point to a tight margin. Book value is €40.49 per share and the stable book value estimate is €39.37 per share, based on weighted future book value estimates from 7 analysts. Stable EPS is €3.85 per share, sourced from weighted future return on equity estimates from 11 analysts, while the cost of equity is put at €3.93 per share. That leads to an excess return of €0.08 per share in the model and an average return on equity of 9.78%.

Putting these elements together, the Excess Returns framework produces an intrinsic value estimate of €38.44 per share. Compared with the recent share price of €33.81, this indicates the stock is 12.0% undervalued on this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Deutsche Bank is undervalued by 12.0%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Deutsche Bank Price vs Earnings

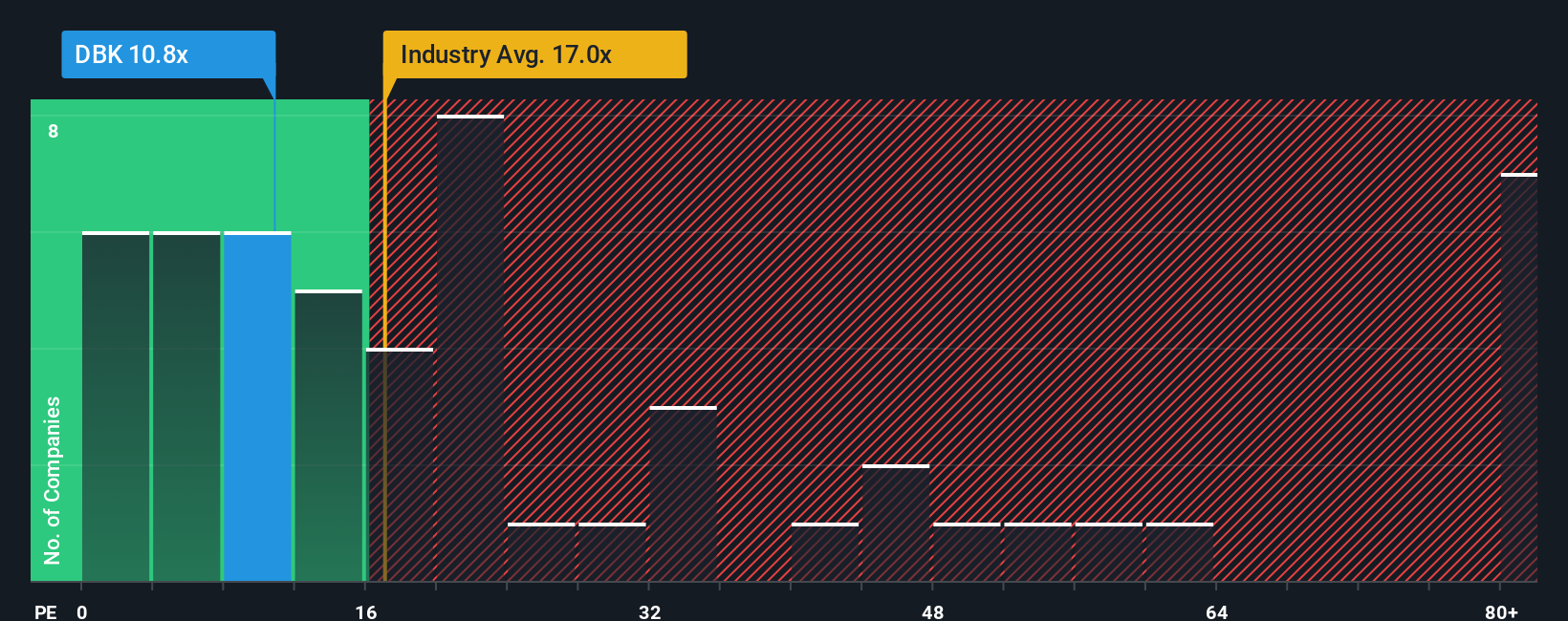

For a profitable company like Deutsche Bank, the P/E ratio is a useful shorthand for how much investors are paying for each euro of earnings. It ties the share price directly to current earnings, which is usually what drives shareholder returns over time.

What counts as a "normal" or "fair" P/E depends on how the market views growth prospects and risk. Higher expected growth and lower perceived risk often coincide with higher P/E ratios, while slower growth or higher risk tend to be associated with lower multiples.

Deutsche Bank currently trades on a P/E of 12.50x. That sits below the Capital Markets industry average of about 14.86x and well below the peer average of 20.58x. Simply Wall St's Fair Ratio for Deutsche Bank is 25.57x. This is its proprietary estimate of what the P/E could be given factors such as earnings growth, profit margins, industry, market value and identified risks. Because the Fair Ratio is tailored to the company, it can be more informative than a simple comparison with industry or peer averages, which treat very different businesses as if they were identical. Here, the Fair Ratio sits meaningfully above the current 12.50x, which suggests the shares may be undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. With Narratives, you set out your view of Deutsche Bank in plain language, connect that story to your own assumptions for future revenue, earnings and margins, and see how that flows through to a fair value that you can compare with the current share price on Simply Wall St's Community page, which is used by millions of investors.

A Narrative is simply your story of what you think is happening at Deutsche Bank, linked directly to numbers like expected earnings, profit margins and an eventual fair value. Instead of only looking at ratios, you are tying a clear thesis to a concrete forecast and a price that makes sense for you.

Because Narratives on Simply Wall St compare your Fair Value with today’s Price, they can help you decide whether the current level looks attractive, fully priced or less appealing based on your own assumptions and risk tolerance, without relying solely on headline targets.

These Narratives update automatically when fresh information such as earnings reports or news hits the platform. This means your fair value view can adjust as the story changes rather than staying fixed at a single point in time.

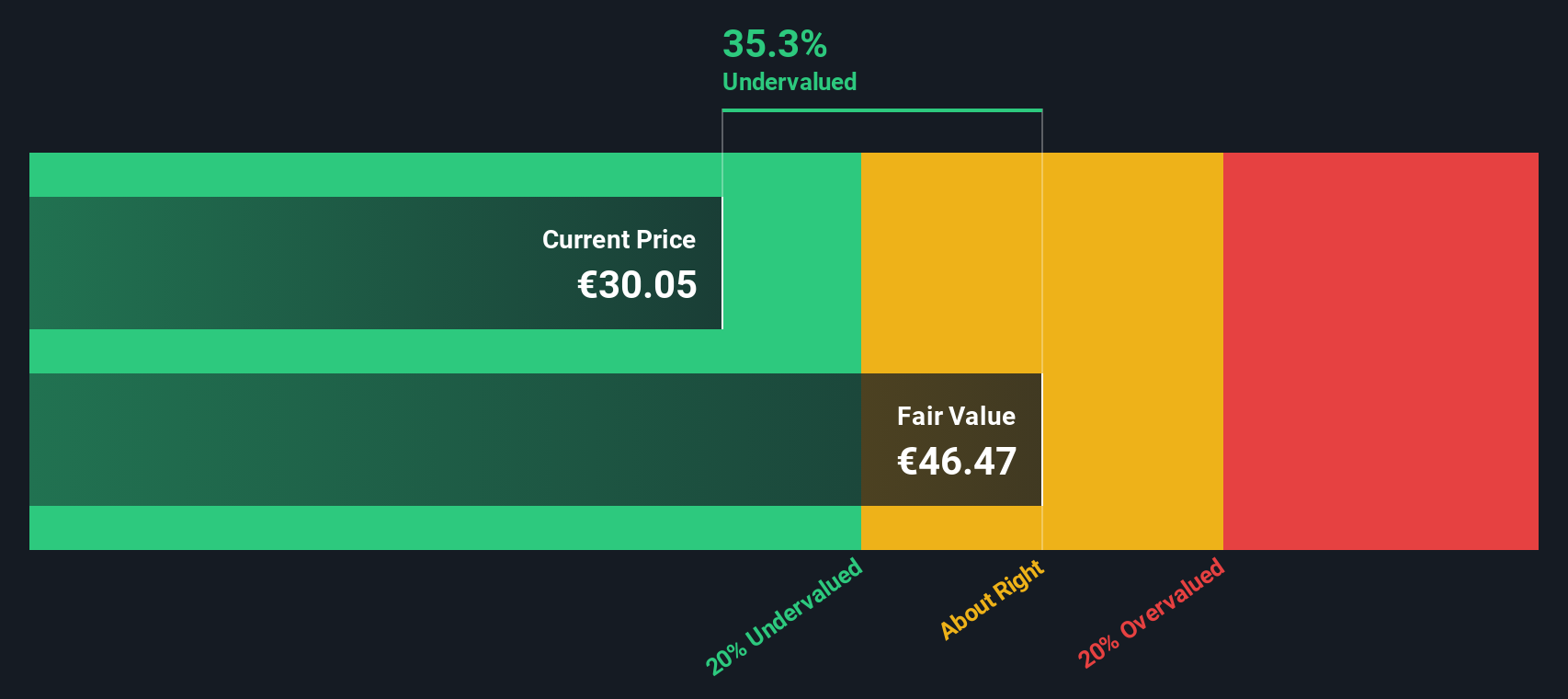

For example, one Deutsche Bank Narrative might focus on ongoing digital investments, capital strength, crypto partnerships and share buybacks with a fair value around €31.27. A more cautious Narrative might lean on the lowest analyst target of €10.93 and highlight risks around credit losses, litigation and regulation, showing how two investors can look at the same bank and reach very different conclusions.

Do you think there's more to the story for Deutsche Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報