A Look At DLocal (DLO) Valuation After Governance Overhaul And Board Refresh

DLocal (NasdaqGS:DLO) is drawing attention after completing a governance reshuffle. The company has moved to a nine person, majority independent board and has added former senior executives from Citigroup and Google to its director lineup.

See our latest analysis for DLocal.

The governance refresh coincides with a recent pickup in momentum, with a 30 day share price return of 11.14% and a 1 year total shareholder return of 32.92% from a last close of US$14.77. However, the 3 year total shareholder return of a 2.33% decline shows that the longer term picture has been more mixed.

If this governance shift has you looking beyond a single name, it could be a useful moment to see what else is happening across payments and fintech and check out fast growing stocks with high insider ownership.

With governance changes in motion, annual revenue of US$960.191m and net income of US$170.947m, plus an indicated intrinsic discount of about 23%, the key question is whether DLocal is mispriced or already reflecting its future growth.

Most Popular Narrative: 17.3% Undervalued

With DLocal closing at US$14.77 against a most followed fair value estimate of US$17.85, the narrative is clearly pricing in more upside than the market.

dLocal's rapid expansion of its solution set (SmartPix for Pix, Buy Now Pay Later partnerships, stablecoin payment infrastructure) and continued onboarding of new alternative payment methods position it to benefit from accelerating digitization of payments in emerging markets, supporting sustained top-line growth and potential for higher take rates on new products, which is positive for revenue and gross margin.

Want to see what justifies that higher fair value? The narrative leans heavily on fast earnings compounding, richer margins, and a future earnings multiple baked into its model.

Result: Fair Value of $17.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on concentration and regulatory risks not flaring up, since a loss of major clients or tighter rules in key markets could quickly challenge that upside story.

Find out about the key risks to this DLocal narrative.

Another View: Earnings Multiple Paints a Different Picture

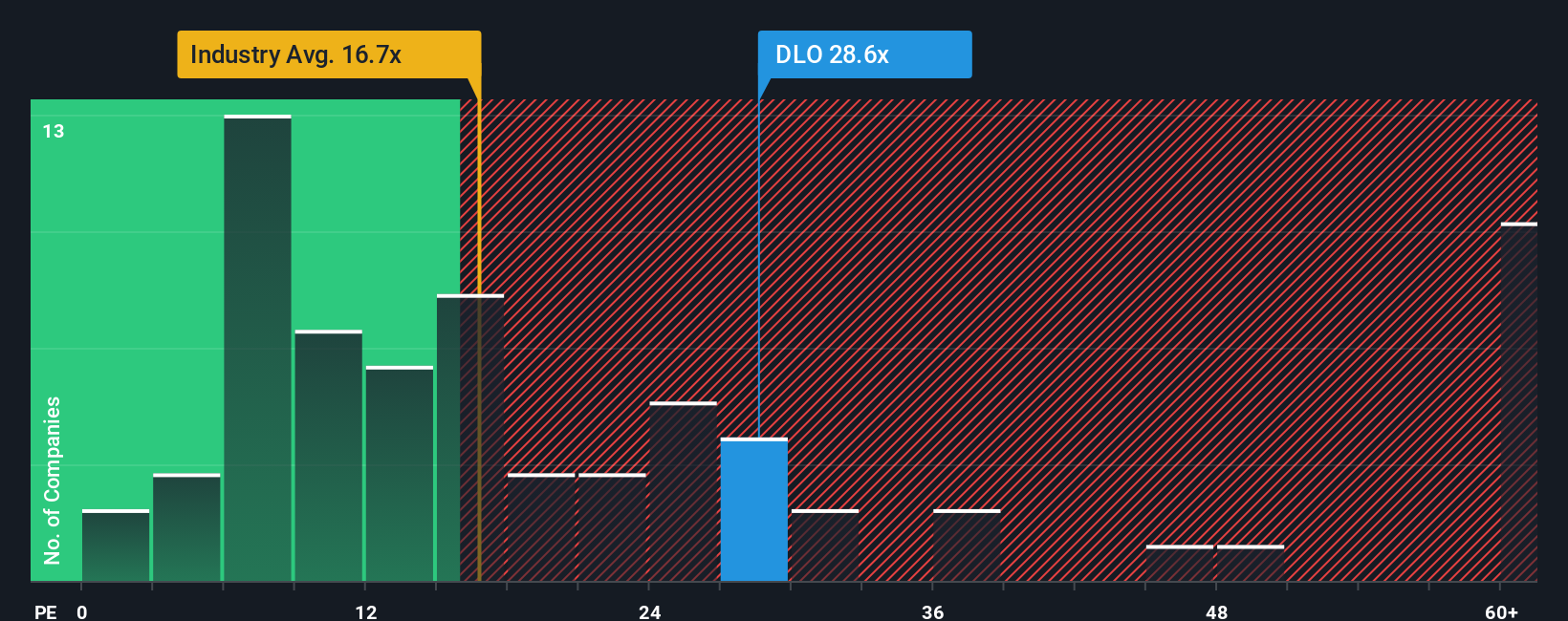

Our model suggests DLocal trades at a 22.9% discount to fair value, yet the P/E story is less forgiving. At 25.5x earnings versus 14x for the US Diversified Financial industry and a 21.1x fair ratio, the shares look expensive. Is this quality premium justified, or is enthusiasm running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DLocal Narrative

If you think the story looks different once you have seen the numbers yourself, you can shape your own view in just a few minutes, starting with Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DLocal.

Looking for more investment ideas?

If DLocal has sharpened your thinking, do not stop here. Broaden your watchlist with focused screeners that can surface opportunities you might otherwise miss.

- Spot potential value plays early by scanning these 877 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Zero in on future tech themes by tracking these 25 AI penny stocks that are tied to artificial intelligence growth stories.

- Boost your income focus by checking these 14 dividend stocks with yields > 3% that may offer yields above 3% for a stronger cash return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報