3 Top Undervalued Small Caps In Global With Insider Buying

As global markets navigate a mixed start to the year, with U.S. stocks experiencing slight declines and European indices reaching new highs, small-cap stocks continue to draw attention amid these dynamic conditions. In this environment, identifying promising opportunities in small-cap companies often involves looking for those with strong fundamentals and potential insider confidence, which can be indicative of alignment between management interests and shareholder value.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paragon Care | 17.3x | 0.1x | 22.42% | ★★★★★☆ |

| Chinasoft International | 21.3x | 0.7x | -1186.09% | ★★★★☆☆ |

| BWP Trust | 10.6x | 13.8x | 14.44% | ★★★★☆☆ |

| Dicker Data | 21.0x | 0.7x | -38.97% | ★★★☆☆☆ |

| Vita Life Sciences | 15.3x | 1.7x | 35.85% | ★★★☆☆☆ |

| Amaero | NA | 72.5x | 23.20% | ★★★☆☆☆ |

| PSC | 10.1x | 0.4x | 17.62% | ★★★☆☆☆ |

| SmartCraft | 41.7x | 7.5x | 33.64% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.6x | 3.12% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -130.81% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

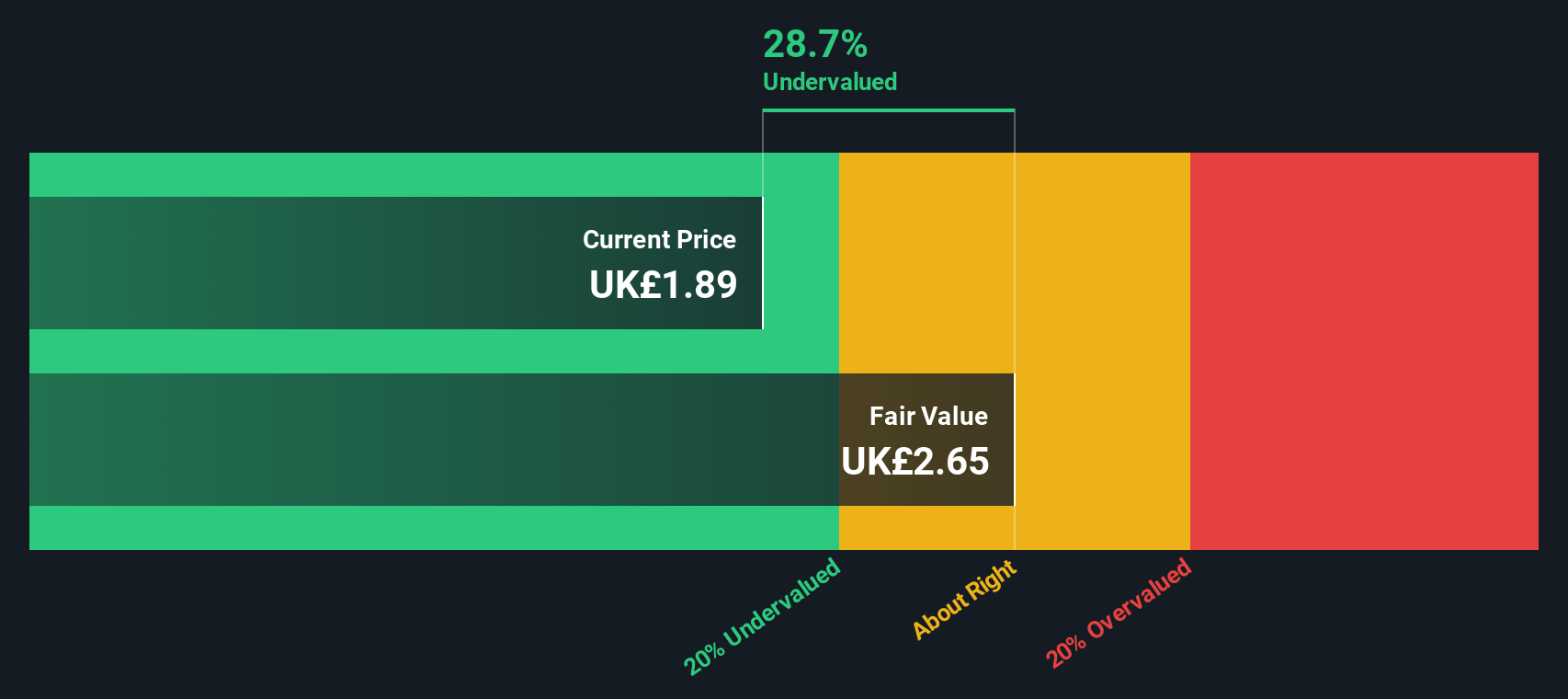

NIOX Group (AIM:NIOX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NIOX Group focuses on providing innovative respiratory diagnostic solutions, primarily through its NIOX® products, with a market capitalization of £0.31 billion.

Operations: The company generates revenue primarily from its NIOX® segment, with a reported £46 million. The gross profit margin has shown an upward trend, reaching 72.25% by the end of 2024. Operating expenses are largely driven by sales and marketing, research and development, and general administrative costs. Net income has fluctuated over time but showed positive margins in recent periods, indicating improved financial performance.

PE: 55.9x

NIOX Group, a small cap stock, shows insider confidence with recent share purchases in late 2025. Despite a drop in profit margins from 28.2% to 10.7%, the company is poised for earnings growth at an impressive rate of 34.15% annually. However, reliance on external borrowing highlights funding risks without customer deposits to cushion liabilities. This dynamic positions NIOX as an intriguing option within its industry context for those considering potential future value growth opportunities.

- Click to explore a detailed breakdown of our findings in NIOX Group's valuation report.

Assess NIOX Group's past performance with our detailed historical performance reports.

Nufarm (ASX:NUF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nufarm is a global agricultural chemical company that specializes in crop protection and seed technologies, with a focus on markets in APAC, Europe, and North America.

Operations: Nufarm generates revenue primarily from its Crop Protection segments in APAC, Europe, and North America, along with its Seed Technologies Global segment. The company's gross profit margin has shown variability over the years, reaching 29.49% in September 2023. Operating expenses are a significant cost component, with sales and marketing being the largest expense category within it.

PE: -4.8x

Nufarm, a company in the agricultural chemicals sector, has seen recent insider confidence with key purchases indicating potential value. Despite a net loss of A$165 million for the year ending September 2025, sales increased to A$3.44 billion from A$3.35 billion previously. Incoming CEO Rico Christensen, effective January 2026, brings extensive global experience and strategic acumen to drive future growth. The company's earnings are projected to grow significantly at over 90% annually amidst changes in executive leadership and bylaws amendments aimed at enhancing capital flexibility.

- Navigate through the intricacies of Nufarm with our comprehensive valuation report here.

Gain insights into Nufarm's past trends and performance with our Past report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Baltic Classifieds Group operates as a leading online classifieds business in the Baltic region, focusing on segments such as auto, real estate, and jobs & services, with a market capitalization of approximately €1.08 billion.

Operations: The company generates revenue primarily from four segments: Auto, Generalist, Real Estate, and Jobs & Services. Over recent periods, the net income margin has shown a positive trend, reaching 57.68% in October 2025. Operating expenses have decreased significantly from €18.86 million in October 2023 to €10.90 million by January 2026, contributing to improved profitability.

PE: 22.8x

Baltic Classifieds Group, a smaller company in the market, shows potential for growth with earnings forecasted to rise 12.39% annually. Despite relying entirely on external borrowing for funding, insider confidence is evident as the Independent Chairman purchased 250,000 shares worth €465K in December 2025. Recent reports indicate sales increased to €44.84 million from €41.83 million year-over-year, while net income rose to €26.44 million from €21.69 million, suggesting promising prospects despite challenges in Estonia's auto market and higher-risk funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Baltic Classifieds Group.

Learn about Baltic Classifieds Group's historical performance.

Seize The Opportunity

- Reveal the 142 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報