Global Undiscovered Gems Featuring Three Promising Small Caps

As global markets navigate a landscape of mixed economic signals, with U.S. small-cap indices like the Russell 2000 experiencing modest declines amid broader market volatility, investors are increasingly eyeing opportunities in under-the-radar stocks that may offer unique growth potential. In this context, identifying promising small-cap companies requires an understanding of how these firms can leverage current economic conditions—such as wage growth and sector-specific trends—to drive their performance and stand out in a competitive market environment.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Konishi | 0.13% | 1.57% | 10.10% | ★★★★★★ |

| Allmed Medical ProductsLtd | 13.03% | -2.37% | -30.93% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| SEC Electric Machinery | NA | -5.40% | -44.23% | ★★★★★★ |

| Kyungbangco.Ltd | 26.40% | 3.35% | -9.29% | ★★★★☆☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

| Chinyang Holdings | 31.98% | 7.57% | -15.85% | ★★★★☆☆ |

| Pizu Group Holdings | 45.21% | -1.54% | -3.14% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Emperor of Cleaning Hi-Tech (SHSE:603200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Emperor of Cleaning Hi-Tech Co., Ltd specializes in water treatment and air duct cleaning services across China, with a market cap of CN¥13.07 billion.

Operations: Shanghai Emperor of Cleaning Hi-Tech generates revenue primarily from its water treatment and air duct cleaning services in China. The company has a market cap of CN¥13.07 billion.

Shanghai Emperor of Cleaning Hi-Tech has shown impressive growth, with earnings surging by 127.2% over the past year, outpacing the Commercial Services industry. Their net income for the first nine months of 2025 reached CNY 119.46 million, a significant increase from CNY 48.4 million in the previous year, reflecting high-quality earnings. Although sales decreased slightly to CNY 353.94 million from CNY 374.6 million last year, their basic earnings per share more than doubled to CNY 0.6808 from CNY 0.2768 a year ago, suggesting strong profitability despite increased debt levels over five years.

HitGen (SHSE:688222)

Simply Wall St Value Rating: ★★★★★☆

Overview: HitGen Inc. operates as a drug discovery research platform focusing on small molecules and nucleic acid drugs in China and internationally, with a market cap of CN¥10.44 billion.

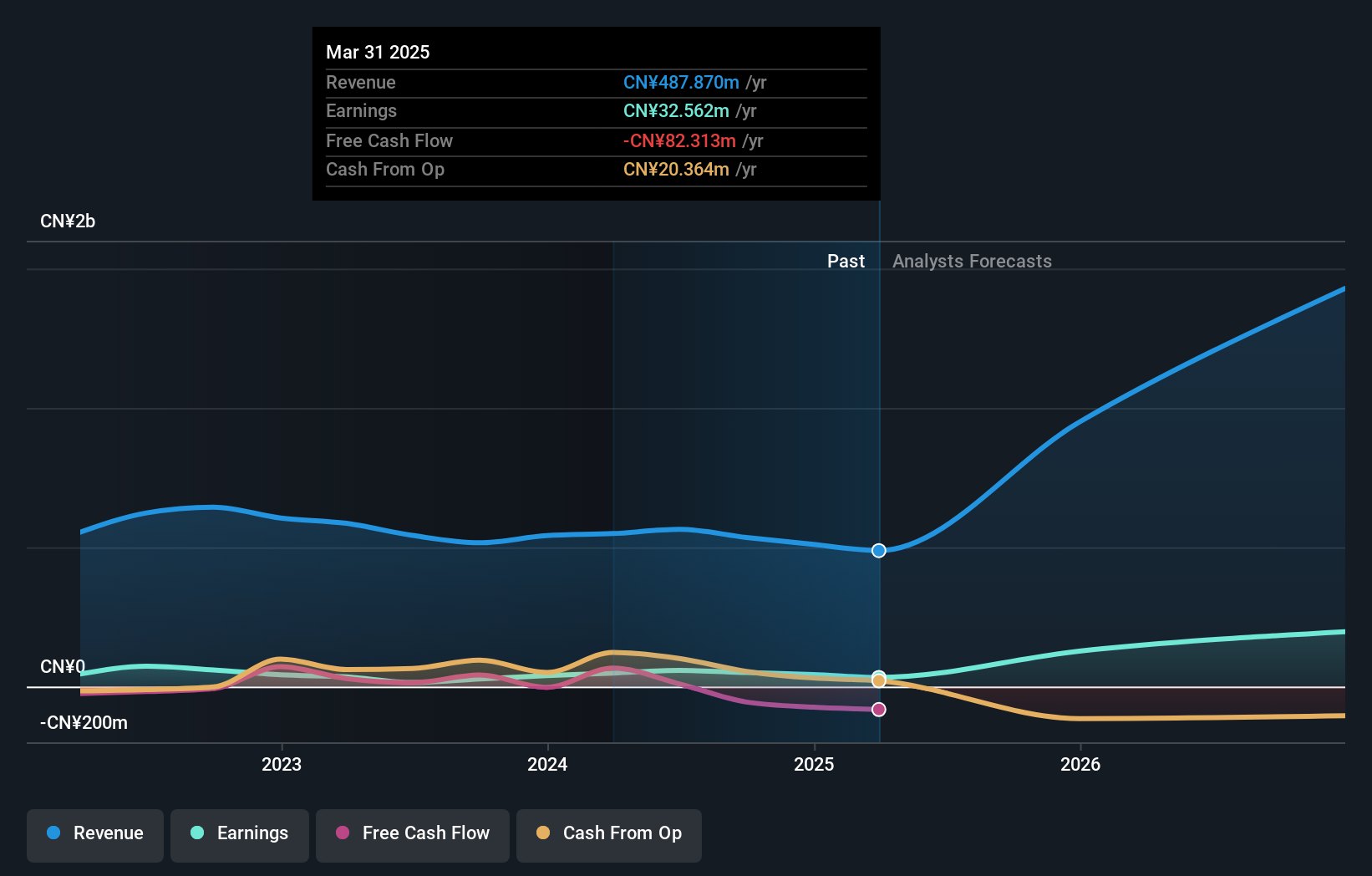

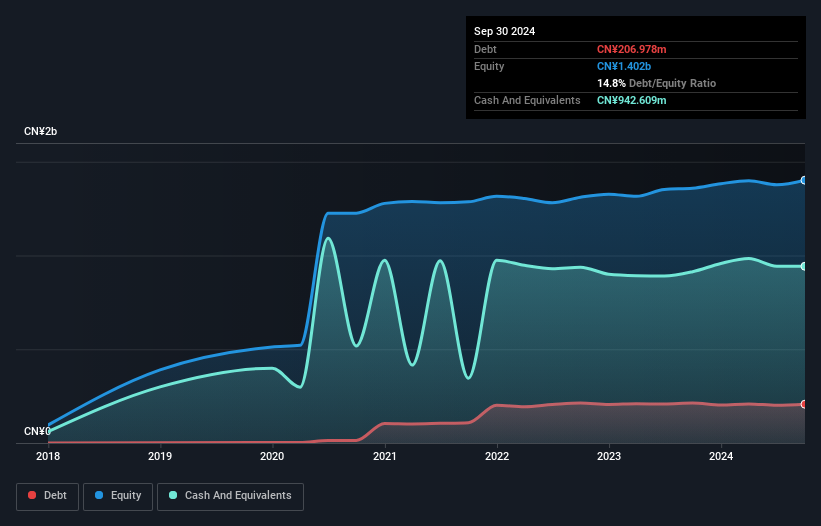

Operations: HitGen generates revenue primarily from its drug discovery research platform, focusing on small molecules and nucleic acid drugs. The company's financial performance is influenced by its cost structure, which impacts its profitability. Notably, the net profit margin has shown interesting trends over recent periods.

HitGen, operating in the life sciences sector, has shown significant financial improvement with earnings growth of 117.1% over the past year, outpacing the industry average of 14.6%. The company reported sales of CNY 369.79 million for nine months ending September 2025, up from CNY 298.27 million a year prior, while net income rose to CNY 92.87 million from CNY 30.12 million previously. With basic and diluted earnings per share both at CNY 0.23 compared to last year's CNY 0.08, HitGen's strong performance is underscored by its high-quality earnings and a manageable debt-to-equity ratio increase to 17.3% over five years.

- Click here and access our complete health analysis report to understand the dynamics of HitGen.

Examine HitGen's past performance report to understand how it has performed in the past.

Shiny Chemical Industrial (TWSE:1773)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiny Chemical Industrial Co., Ltd. is involved in the manufacturing, processing, and trading of chemical solvents both in Taiwan and internationally, with a market capitalization of NT$45.75 billion.

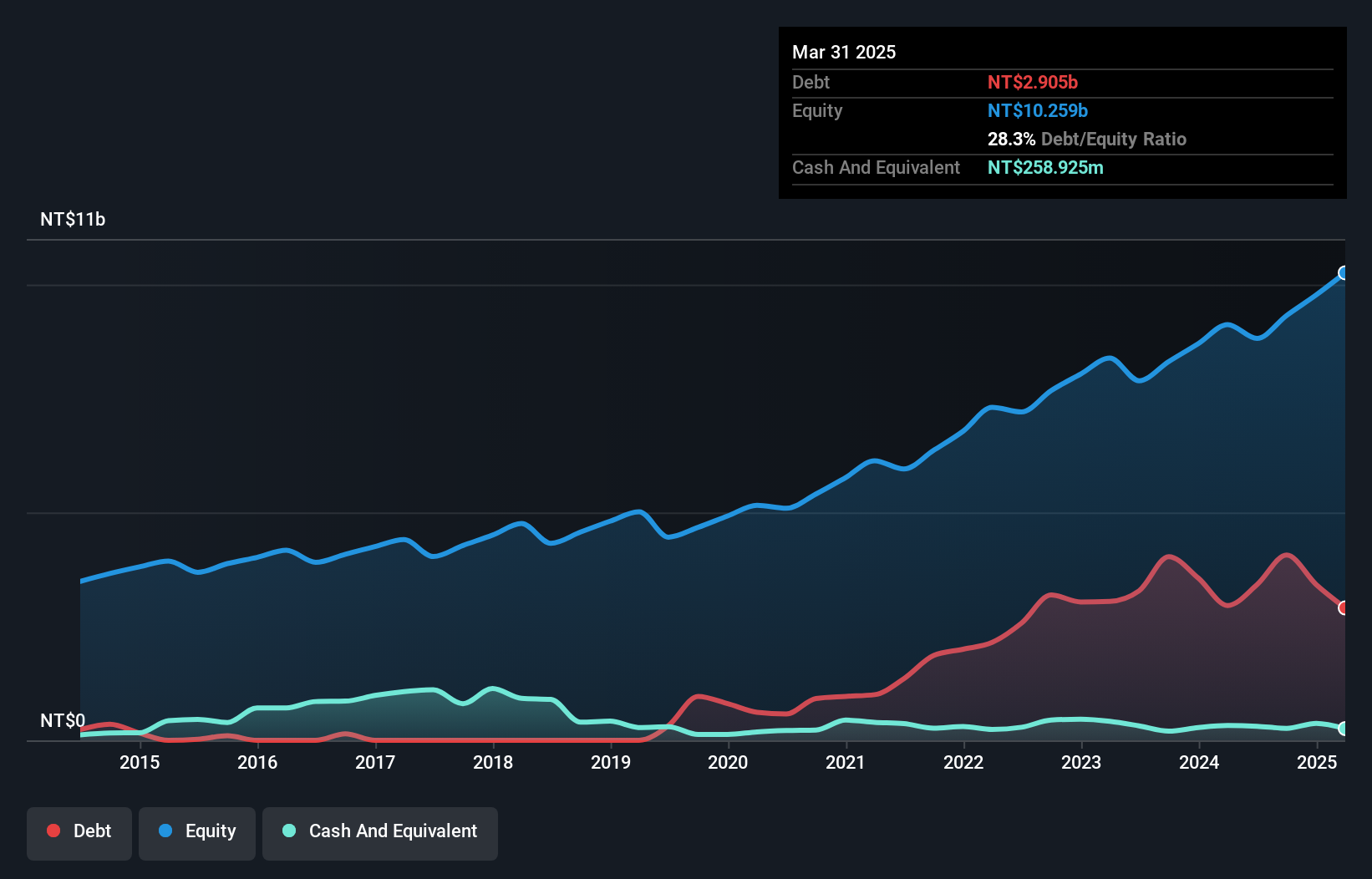

Operations: Shiny Chemical Industrial generates revenue primarily from its Yongan Factory, contributing NT$10.58 billion, and the Zhangbin Plant, adding NT$1.77 billion. Adjustments and eliminations account for a deduction of NT$0.93 billion from the total revenue.

Shiny Chemical Industrial, a smaller player in the chemicals sector, has shown promising growth with earnings rising 12.2% last year, outpacing the industry's -1.6%. The company's net debt to equity ratio stands at 26.5%, deemed satisfactory and manageable within industry norms. Recent financials reveal a revenue increase to TWD 2,918 million for Q3 2025 from TWD 2,876 million the previous year, while net income climbed to TWD 550 million from TWD 478 million. With basic earnings per share up to TWD 1.83 from TWD 1.59 over the same period, Shiny Chemical seems poised for continued robust performance amidst its competitive landscape.

Seize The Opportunity

- Explore the 2997 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報