Discover 3 European Penny Stocks With Market Caps Over €40M

As the European market continues to thrive, with the STOXX Europe 600 Index reaching new highs and major indices like Germany's DAX and France's CAC 40 posting gains, investors are increasingly looking towards diverse opportunities. Penny stocks, though an older term, still capture interest as they represent smaller or emerging companies that can offer significant value. By focusing on those with strong financial health and growth potential, investors may uncover promising opportunities in this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.438 | €1.54B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.79 | €85.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €226.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.30 | €70M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.14 | SEK191.03M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.59 | €405.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.794 | €26.59M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 285 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

FAE Technology (BIT:FAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FAE Technology S.p.A. specializes in the design, development, and manufacturing of embedded and custom electronic products in Italy, with a market cap of €55.07 million.

Operations: The company's revenue is primarily derived from its Ems segment at €43.77 million, followed by Odm at €11.99 million, Engineering at €1.06 million, and Service at €0.68 million.

Market Cap: €55.07M

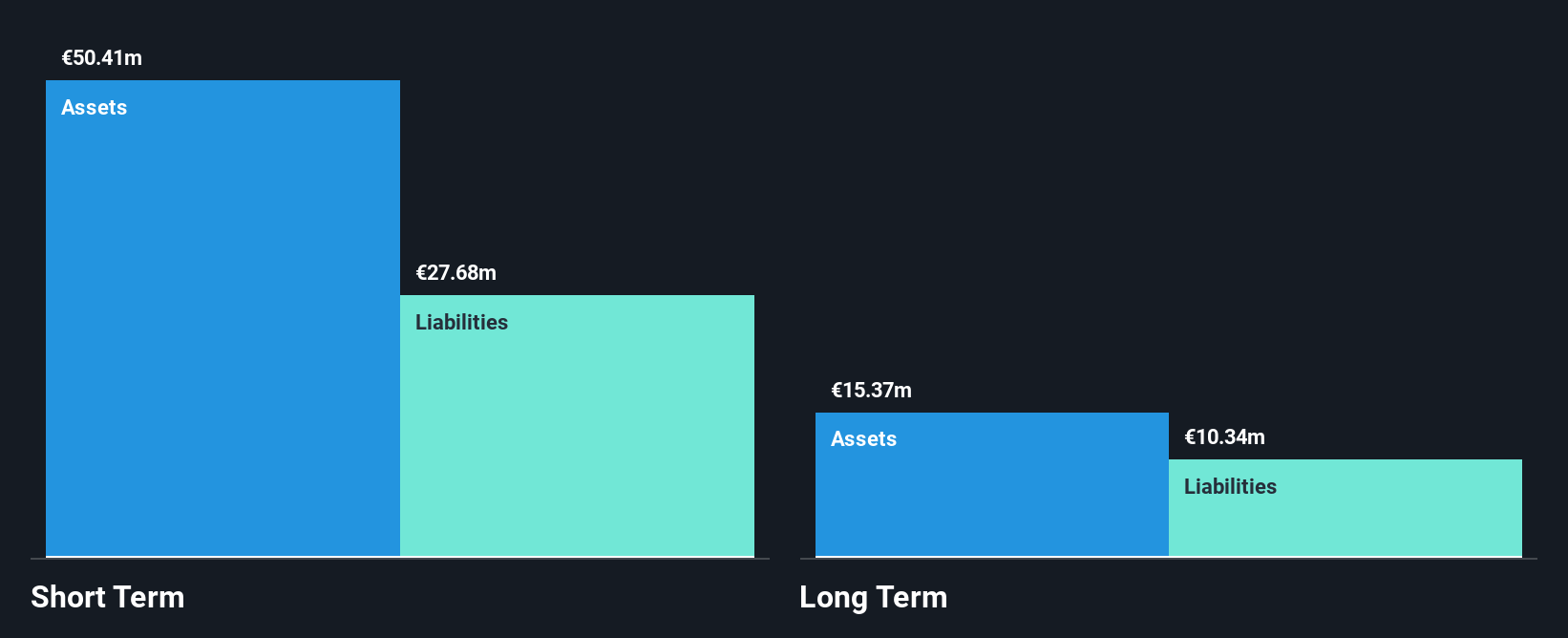

FAE Technology S.p.A. has a market cap of €55.07 million and generates significant revenue from its Ems segment (€43.77 million). Despite negative earnings growth over the past year, FAE's short-term assets exceed both its short and long-term liabilities, indicating financial stability. The company announced a share buyback program worth up to €2 million, potentially supporting stock value. Although profit margins have declined to 1.2% from 5.9%, interest payments are well covered by EBIT (7.5x), and debt is adequately managed with a net debt to equity ratio of 15.5%. Earnings are forecasted to grow significantly at 59.41% annually.

- Take a closer look at FAE Technology's potential here in our financial health report.

- Gain insights into FAE Technology's future direction by reviewing our growth report.

Eurosnack (WSE:ECK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eurosnack S.A. is a company that produces and distributes salty snacks and biscuits both in Poland and internationally, with a market cap of PLN110.58 million.

Operations: The company generates PLN162.87 million in revenue from its food processing segment.

Market Cap: PLN110.58M

Eurosnack S.A., with a market cap of PLN110.58 million, has shown stable financial metrics despite recent challenges. The company's revenue for the third quarter increased to PLN44.86 million from PLN39.25 million in the previous year, though net income slightly decreased to PLN3.07 million from PLN3.49 million. Eurosnack's debt management is robust, with interest payments well covered by EBIT (8.1x) and a satisfactory net debt to equity ratio of 22.4%. Although short-term liabilities exceed assets, long-term liabilities are well managed, and the company maintains high-quality earnings with a strong return on equity at 33%.

- Click to explore a detailed breakdown of our findings in Eurosnack's financial health report.

- Understand Eurosnack's track record by examining our performance history report.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating under the name SPARK VC S.A., is a publicly owned investment manager with a market capitalization of PLN136.44 million.

Operations: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna has not reported any revenue segments.

Market Cap: PLN136.44M

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., is a pre-revenue company with a market cap of PLN136.44 million. Despite being unprofitable, it has reduced losses by 37.2% annually over five years and maintains a positive free cash flow, ensuring a cash runway exceeding three years. The lack of debt positions it favorably for financial stability; however, its short-term assets are insufficient to cover liabilities (PLN1.6M). The company's share price has been highly volatile recently but shows stable weekly volatility compared to the broader Polish market trends.

- Unlock comprehensive insights into our analysis of Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna stock in this financial health report.

- Gain insights into Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's historical outcomes by reviewing our past performance report.

Key Takeaways

- Investigate our full lineup of 285 European Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報