Assessing Shopify (SHOP) Valuation As Momentum Cools After Strong Multi Year Shareholder Returns

Why Shopify Is On Investors’ Radar Now

Shopify (SHOP) has drawn fresh attention after recent trading, with the stock closing at US$166.21 and posting mixed short term returns, including a roughly 6% move over the past day and flat performance over the past 3 months.

See our latest analysis for Shopify.

Beyond the latest move, Shopify’s 1 year total shareholder return of 55.66% and very large 3 year total shareholder return of about 4.6x contrast with more muted recent share price performance. This hints that momentum has cooled even as investors reassess growth potential and risks around its US$166.21 share price.

If Shopify’s recent run has you rethinking your watchlist, this could be a moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Shopify now around US$166 and recent gains already strong, the key question is whether a 56% 1 year total return and solid growth metrics still leave upside on the table, or if the market is already pricing in future growth.

Most Popular Narrative: 5.3% Undervalued

Shopify’s most followed narrative pins fair value around US$175 per share, a touch above the recent US$166.21 close, suggesting modest upside from here.

The analysts have a consensus price target of $161.109 for Shopify based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $114.0.

Curious what justifies a valuation above today’s price? This narrative focuses on strong revenue compounding, rising long term margins, and a rich future earnings multiple. The key assumptions might surprise you.

Result: Fair Value of $175.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case can be challenged if competition squeezes Shopify’s pricing power, or if rising compliance and data privacy costs drag on margins and product rollout.

Find out about the key risks to this Shopify narrative.

Another Take On Shopify’s Valuation

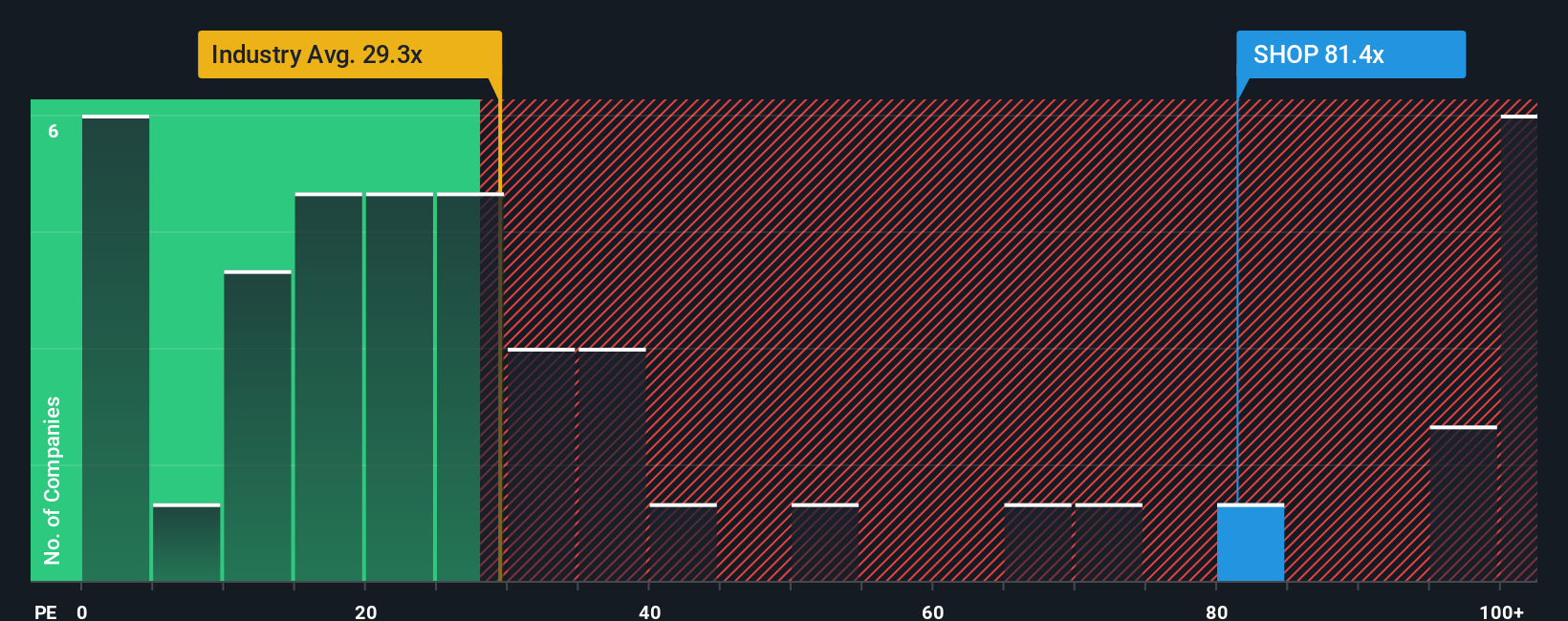

The popular narrative points to a fair value near US$175 per share, but the current P/E of 121.5x tells a tougher story. That is far above the US IT industry at 30.1x, the peer group at 37.7x, and even the fair ratio of 49.2x that the market could move toward. That gap suggests valuation risk rather than a cushion. The real question is whether you think Shopify can grow into this price or if expectations have simply run too far ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you see the numbers differently, or simply prefer to test your own assumptions against the data, you can build a full Shopify story in a few minutes with Do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Shopify has sharpened your focus, do not stop here. Broaden your research with a few targeted screens that surface very different types of opportunities.

- Spot early stage potential by checking out these 3553 penny stocks with strong financials that pair smaller market caps with balance sheets and fundamentals that pass initial quality filters.

- Zero in on growth themes by scanning these 25 AI penny stocks where artificial intelligence sits at the core of each company’s business model.

- Hunt for value by reviewing these 878 undervalued stocks based on cash flows that our models flag as trading below estimated cash flow based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報