Micron Technology (MU.US) recreates the “1993 Fever Moment”! The memory chip market has entered a period of sharp rise in volume and price, and revenue is expected to double in 2026

The Zhitong Finance App learned that with excellent financial results for the first quarter of fiscal year 2026, and the latest results of the continued rise in DRAM prices, analyst Uttam Dey now believes that Micron's stock price can continue to rise, and he has given Micron Technology (MU.US) a “buy” rating.

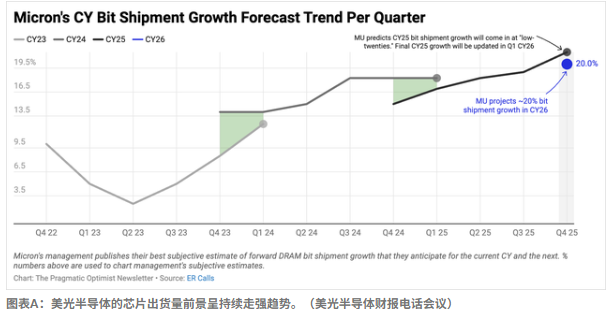

The latest data released last week shows that the sharp rise in DRAM prices, combined with Micron's 20% bit-shipment growth forecast, is creating one of the strongest demand/supply dynamics for the company's storage business since 1993.

Analyst Dey downgraded Micron's stock rating last month. At the time, it was still one week until the company released its financial report for the first quarter of fiscal year 2026 because it anticipated that DRAM prices would stop its astronomical rise. Micron's first-quarter results were so good that they far exceeded expectations, which prompted the analyst to re-evaluate the company's future prospects.

Micron revives the 1993 frenzy

First, Micron gave a very optimistic outlook on bit shipments: management raised the forecast for the full year of bit shipments for the 2025 calendar year from the previous “15% to 19% (high teens) range” to around 20% to 23% (low 20% range). Management also revealed that bit-yuan shipments are expected to grow “about 20%” in the 2026 calendar year.

Micron's management gave subjective guidance on its bitwise shipment outlook. Investors can see that the 20% bitwise shipment outlook is one of the strongest levels in recent years.

The “structural shortfall” that TrendForce refers to is very similar to the strong business environment that storage manufacturers were in in 1993. At the time, prices soared due to severe restrictions on the supply of memory chips, and bit shipments continued to grow, supported by demand brought about by the early development of Internet investment. This made Micron's stock one of the most outstanding performers in 1993.

The combination of Micron's bit-element shipment forecast for this year and the continued rise in DRAM prices made Dey believe that Micron is already experiencing its “1993 moment” and will continue this trend for the rest of the year. The analyst had anticipated a transient stagnation in DRAM prices, but recent reports from IDC, TrendForce, and S&P Intelligence agree that DRAM prices will continue to soar for at least the first quarter.

Shipping guidelines have become a weather vane

Micron's current business environment is characterized by a “lack of price elasticity”, which has brought strong operating results to Micron, benefiting from soaring prices and strong bitwise shipments. The demand for high-bandwidth memory (HBM) has steadfastly maintained Micron's steady future.

According to analysts' median expectations, the company's revenue growth for this year (FY2026) is expected to be around 54%. After noticing a sharp rise in DRAM prices and a 20% bit-shipment outlook, analysts raised their revenue expectations for fiscal year 2026, and now expect revenue growth to reach 98%.

Instead of focusing on traditional valuation metrics now, analysts strongly recommend investors focus on demand and price signals, namely Micron's bitwise shipment outlook and DRAM price trends. Any change in these two market conditions, especially Micron's bitwise shipment outlook, will have a particular impact on the trajectory of Micron's stock price. From a valuation perspective, Micron's transaction price is 4 times the net forward price-earnings ratio, or 5 times the FY2026 price-earnings ratio (based on expectations of doubling this year's revenue), which is very reasonable.

Any drastic reduction in the DRAM outlook or Micron's shipment outlook will threaten Micron's prospects.

Conclusions

As DRAM prices continue to expand significantly, combined with Micron's strong 20% bit shipment growth outlook this year, Micron's DRAM and HBM are facing a strong and inflexible demand environment. These conditions are similar to the structural shortage in 1993, which nearly doubled Micron's stock price. Analyst Dey believes Micron's stock price may replicate the growth trend during the internet bubble.

Nasdaq

Nasdaq 華爾街日報

華爾街日報