3 Undiscovered European Gems With Strong Potential

As European markets continue to thrive, with the STOXX Europe 600 Index reaching new highs and closing 2025 with its strongest yearly performance since 2021, investors are increasingly turning their attention to small-cap stocks that may be poised for growth amid this favorable economic backdrop. In such an environment, identifying stocks with strong fundamentals and unique market positions can offer intriguing opportunities for those seeking to explore under-the-radar gems in the European landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GRK Infra Oyj (HLSE:GRK)

Simply Wall St Value Rating: ★★★★★★

Overview: GRK Infra Oyj is a company that offers infrastructure construction services across Finland, Sweden, and Estonia with a market capitalization of €622.73 million.

Operations: GRK Infra Oyj generates revenue primarily from its heavy construction segment, which reported €877.32 million. The company's financial performance can be assessed by examining the gross profit margin, which is a key indicator of its profitability in the infrastructure construction sector.

GRK Infra Oyj, a Finnish construction company, is making waves with its strategic projects and financial performance. Recently securing contracts worth EUR 14.5 million for the Norrbotniabanan railway and EUR 14 million for the Port of Umea, GRK bolstered its order book significantly. The company's earnings grew by an impressive 58% last year, outpacing the construction industry's average growth of 9.8%. With a price-to-earnings ratio of 12x against Finland's market average of 19.3x, GRK presents an attractive valuation proposition. Additionally, its debt-to-equity ratio improved from 29% to just over 14% over five years.

- Navigate through the intricacies of GRK Infra Oyj with our comprehensive health report here.

Gain insights into GRK Infra Oyj's historical performance by reviewing our past performance report.

Autoneum Holding (SWX:AUTN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Autoneum Holding AG specializes in creating acoustic and thermal management solutions for light and commercial vehicles, with a market capitalization of approximately CHF996.27 million.

Operations: Autoneum's revenue primarily comes from its regional segments, with BG Europe contributing CHF1.10 billion and BG North America adding CHF850.60 million. The company also generates revenue from BG Asia at CHF245 million and BG SAMEA at CHF118.90 million, while corporate activities and eliminations account for a reduction of CHF14.60 million in total revenue.

Autoneum, a notable player in the auto components sector, showcases impressive earnings growth of 70.8% over the past year, outpacing industry averages. Despite its high net debt to equity ratio of 77.7%, which is considered elevated, the company has made strides by reducing this from 246.1% over five years. Its interest payments are well covered with an EBIT coverage of 9.7 times, indicating solid financial health despite some leverage concerns. Trading at about 16.7% below estimated fair value and with earnings projected to grow annually by 11.14%, Autoneum seems poised for potential gains amidst its challenges in managing debt levels efficiently.

- Take a closer look at Autoneum Holding's potential here in our health report.

Understand Autoneum Holding's track record by examining our Past report.

AB (WSE:ABE)

Simply Wall St Value Rating: ★★★★★★

Overview: AB S.A., along with its subsidiaries, is engaged in the distribution of IT products across Poland, the Czech Republic, and Slovakia, with a market capitalization of PLN1.78 billion.

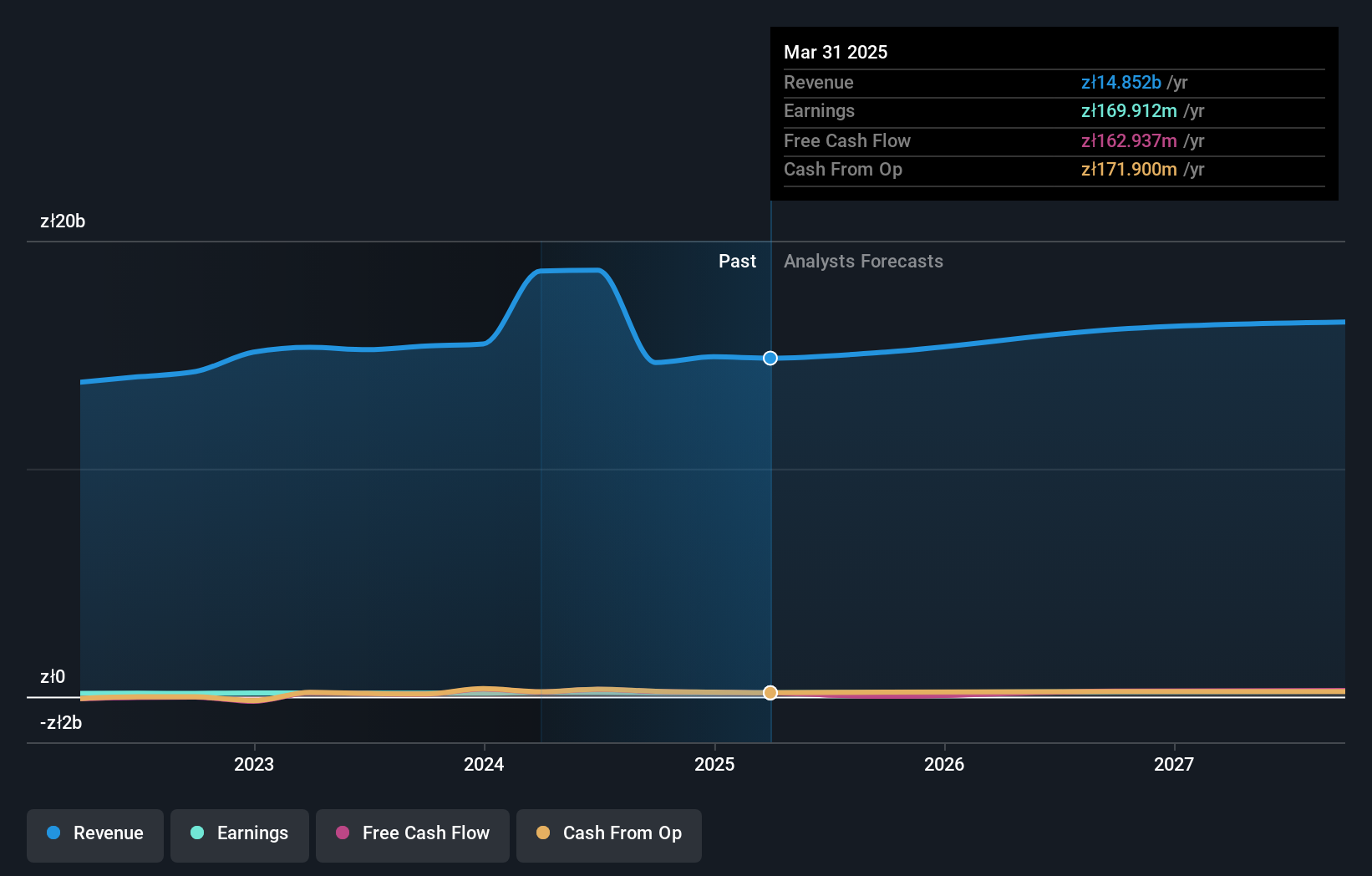

Operations: AB S.A. generates revenue primarily through wholesale trade, contributing PLN14.89 billion, while production adds PLN45.53 million to its income stream. The retail trade segment shows a negative contribution of PLN27.97 million.

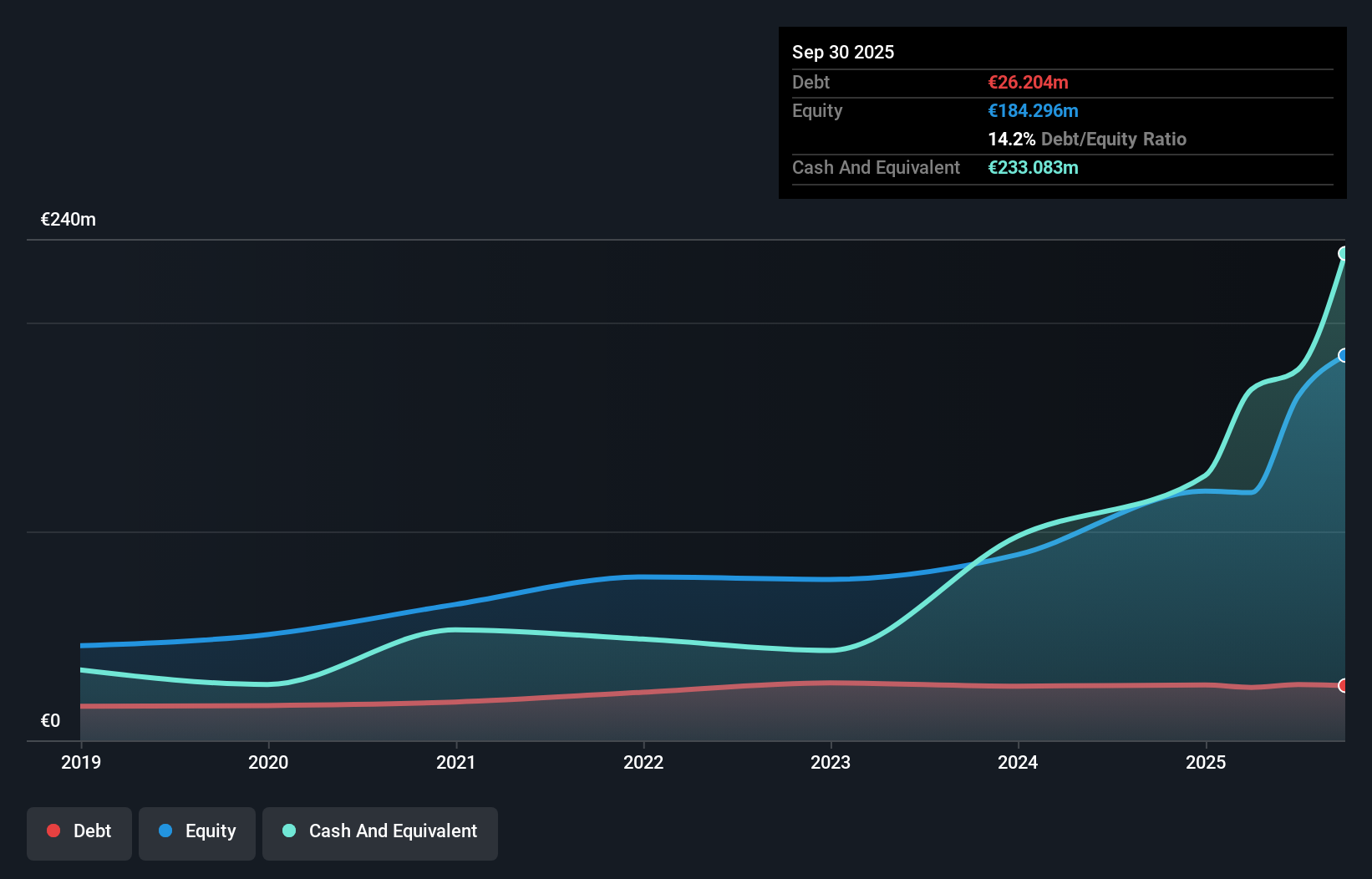

ABE, a nimble player in the electronics sector, shows a promising financial profile despite some hurdles. Its debt to equity ratio has impressively decreased from 28.7% to 12.8% over five years, suggesting prudent financial management. With interest payments well-covered by EBIT at six times and high-quality earnings reported, ABE demonstrates resilience in its operations. Although recent earnings growth was negative at -14.1%, contrasting with the industry average of -0.4%, it trades significantly below estimated fair value by 62.5%. The forecasted annual earnings growth of 6% adds a layer of optimism for future performance prospects within this space.

- Click here and access our complete health analysis report to understand the dynamics of AB.

Review our historical performance report to gain insights into AB's's past performance.

Summing It All Up

- Reveal the 299 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報