American Well Corporation (NYSE:AMWL) Shares Fly 30% But Investors Aren't Buying For Growth

American Well Corporation (NYSE:AMWL) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

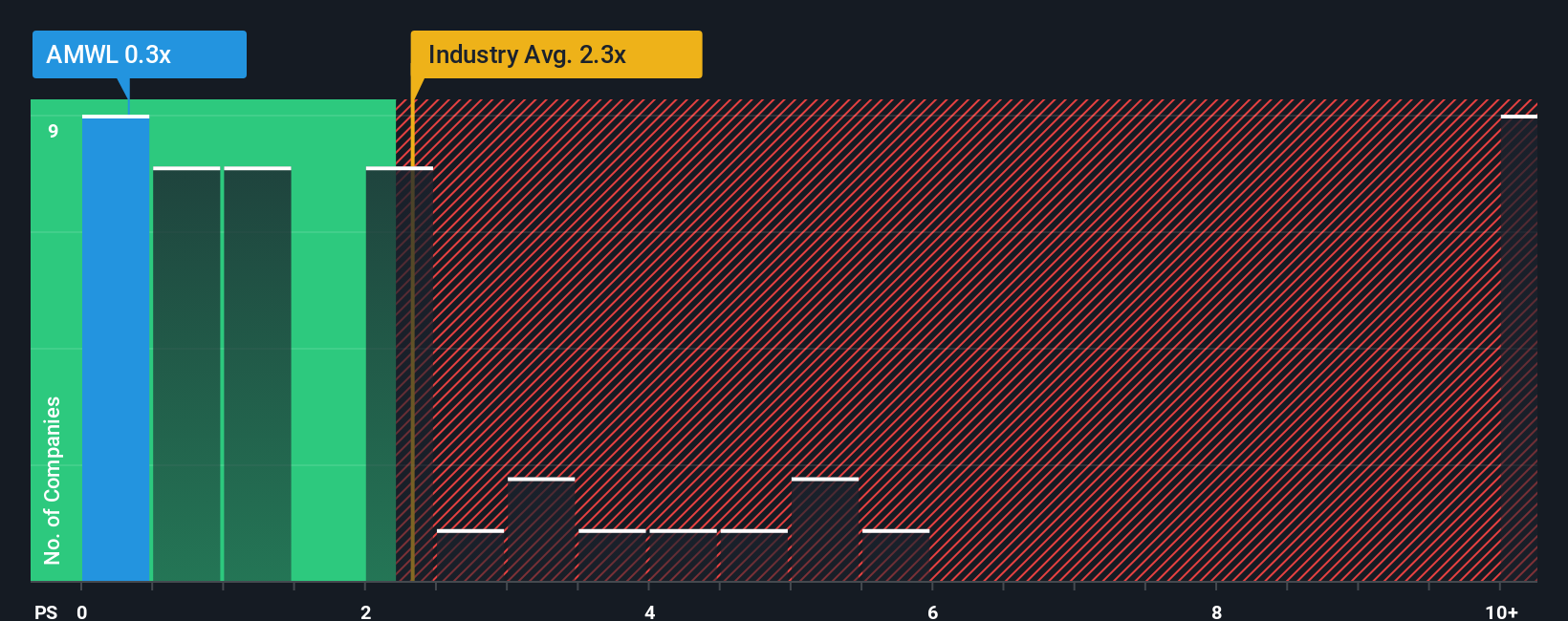

Although its price has surged higher, American Well may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 11x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for American Well

What Does American Well's Recent Performance Look Like?

American Well could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on American Well will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, American Well would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.3%. However, this wasn't enough as the latest three year period has seen an unpleasant 2.1% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 2.1% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 13% per year, which paints a poor picture.

With this information, we are not surprised that American Well is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does American Well's P/S Mean For Investors?

The latest share price surge wasn't enough to lift American Well's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that American Well's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, American Well's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for American Well you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報