IPO Prospects|New Thinking Motors breaks through the transformation dilemma and breakthrough direction under the declining share of optical image stabilization on the Hong Kong Stock Exchange

On January 2, micro precision motor manufacturer New Thinking Motor Co., Ltd. (hereinafter referred to as “New Thinking Motor”) officially submitted a listing application to the Hong Kong Stock Exchange. The co-sponsors were Huatai International and CICC.

Revenue expanded steadily, profit changed from loss to profit

According to the prospectus, New Thinking Motor was founded in 2014 and has now established a dual customer system covering module manufacturers and terminal brands. At the module factory level, the company is the main supplier of motors for mainstream domestic camera module manufacturers such as Ofiliguang, Qiutai Technology, and Shunyu Optics; at the terminal level, its products have entered the supply chain systems of well-known brands such as Huawei, Xiaomi, DJI, vivo, and OPPO.

It is particularly noteworthy that the company's products have been verified by high-end flagship models such as the Huawei P series and Xiaomi Ultra, indicating that its technical capabilities have been recognized by leading customers. This also shows that in the process of impacting the high-end market, domestic mobile phone brands are gradually promoting the localization and high-end of the supply chain, and new-thinking motors have become one of the beneficiaries of this trend.

According to Frost & Sullivan, in terms of revenue in 2024, New Thinking Motor ranked 6th in the world and 3rd in China in terms of revenue, accounting for 9.1% of China's video motor market. In terms of revenue in 2024, in the field of optical image stabilization (“optical image stabilization”) image motors, New Thinking Motors ranked fourth in the world and number one in China, accounting for 20.1% of China's market share.

For the nine months ended September 30 in 2023, 2024, and 2025 (hereinafter referred to as the reporting period), the company achieved revenue of approximately RMB 855 million (unit: RMB, same below), RMB 1,565 million, and RMB 1,457 billion; annual/period (loss) profits were $30.102 million, profit of RMB 105 million, and profit of RMB 9705.5 trillion respectively; during the same period, the company recorded gross profit of RMB 71 million, RMB 249 million, and RMB 234 million respectively.

In short, the company's revenue rose sharply from 855 million yuan to 1,565 billion yuan in the 2023-2024 fiscal year, an increase of about 82.9%, showing strong market expansion capabilities. At the same time, gross margin increased from 8.36% to 15.93%, driving the company to shift from a net loss of 30.1 million yuan in 2023 to a net profit of 105 million yuan in 2024, initially reversing losses.

However, it is worth noting that revenue for the first nine months of 2025 increased by 31.4% year-on-year, which is a marked slowdown from the full-year growth rate of 2024, reflecting a possible weakening of growth momentum after the expansion of the scale base. Furthermore, the company's net profit margin is still low, profits are somewhat dependent on “other income” such as government subsidies, etc., and it will take time to verify the sustainability and stability of the main business profits.

In order to maintain its technological advantage, the company's R&D investment continued to increase. The R&D expenditure in the first nine months of 2025 reached 86.57 million yuan, exceeding the total amount for the full year of 2024. At the same time, with the expansion of the business, various administrative and financial expenses are also on the rise.

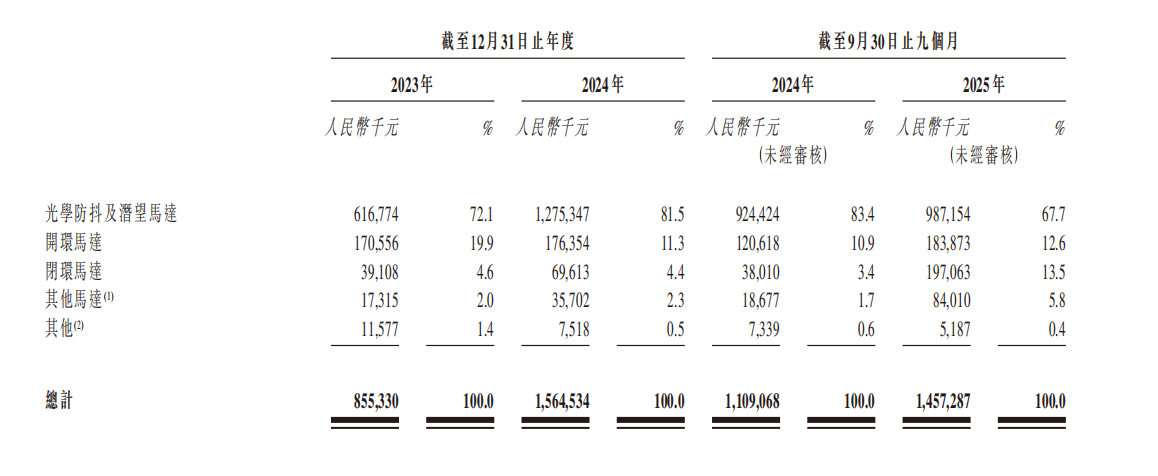

By product, the revenue of Newthink Motors mainly consists of three categories: optical stabilization and periscope motors, open loop motors, and closed loop motors. Among them, optical anti-shake and periscope motors have always been the company's main source of revenue, accounting for 72.1% of revenue in 2023, and further increasing to 81.5% in 2024. However, in the first three quarters of 2025, revenue from this type of product was 987 million yuan, which fell to 67.7%.

Furthermore, the company is currently building new production bases in Nanchang and Dongguan, and is expected to be put into operation in 2026. Although production capacity expansion is beneficial to the long-term layout, it will also lead to larger capital expenses and subsequent depreciation and amortization, which may further erode net profit in the short term.

Among them, profit turns are usually accompanied by the process of migrating the product line from the middle to the low end to the middle and high-end, which is very much in line with the current situation and trend of the high-end development of the domestic mobile phone market. But compared to looking back on the past, future growth is the focus. The explosive growth in demand in segments such as multiple intelligent terminals, robotics, electric vehicles, and automation is a clear development direction for the entire industry.

The capital abacus behind high-end breakthroughs and capacity expansion

In the context of smartphone image upgrades entering the platform phase, the micro precision motor industry is undergoing structural changes. Future growth will no longer rely solely on the demand for mobile phone optical modules, but will shift to multi-terminal, multi-scenario collaborative driving. Emerging fields such as physical robots, low-altitude aircraft, smart wearables, in-vehicle camera systems, and industrial automation are generating urgent demand for high-performance, miniaturized, and high-precision driving solutions. According to industry forecasts, the compound annual growth rate of the global non-mobile micromotor market is expected to exceed 20% by 2028, making it a strategic circuit that industrial chain enterprises must lay out.

New Thinking Motor clearly listed “expansion into emerging fields such as physical robots and low-altitude economy” as the development direction in its prospectus, showing the company's management's forward-looking judgment on industry trends. Its non-imaging products, such as stepper motors and brushless DC motors, have been initially used in fields such as sweeping robots, security monitoring, and automotive electronics, laying the product and technical foundation for subsequent penetration into more cutting-edge scenarios.

Although domestic micro motor companies have taken a place in the global market, and have achieved technological breakthroughs in segments such as optical image stabilization (OIS), the overall market share is still scattered, and the high-end market is still dominated by Japanese and some European and American companies. Although New Thinking Motors ranks first in the Chinese OIS market, it only ranks sixth in the global imaging motor market, with a share of less than 10%, reflecting that domestic companies still have room to improve in terms of brand premiums, patent layout, and system integration capabilities.

This competitive trend of “leading the segment and catching up as a whole” means that if an enterprise wants to achieve continuous growth, it must work simultaneously in two dimensions: one is to further consolidate technical barriers and customer stickiness in areas where it already has advantages; the other is to enter a wider middle and high-end incremental market through diversification of products and large-scale production capacity.

In order to support long-term growth, New Thinking Motors is actively promoting production capacity construction. The production base in Jiashan, Zhejiang is expected to be completed in March 2026. It is planned to lay out more than 30 fully automatic production lines, all of which are expected to reach an annual output value of more than 5 billion yuan after delivery. The implementation of this project not only represents a digital increase in production capacity, but also a systematic upgrade of the production model — improving product consistency, reducing production costs, and shortening the delivery cycle through automation and intelligent transformation, thereby enhancing the company's competitiveness in both price-sensitive and high-end customized markets.

In summary, with technological breakthroughs in segments such as optical image stabilization, Newthink Motors has been successfully embedded in the flagship supply chains of leading brands such as Huawei and Xiaomi, achieving a critical leap from “following” to “running side by side.” However, as the smartphone industry enters the competitive stage for stocks, the growth ceiling of a single track is also gradually showing. The company's current listing is not only to raise capital for capacity expansion and technology upgrades, but also to reserve ammunition for emerging racetracks such as robotics, low-altitude economy, and automotive electronics.

It is worth noting that Newthink Motor still faces multiple challenges such as high business concentration, large share of related transactions, and scattered global market share. After listing in Hong Kong, the company needs to maintain its advantages in the field of optical image stabilization while speeding up the large-scale implementation of non-mobile phone businesses and optimizing the customer structure and profit model in order to truly open up room for long-term growth.

Nasdaq

Nasdaq 華爾街日報

華爾街日報