Will Lumentum’s (LITE) Accounting Transition Reshape Confidence in Its AI-Focused Investment Narrative?

- Lumentum Holdings Inc. disclosed that Chief Accounting Officer and Senior Vice President, Finance, Matthew Sepe, plans to retire in fall 2026, with Eric Chang, a seasoned finance executive and certified public accountant, appointed to assume the Chief Accounting Officer role after the company files its quarterly report for the period ended December 27, 2025.

- The transition puts fresh focus on Lumentum’s financial leadership and reporting oversight just as investors await its upcoming fiscal second-quarter 2026 earnings release and commentary on business conditions.

- Against this backdrop of a planned Chief Accounting Officer transition, we’ll examine how the leadership change may influence Lumentum’s AI-focused investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Lumentum Holdings Investment Narrative Recap

Lumentum’s appeal rests on belief in its optical and photonic technology staying central to AI and cloud infrastructure while translating into durable earnings power. The planned Chief Accounting Officer handoff to Eric Chang looks orderly and, by itself, does not materially change the near term focus on execution in cloud modules or the key risk around concentrated hyperscale customer demand.

The most relevant nearby event is Lumentum’s upcoming fiscal second quarter 2026 earnings release on February 3, which will give investors fresh data on revenue mix, cloud module margins, and hyperscale order trends. That update will likely frame how investors weigh the benefits of Lumentum’s AI exposure against concerns about lower margin products and dependence on a small group of large customers.

Yet investors should be aware that if a few hyperscale customers pull back at once, the impact on Lumentum’s earnings profile could...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.1 billion revenue and $389.1 million earnings by 2028. This requires 23.4% yearly revenue growth and about a $363.2 million earnings increase from $25.9 million today.

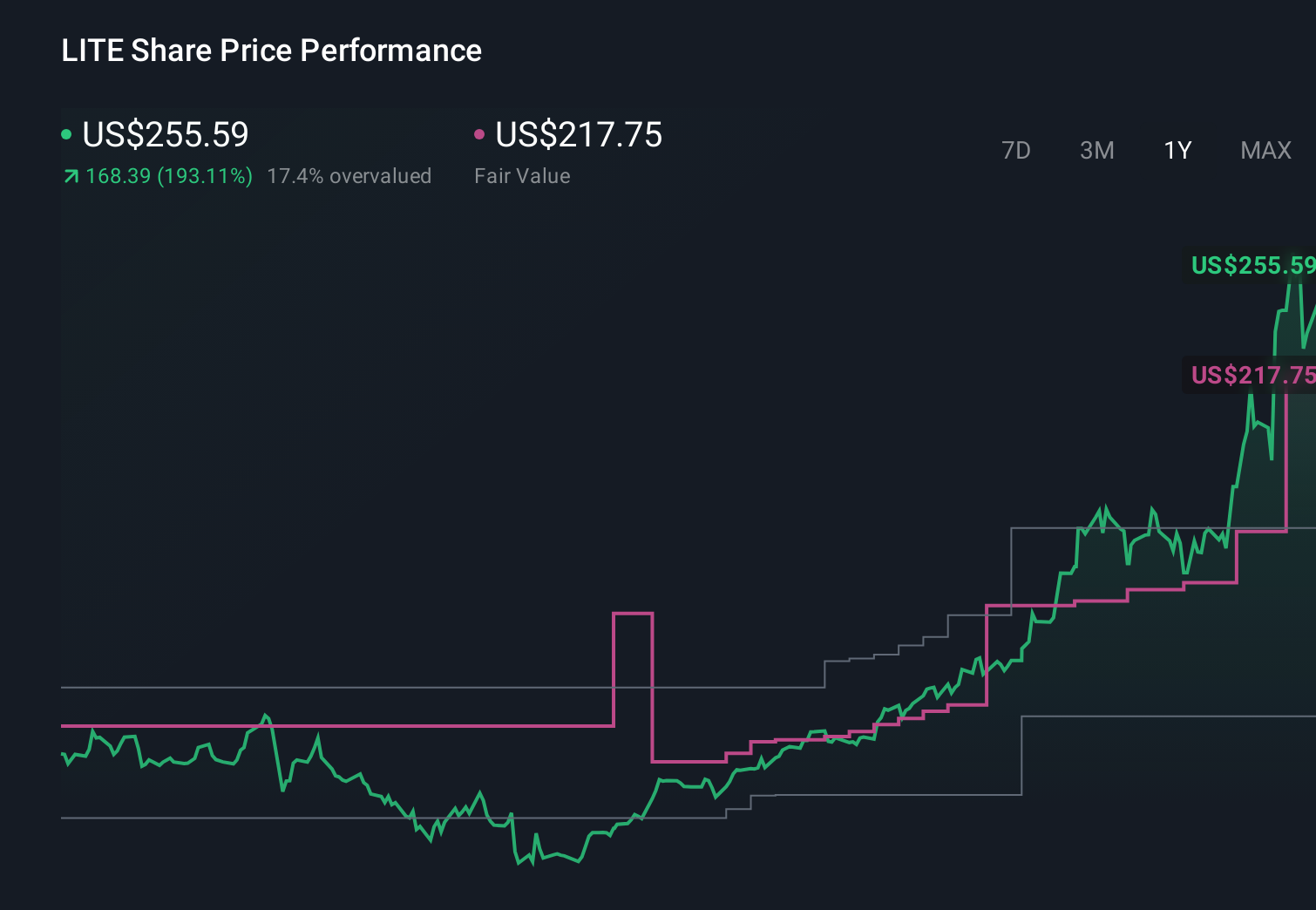

Uncover how Lumentum Holdings' forecasts yield a $255.14 fair value, a 29% downside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community currently place Lumentum’s fair value between US$68 and US$578, reflecting sharply different expectations for its AI linked trajectory. You should weigh these views against the concentration risk in a handful of hyperscale customers, which could have outsized effects on future performance and sentiment.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth less than half the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報