How Ciena’s AI Webscale Surge And S&P 500 Prospects At Ciena (CIEN) Has Changed Its Investment Story

- In recent months, Ciena has reported fiscal fourth-quarter results that exceeded forecasts and highlighted a very large year-over-year increase in AI-focused webscale customers, which now account for a sizeable share of its sales mix. UBS and other market observers have emphasized Ciena’s evolution into a core optical networking supplier for hyperscale cloud and AI infrastructure, underpinned by technologies such as WaveLogic 6 and its expanding hyperscaler relationships.

- At the same time, Ciena is widely viewed as a candidate for S&P 500 index inclusion in early 2026, a shift that could materially influence its investor base, liquidity profile, and how its role in the AI infrastructure ecosystem is perceived.

- We’ll now examine how Ciena’s growing role as an AI infrastructure provider reshapes its investment narrative and long-term business profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ciena Investment Narrative Recap

To own Ciena today, you need to believe its shift from traditional telecom into an essential supplier for AI and cloud networks can support durable demand, even as technology and customer needs keep changing. The latest results, with webscale customers now 42% of sales, appear to reinforce the AI infrastructure catalyst, but also magnify the key near term risk that a small group of hyperscalers could quickly alter spending or sourcing decisions.

Against this backdrop, Ciena’s strong fiscal Q4 2025 revenue of US$1,351.98 million and continued share repurchases under its October 2024 buyback plan are especially relevant, because they highlight both the scale of current AI driven orders and management’s willingness to return capital while earnings are still modest relative to revenue. How sustainable that balance is if AI data center capex or hyperscaler relationships change is something investors should consider carefully...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and a $449.6 million earnings increase from $140.9 million today.

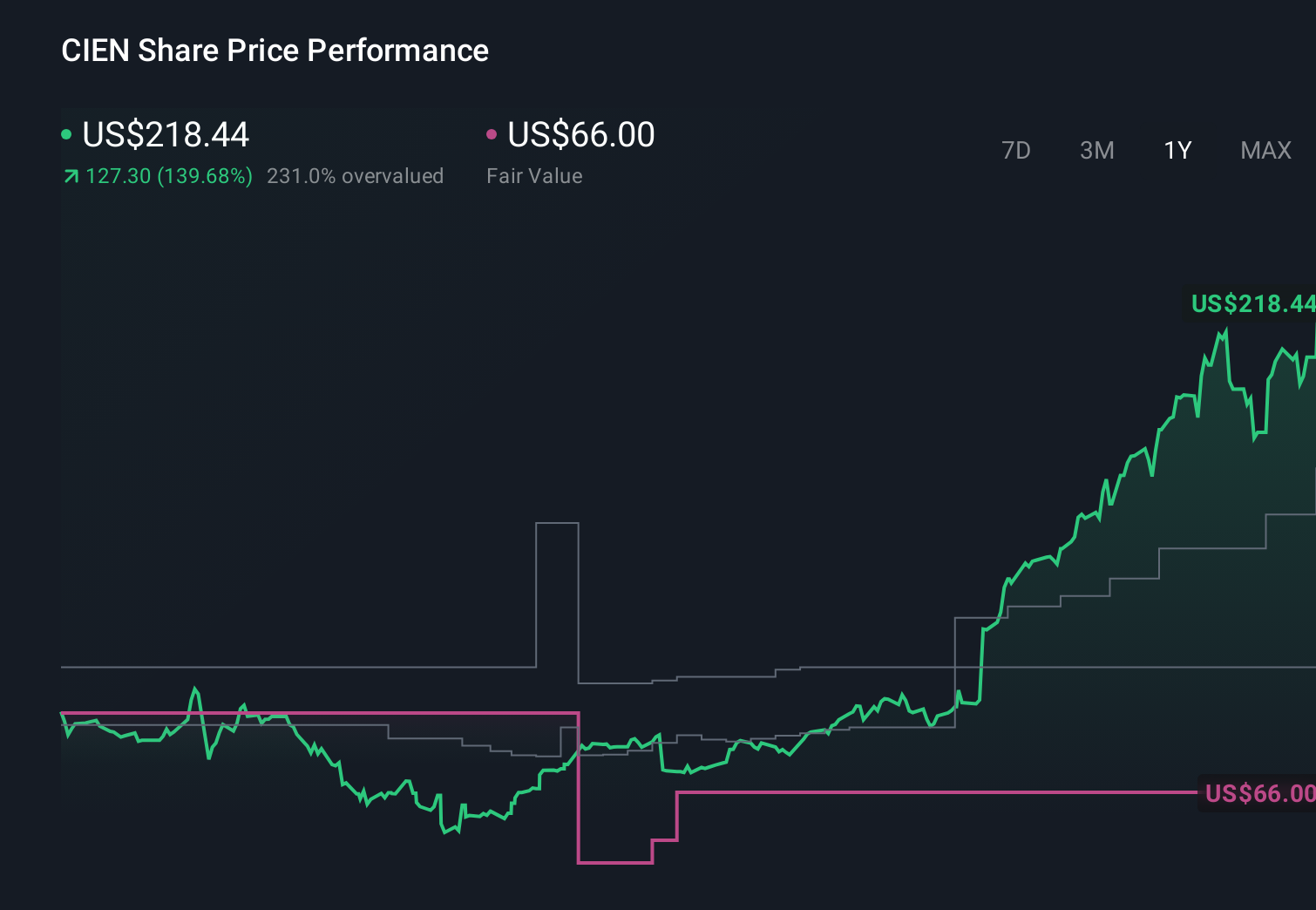

Uncover how Ciena's forecasts yield a $237.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$67.93 to US$305 per share, reflecting very different expectations for Ciena’s future. Before you anchor on any single view, remember that Ciena’s growing reliance on a concentrated group of hyperscaler customers can cut both ways for the business and its share price over time.

Explore 6 other fair value estimates on Ciena - why the stock might be worth as much as 32% more than the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報