Cambridge Nutritional Sciences plc's (LON:CNSL) Low P/S No Reason For Excitement

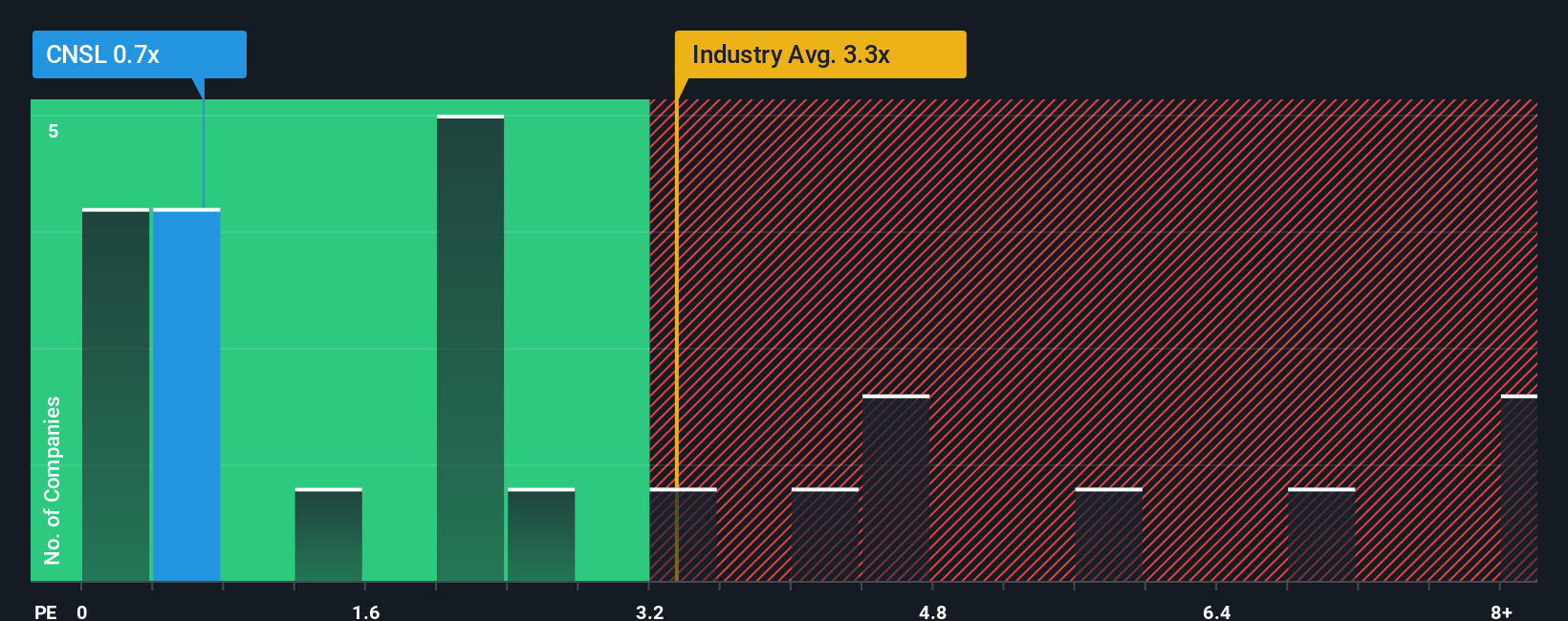

You may think that with a price-to-sales (or "P/S") ratio of 0.7x Cambridge Nutritional Sciences plc (LON:CNSL) is a stock worth checking out, seeing as almost half of all the Medical Equipment companies in the United Kingdom have P/S ratios greater than 2.3x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Cambridge Nutritional Sciences

What Does Cambridge Nutritional Sciences' Recent Performance Look Like?

For instance, Cambridge Nutritional Sciences' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Cambridge Nutritional Sciences, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cambridge Nutritional Sciences' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cambridge Nutritional Sciences' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 6.6% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Cambridge Nutritional Sciences is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Cambridge Nutritional Sciences revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Cambridge Nutritional Sciences (2 are significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Cambridge Nutritional Sciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報